Verifying US Bank Cashier's Checks: A Comprehensive Guide

Have you ever received a cashier's check and felt a twinge of uncertainty about its authenticity? In today's world, financial instruments like cashier's checks, particularly those from major institutions like US Bank, require careful scrutiny. This comprehensive guide will delve into the various aspects of confirming the legitimacy of a US Bank cashier's check, offering practical advice and insights to empower you in your financial transactions.

Cashier's checks are often perceived as guaranteed funds, making them popular for significant purchases like real estate or vehicles. However, the unfortunate reality is that counterfeit cashier's checks exist. Understanding how to validate a US Bank cashier's check is crucial for protecting yourself from potential financial loss.

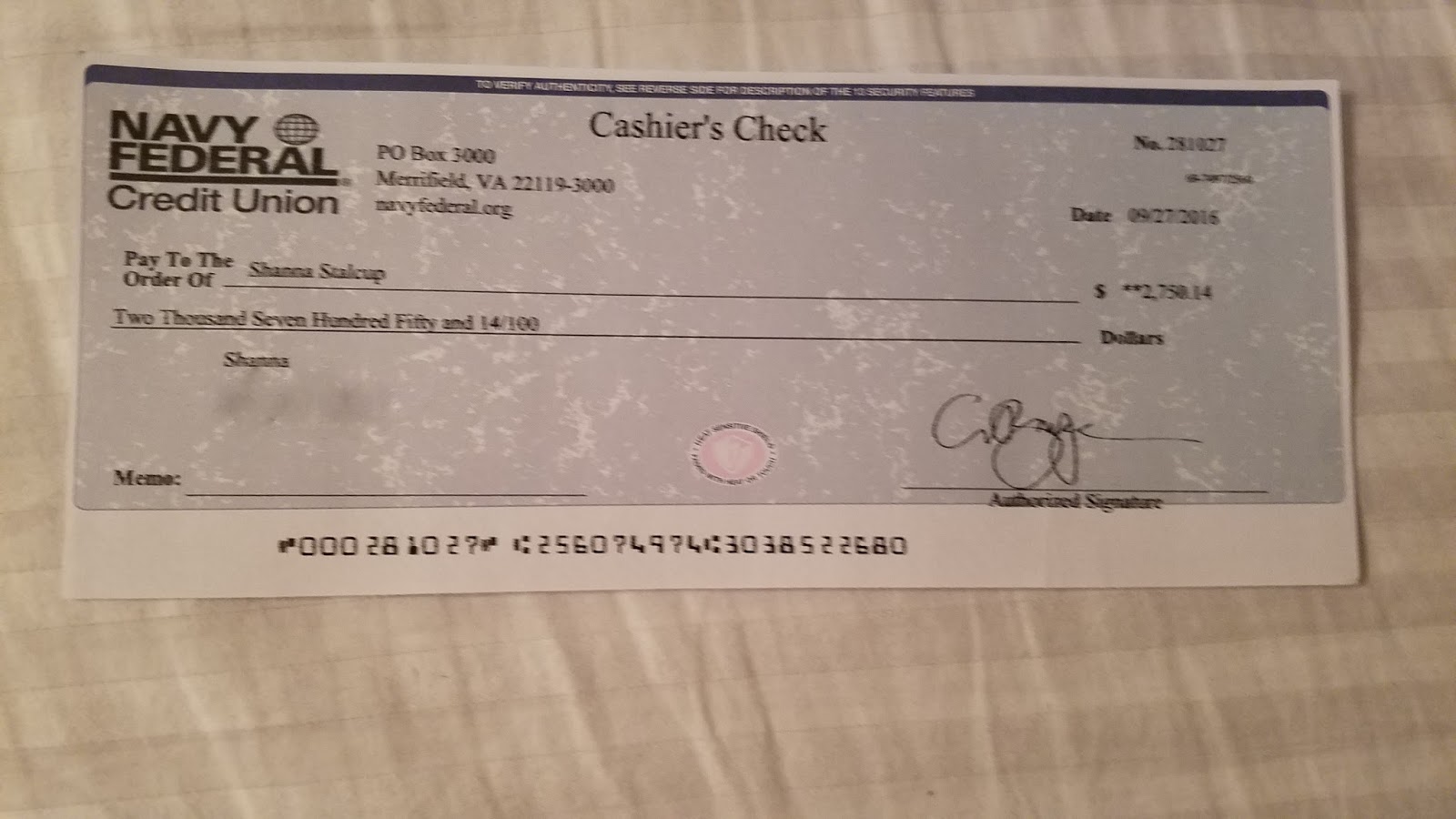

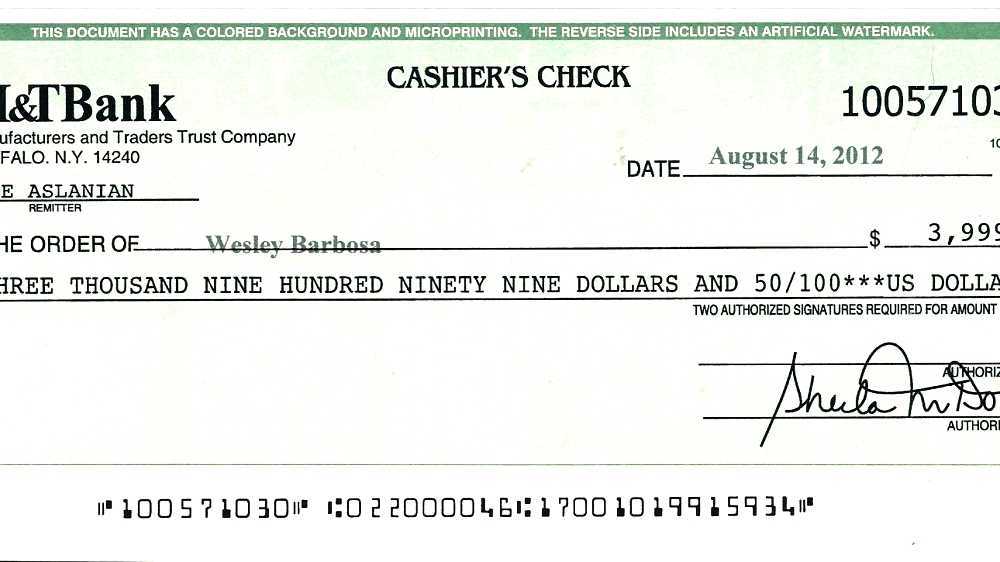

A key aspect of verifying a cashier's check involves understanding its identifying features. While specific details may vary, US Bank cashier's checks typically include a check number, bank logo, and other security elements. Learning to recognize these features can help you differentiate a genuine check from a fraudulent one. Confirming the check number with the issuing bank is a critical step in the verification process. This involves contacting US Bank directly and providing the necessary information to validate the check's authenticity.

While we don't have a specific historical "origin" story for the US Bank cashier's check verification number itself, the practice of verifying financial instruments has evolved over time. As financial fraud became more sophisticated, banks implemented various security measures, including verification numbers, to enhance the integrity of their instruments and protect their customers. This evolution underscores the importance of staying informed about current best practices for verifying cashier's checks.

The verification process helps establish the check's validity, confirms the available funds, and protects you from accepting a counterfeit instrument. It's a crucial step in ensuring a secure transaction. Neglecting to verify a cashier's check can lead to significant financial repercussions. Accepting a fraudulent check can result in the loss of funds, legal complications, and damage to your credit rating. Therefore, taking the time to verify a cashier's check is a proactive measure to safeguard your financial well-being.

Several methods exist to confirm a US Bank cashier's check. You can call US Bank directly, visit a local branch, or utilize their online banking platform. Each method offers a secure way to ascertain the check's legitimacy.

Benefits of verifying a US Bank cashier's check include peace of mind knowing the funds are legitimate, avoiding financial loss from fraudulent checks, and ensuring a smooth transaction process. For example, imagine purchasing a car with a cashier's check. Verifying the check beforehand ensures you won't lose the car and your money to a fraudulent seller.

To verify a US Bank cashier's check, contact the bank directly, providing the check number and other relevant details. They will confirm its authenticity and the availability of funds.

Advantages and Disadvantages of Using Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Perceived as guaranteed funds | Can be counterfeited |

| Widely accepted | Requires verification |

Best practices include verifying the check with the bank, examining the check for security features, and avoiding accepting cashier's checks from unknown or untrusted sources.

Challenges in verifying cashier's checks include potential delays in the verification process and the possibility of encountering sophisticated counterfeit checks. Solutions include contacting the bank directly for verification and being vigilant in examining the check for inconsistencies.

Frequently asked questions about cashier's check verification include: How do I verify a US Bank cashier's check? What information do I need to verify a cashier's check? What are the risks of accepting an unverified cashier's check?

Tips for handling cashier's checks include keeping the check secure until it's deposited, avoiding sharing the check details with unauthorized individuals, and reporting any suspicious activity related to cashier's checks to the bank immediately.

In conclusion, verifying a US Bank cashier's check is a critical step in protecting yourself from fraud and ensuring the security of your financial transactions. By understanding the verification process, recognizing security features, and following best practices, you can confidently handle cashier's checks and mitigate the risks associated with fraudulent activities. Remember, taking the time to verify a cashier's check is a small effort that can prevent significant financial losses and legal complications. Don't hesitate to contact US Bank directly for verification and ensure the legitimacy of your funds. Your financial well-being is worth the extra effort.

The enchanting world of time travel harry fanfic

Decoding the rav4 hybrid price tag your ultimate guide

Conquer indonesian essays unlock the power of contoh kerangka karangan topik

us bank cashier's check verification number | Solidarios Con Garzon

Check your checks York woman warns of counterfeit check scam | Solidarios Con Garzon

Wire Transfer Navy Federal Credit Union Limit | Solidarios Con Garzon

What is a cashiers check | Solidarios Con Garzon

Cash Check With Square at Reuben Cawley blog | Solidarios Con Garzon

Do Bank Checks Cost Money at Darcy Lopez blog | Solidarios Con Garzon

Is A Managers Check A Cash Equivalent at Lonnie Beebe blog | Solidarios Con Garzon

Resultado de imagen para bank of america usa cashiers check samples | Solidarios Con Garzon

us bank cashier's check verification number | Solidarios Con Garzon

Fake Check Template Beautiful Finally Got A Fake Cashier S Check Agent | Solidarios Con Garzon

What does cash at bank credit mean Leia aqui What is cash in bank credit | Solidarios Con Garzon

TAB Bank Cashiers Check Request 2013 | Solidarios Con Garzon

What Is The Starting Check Number at Krystle Jordan blog | Solidarios Con Garzon

us bank cashier's check verification number | Solidarios Con Garzon

us bank cashier's check verification number | Solidarios Con Garzon