Unlocking Your Bank's Secrets: A Guide to Finding Your Transit Number

Ever felt that little flutter of panic when filling out a direct deposit form and realizing you're missing a crucial piece of information? It's a common scenario, and often, the missing piece is your bank transit number. This seemingly small number plays a big role in the world of financial transactions, acting as a sort of address for your bank branch. This guide will demystify the process of locating your transit number, making those online payments and direct deposits a breeze.

So, what exactly is this elusive transit number? In simple terms, it's a numerical code that identifies a specific bank branch. Think of it like a zip code for your bank. When you initiate a transaction, this number tells the system where your funds are held, ensuring they arrive at the correct destination. Finding your transit number isn't as daunting as it might seem. There are several straightforward methods you can use, and we'll explore them all.

The history of transit numbers is intertwined with the evolution of banking itself. As the financial system modernized and transactions became more complex, the need for a standardized way to identify banks and branches arose. These numbers, combined with your institution number and account number, ensure accuracy and efficiency in the flow of funds. Understanding the importance of this number underlines the significance of keeping it secure, just like any other sensitive financial information.

One of the main issues people face when trying to locate their transit number is simply not knowing where to look. This guide aims to eliminate that confusion by providing clear and concise instructions. We'll cover everything from checking your checkbook to navigating online banking portals. Another potential hurdle is the fear of accidentally revealing sensitive information. Rest assured, the methods outlined here are safe and secure, prioritizing the protection of your financial details.

The transit number, often referred to as the routing number in the United States, is usually a nine-digit code. In Canada, it’s a five-digit branch number combined with a three-digit financial institution number. For instance, on a check, you'll typically find it printed at the bottom, alongside your account number. Let's say your transit number is 12345 and your institution number is 678, your cheque would display 12345-678. This combination acts as the complete address for your specific bank branch.

Knowing how to find your transit number offers several advantages. Firstly, it empowers you to manage your finances independently. You can set up direct deposits, pay bills online, and transfer funds between accounts seamlessly. Secondly, it saves you time and effort. No more frantic calls to customer service or trips to the bank just to retrieve this one piece of information. Thirdly, it provides a sense of control over your financial life, fostering confidence in managing your money.

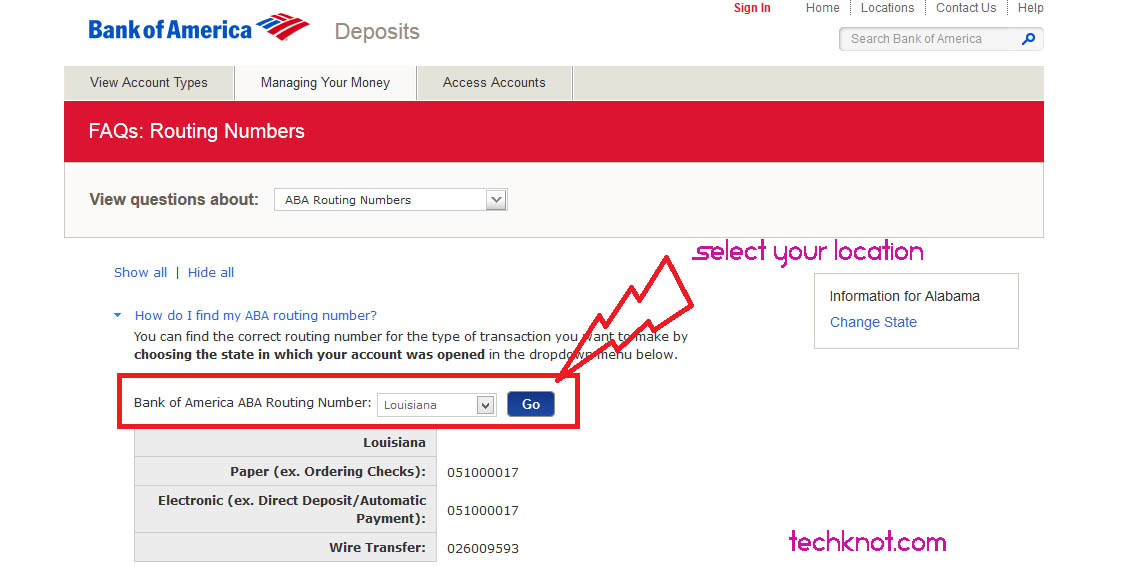

Your bank’s website and mobile app are likely the quickest ways to find this information. Your monthly statements, whether paper or electronic, will usually display your transit and institution numbers. Lastly, your checkbook provides a readily available source.

Advantages and Disadvantages of Different Methods

| Method | Advantage | Disadvantage |

|---|---|---|

| Checking a check | Readily available | Might not have a checkbook handy |

| Online banking | Quick and convenient | Requires internet access |

| Bank statement | Reliable information | Might take time to locate |

Best Practices: Always double-check the number to avoid errors. Keep your checks and bank statements secure. Refer to official bank resources for accurate information. Contact customer service if you have any doubts. Prioritize the safety of your financial details.

FAQs

What is a transit/routing number? (Explained above)

Where can I find it on a check? (Bottom left corner)

Is it safe to share my transit number? (Generally safe for transactions, but avoid unsolicited requests)

What if I can’t find my transit number? (Contact your bank)

Is the transit number the same as the institution number? (No, they are distinct identifiers)

Why is my transit number important? (Essential for directing funds correctly)

Can I find my transit number online? (Yes, through online banking)

What if my check doesn’t have a transit number? (Contact your bank, some specialized checks may not have them)

Understanding how to locate your transit number is a fundamental aspect of managing your finances in today's digital world. From setting up direct deposit to paying bills online, this seemingly small number plays a pivotal role. By familiarizing yourself with the various methods outlined in this guide, you can gain control over your financial transactions and navigate the banking landscape with confidence. Remember, knowing where to find this essential piece of information empowers you to handle your money efficiently and securely, contributing to greater financial peace of mind.

Mastering english voice rules for clear communication

Unlocking german culture your guide to unter unserm himmel mediathek heute

Unveiling the ancient greek flute music mythology and more

Chase Bank Void Check | Solidarios Con Garzon

How to Find Transit Numbers for Banks in Canada | Solidarios Con Garzon

What Is The Account Number On Rbc Cheque | Solidarios Con Garzon

Void Cheque Meaning In Hindi at Steven Fay blog | Solidarios Con Garzon

How To Find Your Transit Number Td Bank | Solidarios Con Garzon

Define Transit Number at Elaine Pace blog | Solidarios Con Garzon

How do I find my TD branch number | Solidarios Con Garzon

How to Add a Bank Account to your Organization | Solidarios Con Garzon

How To Find Your Transit Number Td Bank | Solidarios Con Garzon

14696 Routing Number MICR Transit Code Bank Address and Contact | Solidarios Con Garzon

How To Read a Void Cheque | Solidarios Con Garzon

Canada Local Transfer Guide | Solidarios Con Garzon