Unveiling the Mystery: A Deep Dive into Rincian Biaya Pajak Rumah (Property Tax Details)

Owning a home is a significant milestone, a tangible symbol of security and achievement. But with the joy of homeownership comes responsibility, including navigating the intricate world of property taxes. In Indonesia, understanding the "rincian biaya pajak rumah" – the detailed breakdown of your property tax – is crucial for both financial planning and peace of mind.

Imagine receiving your annual property tax bill and feeling a wave of confusion wash over you. Unfamiliar terms, seemingly arbitrary figures, and the lingering question: "Am I paying a fair amount?". This scenario is all too common for many homeowners, but it doesn't have to be. By demystifying the components of your property tax bill, you can take control of your finances and make informed decisions about your most valuable asset.

While the concept of property tax is universal, its implementation varies significantly across countries. In Indonesia, the property tax system, known as Pajak Bumi dan Bangunan (PBB), plays a vital role in funding local government services and infrastructure projects. The "rincian biaya pajak rumah" essentially acts as your roadmap to understanding this system, outlining the factors influencing your tax liability and empowering you to verify its accuracy.

Navigating the Indonesian property tax landscape might appear daunting at first, but breaking it down into digestible components can significantly alleviate the stress. By understanding the "rincian biaya pajak rumah," you're not just paying a bill – you're actively participating in a system designed to support your community and ensure the sustainable development of your city or region.

This comprehensive guide aims to equip you with the knowledge and tools to confidently approach your property tax obligations. From deciphering technical jargon to uncovering potential savings, we'll delve into the intricacies of "rincian biaya pajak rumah," transforming you from a passive payer into an informed homeowner.

Advantages and Disadvantages of Understanding Rincian Biaya Pajak Rumah

| Advantages | Disadvantages |

|---|---|

| Informed financial planning and budgeting. | Requires time and effort to understand the details. |

| Ability to identify potential errors or overcharges. | Can be overwhelming for first-time homeowners. |

| Empowerment to negotiate property value assessments. |

While there are clear benefits to understanding your "rincian biaya pajak rumah," some homeowners might find the process time-consuming and complex. However, the potential for financial savings, increased transparency, and informed decision-making far outweigh the initial effort required.

Remember, knowledge is power, especially when it comes to your finances. By taking the time to understand your "rincian biaya pajak rumah," you're investing in your financial well-being and ensuring a smoother, more transparent homeownership experience.

Unlocking potential navigating the e pelajar mrsm muar platform

Ace the california drivers written test

Unraveling the mystery what does placa do jogo de ontem mean

Kwitansi Contoh Rincian Biaya Rawat Inap Rumah Sakit Harapan Kita | Solidarios Con Garzon

Detail Contoh Rincian Biaya Rumah Sakit Koleksi Nomer 18 | Solidarios Con Garzon

Contoh Invoice Tagihan Pembayaran | Solidarios Con Garzon

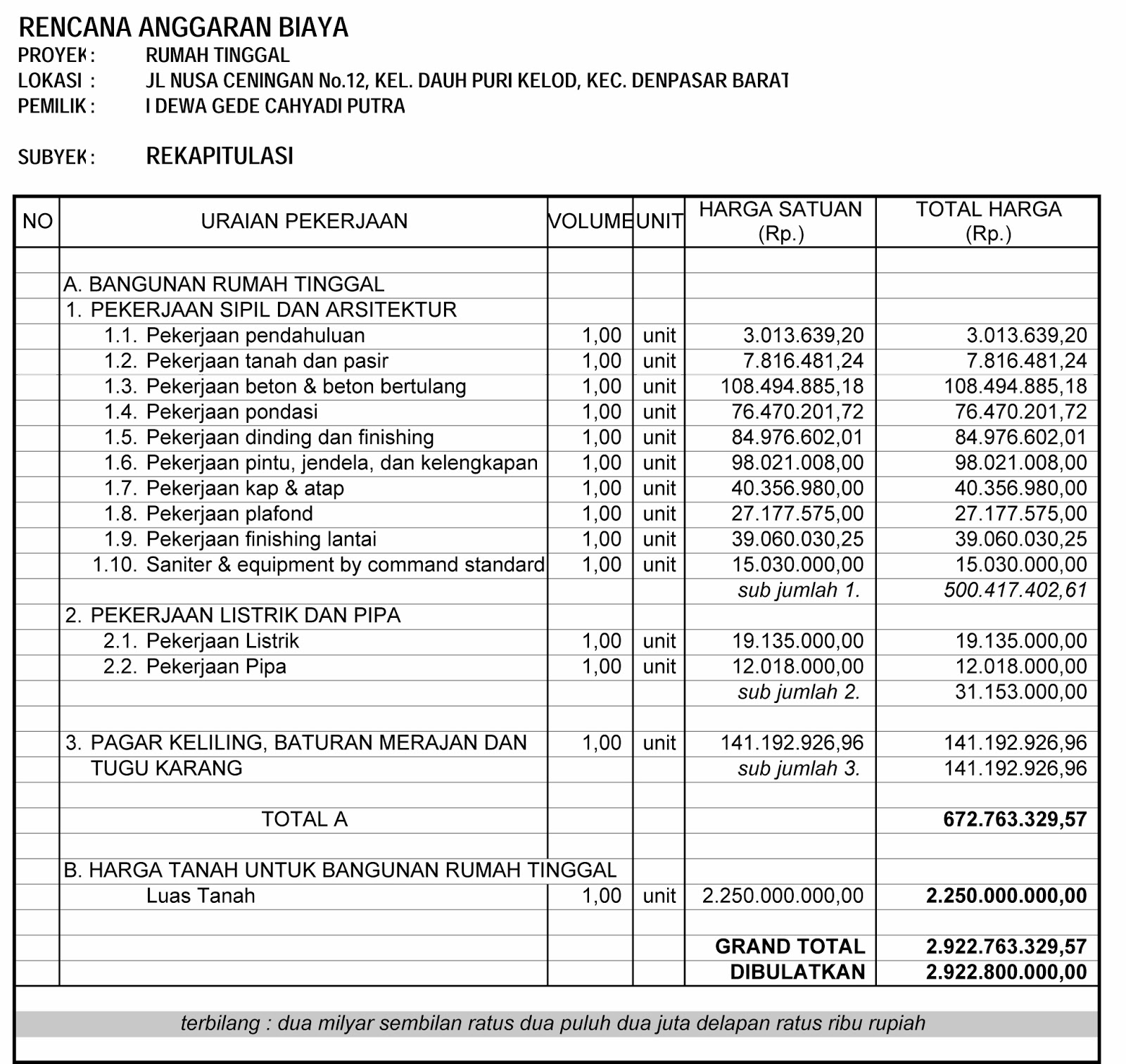

Contoh Rencana Anggaran Biaya Rab Rumah Kegunaannya | Solidarios Con Garzon

Kwitansi Rumah Sakit Kosong | Solidarios Con Garzon

rincian biaya pajak rumah | Solidarios Con Garzon

Contoh Surat Rincian Biaya Rumah Sakit | Solidarios Con Garzon

rincian biaya pajak rumah | Solidarios Con Garzon

Contoh Rencana Anggaran Perusahaan Jasa | Solidarios Con Garzon

Contoh Rencana Anggaran Biaya Renovasi Rumah 1 Lantai | Solidarios Con Garzon

Pajak Beli Rumah: Rincian Biaya dan Cara Menghitungnya | Solidarios Con Garzon

Contoh Surat Rincian Biaya Rumah Sakit | Solidarios Con Garzon

Contoh Surat Pemberitahuan Pajak | Solidarios Con Garzon

Contoh Surat Rincian Biaya Rumah Sakit | Solidarios Con Garzon

Pajak Jual Beli Rumah: Rincian Biaya, Cara Hitung, dan Contoh Kasus | Solidarios Con Garzon