Unlocking the Secrets of Your Check: A Guide to Finding the Transit Number

In the intricate dance of modern finance, where digital streams and paper trails intertwine, the humble check persists as a tangible testament to the flow of value. But within this familiar rectangle of paper lies a small, yet powerful, sequence of numbers: the transit number. Often overlooked, this unassuming code plays a pivotal role in ensuring the smooth passage of funds from one account to another. Understanding its location and significance empowers us to navigate the financial landscape with greater confidence and control.

The transit number, sometimes referred to as the routing number, acts as a geographical address for your bank. It identifies the specific financial institution where your account is held, enabling the seamless transfer of funds during check processing. Like a postal code directs a letter to its destination, the transit number guides your check to its rightful home within the banking system. Imagine the chaos if each piece of mail lacked a destination address – a similar disarray would ensue in the financial world without the transit number.

Locating the transit number on a check is generally straightforward. It is typically found at the bottom left corner of the check, printed as a nine-digit numerical code. This code is usually enclosed within two symbols, often resembling stylized vertical bars or brackets. However, the exact presentation can vary slightly depending on the financial institution and check design. Developing a keen eye for recognizing this crucial piece of information is essential for anyone who utilizes checks for financial transactions.

The history of the transit number is interwoven with the evolution of the banking system itself. As the volume of checks processed grew exponentially, the need for a standardized system of identification became paramount. The American Bankers Association (ABA) developed the transit numbering system to streamline check processing and minimize errors. This system, implemented in the early 20th century, revolutionized the efficiency of financial transactions and laid the foundation for the modern banking landscape we navigate today. Understanding this historical context adds another layer of appreciation for the seemingly simple transit number.

The importance of correctly identifying and utilizing the transit number cannot be overstated. Errors in transcribing this code can lead to delays in processing, returned checks, and potential fees. In an increasingly interconnected financial world, where transactions occur with lightning speed, the accuracy of every detail becomes critical. The transit number, though small, holds significant weight in ensuring the smooth and efficient functioning of our financial systems.

The transit number is essential for electronic transactions, direct deposits, and online bill payments. Knowing where to find the transit number is crucial for setting up these services.

Benefits of knowing how to locate the transit number on your check:

1. Accurate Transactions: Ensures funds are deposited or withdrawn from the correct account.

2. Efficient Processing: Prevents delays and returned checks due to incorrect information.

3. Secure Banking: Protects against potential fraud or errors by verifying the correct bank.

Action Plan for Locating the Transit Number:

1. Obtain a check from your bank.

2. Examine the bottom left corner.

3. Look for the nine-digit code within symbols.

Advantages and Disadvantages of Knowing Where to Find the Transit Number

| Advantages | Disadvantages |

|---|---|

| Enables accurate and efficient transactions | Requires careful attention to detail to avoid errors |

| Facilitates online banking and bill payments | None inherent to knowing the location |

Best Practices for Utilizing the Transit Number:

1. Double-check the number when entering it online or providing it for direct deposits.

2. Keep your checks in a secure location to prevent unauthorized access.

3. Contact your bank immediately if you suspect fraudulent activity.

4. Verify the transit number on your checks matches the one provided by your bank.

5. Educate yourself about common check fraud schemes and protective measures.

Frequently Asked Questions:

1. What if my check doesn't have a transit number? - Contact your bank for assistance.

2. Is the transit number the same as the account number? - No, they are distinct numbers.

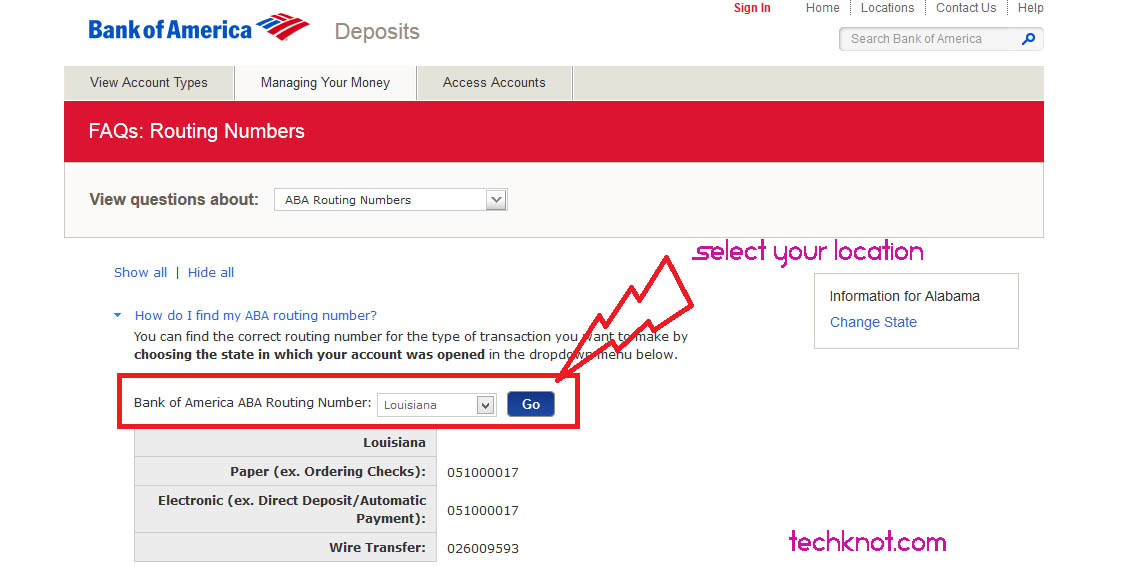

3. Can I find my transit number online? - Yes, usually on your bank's website.

4. What if I use the wrong transit number? - The transaction may be delayed or rejected.

5. Is the transit number different for different branches of the same bank? - Sometimes, but not always. Confirm with your bank.

6. How can I verify my bank's transit number? - Check your bank's website or contact customer service.

7. Is the transit number used for international transactions? - No, different systems are used for international transfers.

8. What should I do if I suspect someone has fraudulently used my transit number? - Contact your bank immediately.

Tips and Tricks:

Use a magnifying glass if you have difficulty reading the small print.

In conclusion, the transit number, often overlooked in the flurry of financial transactions, holds a key to unlocking the seamless flow of funds in our modern banking system. Understanding its location on a check, recognizing its historical significance, and appreciating its role in ensuring accuracy and efficiency empowers us to navigate the complexities of personal finance with confidence. By adhering to best practices and remaining vigilant against potential fraud, we can harness the power of this small but mighty numerical code to manage our financial lives effectively. Knowing where to find and how to use the transit number is a fundamental aspect of financial literacy, enabling us to participate fully and securely in the intricate dance of modern monetary exchange. Take the time to familiarize yourself with this crucial element of your checks and empower yourself in the world of finance.

Effortless towing understanding electric trailer brake systems

Breathing life into dice rolls the art of custom dd portraits

Acc basketball tournament a march madness staple

Checking Account Check Registers 1 Answers at Linda Greenfield blog | Solidarios Con Garzon

How To Check Someones Plate Number at Shelia Parker blog | Solidarios Con Garzon

How To Find Your Transit Number Td Bank | Solidarios Con Garzon

Td Bank Cheque Numbers Explained | Solidarios Con Garzon

Sympton deberes Distraer international routing code canada Preparación | Solidarios Con Garzon

Void Cheque Meaning In Hindi at Steven Fay blog | Solidarios Con Garzon

Capstar Routing Number at Bessie Collins blog | Solidarios Con Garzon

Elaborar tratar con terrorismo where is the routing number combinar | Solidarios Con Garzon

How to Find Your BMO Routing Number in Canada | Solidarios Con Garzon

How To Read a Void Cheque | Solidarios Con Garzon

Specimen De Cheque Banque National Du Canada at William Stagg blog | Solidarios Con Garzon

.png)

Locating Your TD Routing Number 2023 A Guide | Solidarios Con Garzon