Unlocking the Secrets of USAA Auto Loan Credit Scores

In the labyrinth of personal finance, few things loom as large as the purchase of a car. This significant investment often necessitates borrowing, and thus the shadow of the credit score stretches long. For those eyeing a USAA auto loan, understanding the role of credit is paramount. What numerical key unlocks the door to favorable loan terms? This exploration delves into the world of USAA auto loan credit scores, seeking to illuminate the path toward a successful application.

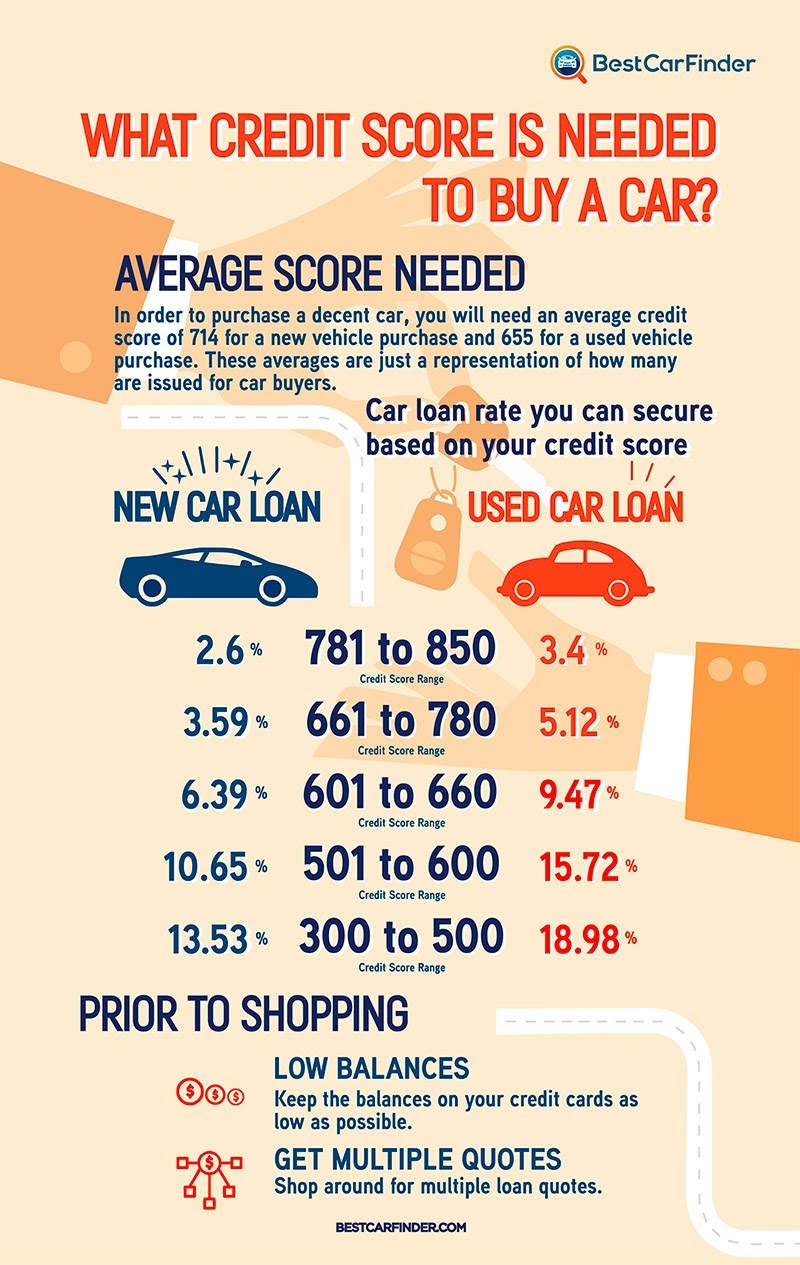

The credit score, a three-digit distillation of our financial history, acts as a shorthand for lenders assessing risk. While USAA, known for serving military members and their families, doesn't publicly disclose a specific minimum credit score, understanding the general landscape is crucial. A higher credit score generally translates to lower interest rates and better loan terms. Conversely, a lower score can lead to higher interest rates, a larger down payment requirement, or even loan denial. The credit score, then, is not merely a number; it's a narrative of our financial responsibility, whispering tales of past payments and debts to potential lenders.

Navigating the credit score landscape requires understanding its components. Payment history, amounts owed, length of credit history, new credit, and credit mix all contribute to this numerical representation. For prospective USAA auto loan applicants, focusing on timely payments and managing debt are key strategies for enhancing creditworthiness. This journey toward a healthier credit score is not a sprint but a marathon, requiring consistent effort and mindful financial habits.

While USAA doesn't advertise a specific minimum credit score, having a good to excellent credit score enhances the chances of approval and securing favorable terms. This begs the question: what constitutes a "good" credit score? Generally, scores above 700 are considered good, with scores above 750 often categorized as excellent. However, even those with lower scores may still qualify for a USAA auto loan, though potentially with less advantageous terms. The importance of knowing one's credit score before applying cannot be overstated, allowing for realistic expectations and informed decision-making.

Before venturing into the loan application process, understanding your credit standing is paramount. Several online resources and credit bureaus offer free credit reports and scores. Reviewing your credit report for inaccuracies and disputing any errors can positively impact your score. This preemptive action allows for a smoother loan application process and demonstrates financial responsibility to potential lenders.

The advantages of a good credit score when seeking a USAA auto loan are numerous. Lower interest rates translate to lower monthly payments and less overall interest paid over the loan's lifespan. Favorable loan terms may also include a lower down payment requirement, making the car purchase more accessible. A strong credit history also empowers borrowers to negotiate better deals and potentially qualify for larger loan amounts.

If your credit score isn't where you'd like it to be, don't despair. Improving your credit score is a journey, not a destination. Paying bills on time, reducing debt, and avoiding opening too many new credit accounts are all steps in the right direction. Patience and consistent effort are key to building a healthier credit profile.

Advantages and Disadvantages of Focusing on Credit Score for USAA Auto Loans

| Advantages | Disadvantages |

|---|---|

| Better interest rates | Can be discouraging if score is low |

| Higher loan approval chances | Takes time and effort to improve |

| More favorable loan terms | Doesn't guarantee loan approval |

Frequently Asked Questions:

1. Does USAA have a minimum credit score requirement? USAA doesn't publicly disclose a minimum credit score.

2. How can I check my credit score? Several online resources and credit bureaus offer free credit reports and scores.

3. What factors affect my credit score? Payment history, amounts owed, length of credit history, new credit, and credit mix.

4. How can I improve my credit score? Pay bills on time, reduce debt, and avoid opening too many new accounts.

5. What are the benefits of a good credit score? Lower interest rates, better loan terms, higher loan approval chances.

6. How does my credit score impact my USAA auto loan application? It influences interest rates, loan terms, and approval chances.

7. What if I have a low credit score? You may still qualify for a loan, but potentially with less advantageous terms.

8. Where can I learn more about USAA auto loans? Visit the USAA website or contact a USAA representative.

In conclusion, the credit score is a pivotal element in the USAA auto loan application process. While a specific minimum credit score isn't publicized, understanding the importance of a healthy credit profile is essential. By focusing on responsible financial habits, prospective borrowers can unlock the door to favorable loan terms and embark on their car ownership journey with confidence. Remember, the journey to a better credit score is an ongoing process, one that rewards diligence and mindful financial management. Empower yourself with knowledge, take control of your credit, and navigate the path toward your dream car with clarity and confidence.

Level up your game the ultimate guide to finding epic names

Unmasking the dark side who was the original darth vader

Decoding bicycle wheel diameter your guide to perfect fit and performance

What is a Good Credit Score to Buy a House in 2019 | Solidarios Con Garzon

Can you get a car loan with a 500 credit score Leia aqui Can I get a | Solidarios Con Garzon

Credit Bureau Used by USAA | Solidarios Con Garzon

Can I get a loan with credit score of 500 Leia aqui Can I get | Solidarios Con Garzon

HOW TO GET A GOOD CREDIT SCORE IN 2021 in 2021 | Solidarios Con Garzon

USAA Car Loan Reviews | Solidarios Con Garzon

Which are the USAA car interest rates | Solidarios Con Garzon

Car Loans and Credit Scores What You Need to Know | Solidarios Con Garzon

Home Equity Loan With 600 Credit Score | Solidarios Con Garzon

56 US Auto Loan Statistics to Know in 2022 | Solidarios Con Garzon

USAA Career Starter Loan 2020 | Solidarios Con Garzon

Fillable Online ejmr UNDERTAKING AND COPYRIGHT TRANSFER FORM | Solidarios Con Garzon

How To Calculate Market Value Of Bank Loan | Solidarios Con Garzon

Credit Score Needed for USAA Credit Card | Solidarios Con Garzon

Chevrolet Interest Rates 0 Interest | Solidarios Con Garzon