Unlocking Medicare Supplement Plans with AARP: Your Guide

Are you approaching Medicare eligibility and feeling overwhelmed by the alphabet soup of options? You're not alone. Medicare can be confusing, but understanding your supplement choices can empower you to make informed decisions about your healthcare future. One popular option is supplementing your Original Medicare coverage with a plan offered through AARP, endorsed by UnitedHealthcare. Let's dive into the details of AARP Medicare Supplement plan information so you can navigate this important decision with confidence.

AARP doesn't offer Medicare Supplement insurance directly, but they endorse plans provided by UnitedHealthcare. These plans are designed to help fill the gaps in Original Medicare (Parts A and B), covering some of the costs that you would otherwise have to pay out-of-pocket, such as copayments, coinsurance, and deductibles. This can provide significant financial protection and predictable healthcare expenses. Understanding the nuances of these plans is crucial for maximizing your healthcare dollars and ensuring you have the coverage you need.

Medicare Supplement plans, also known as Medigap, have a rich history tied to the evolution of Medicare itself. As healthcare costs rose, the need for supplemental coverage became increasingly apparent. These plans were designed to standardize benefits and provide consumers with a clear understanding of their coverage options. AARP's endorsement of UnitedHealthcare plans provides a trusted resource for many seeking this supplemental coverage. Finding reliable AARP Medicare supplement plan details becomes essential for navigating this landscape effectively.

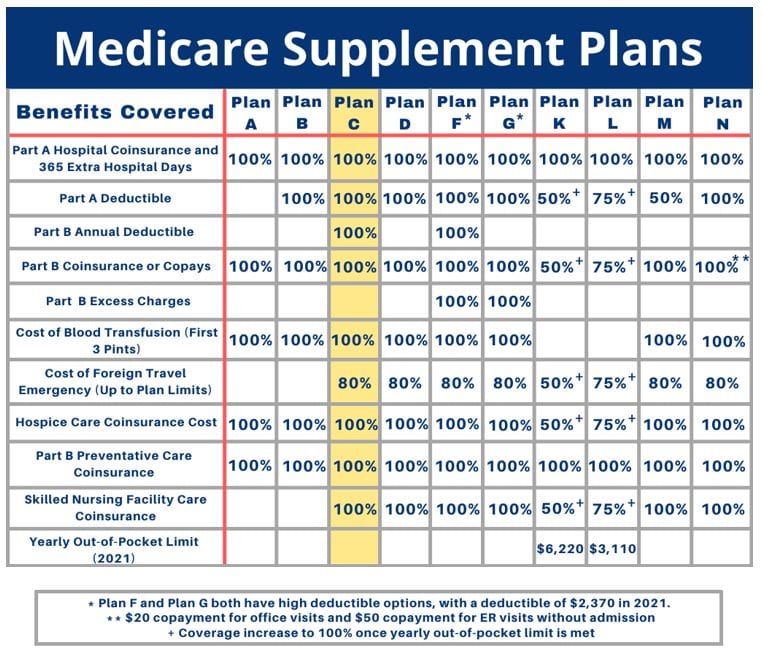

The importance of AARP Medicare supplement plan information cannot be overstated. These plans can offer peace of mind by protecting you from unexpected medical expenses. By understanding the different plan options (like Plan G, Plan N, Plan F, and Plan K, to name a few), you can tailor your coverage to your specific health needs and budget. This proactive approach to healthcare planning allows you to focus on your well-being rather than worrying about the financial burdens of illness or injury. A thorough review of AARP Medicare Supplement plans is a critical step in securing your healthcare future.

A common issue related to AARP Medicare supplement plan data is the sheer volume of information available. Sifting through brochures, websites, and policy documents can be daunting. It's easy to feel overwhelmed and unsure where to begin. A streamlined approach to accessing and understanding this information is key. Breaking down the complexities into manageable pieces can empower you to make the best choice for your individual circumstances.

Plan F, for example, offers comprehensive coverage, including the Part B deductible, while Plan G leaves the deductible to you but offers lower premiums. Plan N shares similarities with Plan G but asks you to pay copays for certain doctor visits and emergency room visits. You must weigh the pros and cons of each based on your individual healthcare needs and budget.

One benefit is predictable healthcare costs. Knowing your out-of-pocket expenses allows you to budget effectively. Another advantage is the freedom to choose any doctor who accepts Medicare, offering flexibility in your healthcare. Finally, these plans can travel with you, providing coverage anywhere in the US, giving you peace of mind wherever you go.

To choose a plan, first assess your healthcare needs and budget. Then, compare AARP/UnitedHealthcare plans, considering premiums, deductibles, and coverage. Finally, enroll in the plan that best aligns with your requirements.

Advantages and Disadvantages of AARP/UnitedHealthcare Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable Costs | Premiums can be higher than Medicare Advantage |

| Freedom to Choose Doctors | Separate prescription drug coverage (Part D) required |

| Nationwide Coverage | May not cover all out-of-pocket expenses |

Five best practices include: 1) Review your current healthcare needs, 2) Compare plan benefits and costs, 3) Consider your budget, 4) Read plan details carefully, and 5) Consult with a licensed insurance agent.

Frequently asked questions include: What is the difference between Medicare Supplement Plans F and G? How much are the premiums? Does the plan cover pre-existing conditions? What is the enrollment period? Can I switch plans later? Are there any network restrictions? Does the plan cover international travel? Where can I find more information?

One helpful tip is to use online comparison tools to evaluate different AARP Medicare Supplement plans side-by-side. This allows you to quickly see the differences in premiums, deductibles, and coverage.

In conclusion, securing your healthcare future requires careful planning and informed decisions. AARP Medicare Supplement plans, provided by UnitedHealthcare, offer a viable option for supplementing your Original Medicare coverage. By understanding the different plan options, benefits, and costs, you can choose the coverage that best meets your individual needs and budget. Taking the time to research AARP Medicare Supplement plan information empowers you to navigate the complexities of Medicare with confidence and ensures you have the protection you need for a healthy and secure future. Don’t wait, take control of your healthcare journey today and explore the options available to you. Your future self will thank you.

Sakit ng tagiliran kaliwa whats this pain on my left side

From spells to skin finding the best tattoo services for wizards

Natures tiny assassins the world of insectivorous insects

aarp medicare supplement plan information | Solidarios Con Garzon

AARP Medicare Supplement Insurance Plan from UnitedHealthcare | Solidarios Con Garzon

.jpeg)

AARP Medicare Supplement Insurance by United Healthcare | Solidarios Con Garzon

Cost Of Medicare Part C In 2024 | Solidarios Con Garzon

Aarp Plan F Cost 2024 | Solidarios Con Garzon

What Is Medicare Supplement Plan P | Solidarios Con Garzon

Are All Medicare Supplement Plan G The Same | Solidarios Con Garzon

Does Aarp Plan F Cover Chiropractic at Marian Black blog | Solidarios Con Garzon

UnitedHealthcare AARP Medicare Supplement Plans Review Comprehensive | Solidarios Con Garzon

Aarp Medicare Advantage 2024 Plan Pdf | Solidarios Con Garzon

Medicare Supplement Plan N | Solidarios Con Garzon

Aarp Medicare Supplemental Insurance | Solidarios Con Garzon

Aarp Medicare Supplement Plan F | Solidarios Con Garzon

aarp medicare supplement plan information | Solidarios Con Garzon

Medicare Supplement Plans Comparison Chart 2023 | Solidarios Con Garzon