Unlocking Payments: Your Guide to Authorization Letters

Ever been in a situation where you needed someone else to pick up a check or receive funds on your behalf? That's where the power of a payment authorization letter comes in. These documents, sometimes referred to as letters of authorization for payment or payment collection authorization letters, act as your stand-in, granting a designated individual the legal right to receive money owed to you.

Think of it as a financial power of attorney, but specifically tailored for individual transactions or a series of payments. A well-crafted payment authorization letter can be a lifesaver in various scenarios, from picking up a paycheck while you're out of town to having a trusted representative manage your business receivables. But what exactly goes into creating a valid and effective letter? What are the key components that ensure it’s legally sound and protects your interests? We'll delve into all of that and more.

While the exact origins of payment authorization letters are difficult to pinpoint, they have evolved alongside the development of modern banking and commerce. As businesses and transactions became more complex, the need for a formal method of delegating payment collection became evident. These letters provide a paper trail and establish clear responsibility, reducing the potential for disputes or misunderstandings regarding who is authorized to receive funds.

The importance of a properly written authorization letter for collecting payment cannot be overstated. It safeguards both the payer and the payee by clearly outlining the terms of the authorized transaction. This minimizes the risk of fraud or misappropriation of funds. Without a formal authorization, payers could inadvertently release funds to the wrong person, leading to legal and financial complications.

Several common issues can arise if a payment collection authorization letter is not drafted correctly. Ambiguity in the language, missing crucial details like the amount or payment method, and lack of proper identification can lead to delays or rejection of the authorization. Additionally, failing to specify the duration or scope of the authorization can create confusion and potential disputes down the line.

A payment authorization letter is a formal document granting a third party permission to receive payment on your behalf. A simple example: You're out of the country, and your rent is due. You write a letter authorizing your friend to collect your check and pay your landlord.

Benefit 1: Convenience: Imagine you're unable to physically collect a payment. A payment collection authorization letter allows someone else to do it for you, saving you time and effort. For example, a business owner can authorize an employee to collect checks from clients.

Benefit 2: Security: A properly drafted letter clearly specifies who is authorized to collect the payment, reducing the risk of fraud or misdirection of funds. This is particularly crucial for larger transactions.

Benefit 3: Efficiency: In business settings, delegated payment collection streamlines operations, allowing businesses to receive payments promptly even if the owner isn't available. This keeps cash flow moving and minimizes administrative overhead.

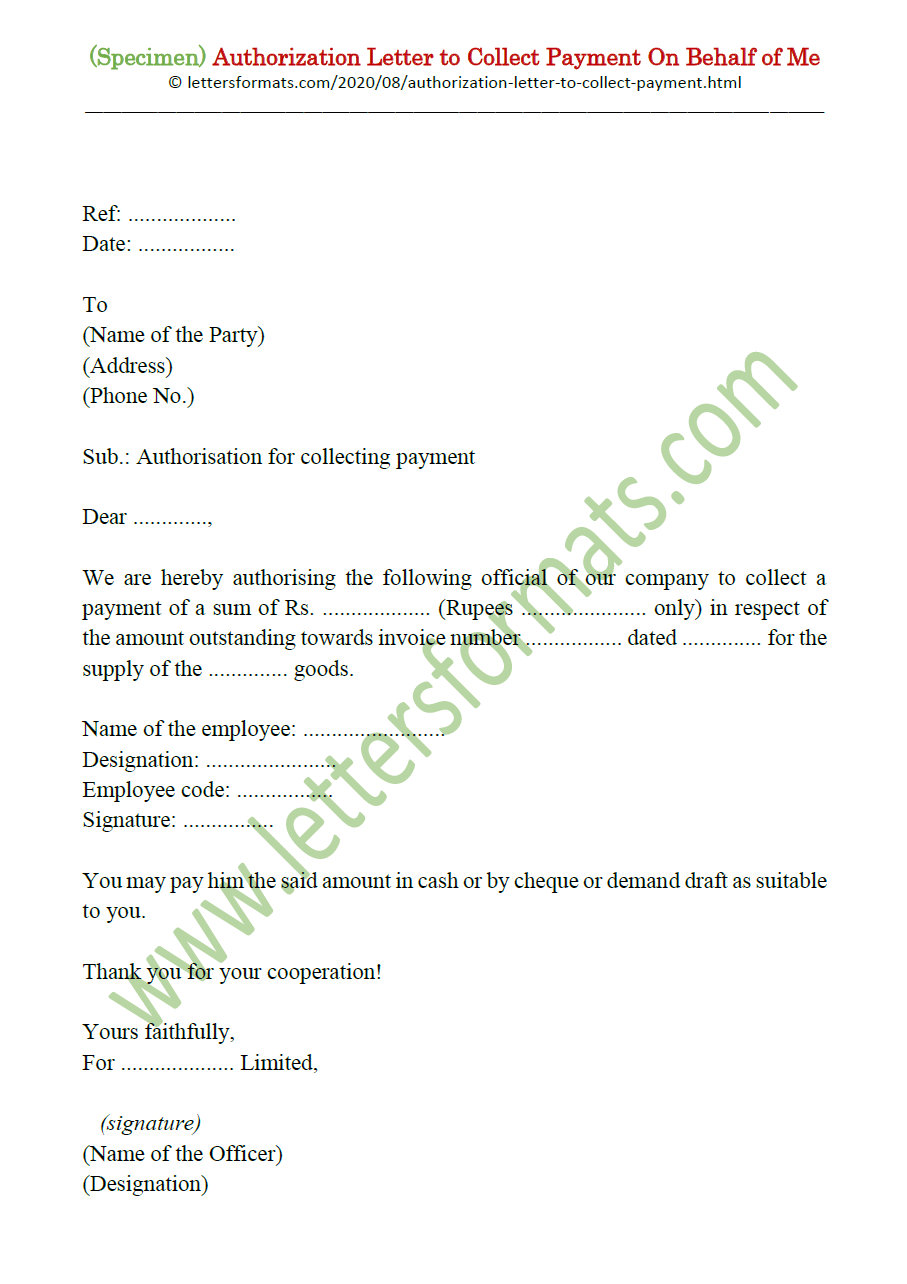

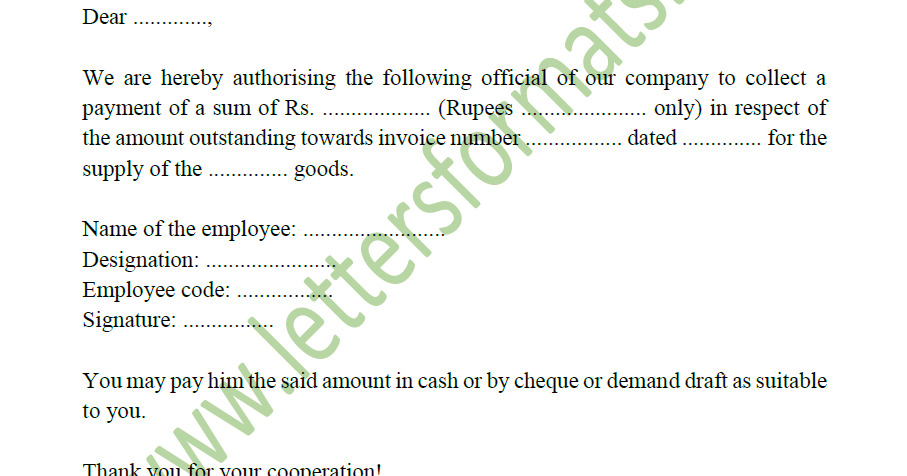

Creating an Effective Authorization Letter:

1. Identify Yourself: Clearly state your full name and address.

2. Identify the Authorized Party: Provide their full name and address.

3. Payment Details: Specify the amount, payment method (check, cash, etc.), and the payer.

4. Purpose of Payment: Briefly explain the reason for the payment (e.g., rent, invoice #123).

5. Duration: If applicable, state the period for which the authorization is valid.

6. Signature and Date: Sign and date the letter.

Advantages and Disadvantages of Payment Authorization Letters

| Advantages | Disadvantages |

|---|---|

| Convenience | Potential for misuse if not drafted carefully |

| Security | Requires trust in the authorized individual |

| Efficiency | Not suitable for all situations (e.g., highly sensitive transactions) |

FAQs

1. Is a payment authorization letter legally binding? Generally, yes, if drafted correctly.

2. What if the authorized person misuses the letter? You should contact the payer immediately and legal counsel if necessary.

3. Can I revoke a payment authorization letter? Yes, you can typically revoke it in writing.

4. Do I need to notarize a payment authorization letter? Not always, but it can strengthen its validity.

5. Can I authorize someone to collect payment on my behalf for multiple transactions? Yes, you can specify the scope of the authorization in the letter.

6. What information should be included in the letter? Include your and the authorized party's details, payment details, purpose, duration, and signature.

7. What if the payer refuses to accept the authorization letter? You may need to explore alternative payment arrangements.

8. Are there templates available for authorization letters? Yes, you can find various templates online or consult legal professionals.

Conclusion

Payment authorization letters are indispensable tools in today's financial landscape. They bridge the gap between payers and payees, providing a secure and efficient way to manage transactions, especially when direct access isn’t possible. From simplifying rent payments to facilitating complex business transactions, these letters offer significant advantages in terms of convenience, security, and operational efficiency. While drafting these letters, it is crucial to be precise and include all the necessary details to avoid potential issues. Remember to clearly identify all parties involved, provide explicit payment details, and specify the scope and duration of the authorization. By understanding the importance and proper implementation of these letters, individuals and businesses alike can streamline their payment processes and navigate financial transactions with confidence and ease. Take advantage of the convenience and security offered by payment authorization letters – they’re a valuable asset in managing your finances effectively.

The cultural impact of cartoon gangster archetypes

Decoding aarp medicare plans

Dryer vent flex pipe your ultimate guide to safe and efficient drying

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon

authorization letter to collect payment | Solidarios Con Garzon