Unlocking Indonesia's Income Tax Puzzle: What Salary Triggers Tax?

Imagine this: you've landed your dream job in Indonesia, the salary is great, and you're ready to embrace island life. But amidst the excitement, a crucial question arises: how much of this hard-earned rupiah will go towards income tax? Understanding Indonesia's income tax system, particularly the "wajib pajak gaji berapa" threshold – the minimum salary requiring tax payment – is crucial for anyone earning an income in the country.

Whether you're a seasoned expat or a fresh graduate entering the workforce, grasping the intricacies of "wajib pajak gaji berapa" can feel like navigating a labyrinth. But fear not! This comprehensive guide will equip you with the knowledge to demystify Indonesia's income tax system, empowering you to make informed financial decisions.

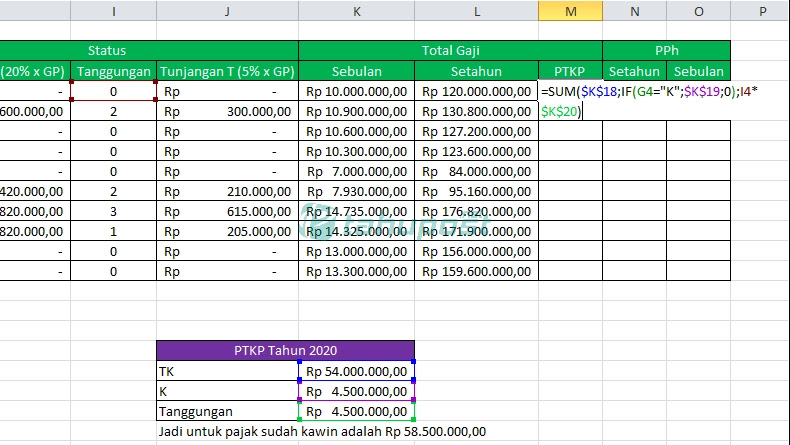

In essence, "wajib pajak gaji berapa" boils down to determining the salary level that triggers income tax obligations in Indonesia. This threshold isn't static; it's influenced by factors such as annual income, tax deductions, and applicable tax brackets. By understanding these elements, you can calculate your tax liability accurately and ensure compliance with Indonesian tax regulations.

But beyond mere compliance, comprehending "wajib pajak gaji berapa" offers a gateway to financial optimization. By leveraging tax deductions, understanding tax relief programs, and strategically planning your finances, you can potentially reduce your tax burden and maximize your income. This knowledge empowers you to take control of your finances, ensuring more rupiah stays in your pocket.

So, whether you're dreaming of exploring ancient temples or surfing epic waves, mastering the intricacies of "wajib pajak gaji berapa" is an essential step towards enjoying a financially secure and fulfilling life in Indonesia. Let's dive in and demystify the world of Indonesian income tax together!

Advantages and Disadvantages of Understanding "Wajib Pajak Gaji Berapa"

While inherent complexities exist within any tax system, understanding "wajib pajak gaji berapa" presents both advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Empowers informed financial planning and budgeting. | Requires navigating complex tax regulations and potential language barriers. |

| Facilitates compliance with Indonesian tax laws, avoiding penalties. | Tax laws and regulations are subject to change, necessitating staying updated. |

| Unlocks potential tax optimization strategies through deductions and reliefs. | Seeking professional tax advice may incur additional costs. |

Frequently Asked Questions About "Wajib Pajak Gaji Berapa"

Navigating the Indonesian tax landscape often sparks numerous questions. Here are some frequently asked questions about "wajib pajak gaji berapa":

1. What is the current "wajib pajak gaji berapa" threshold in Indonesia?

The specific threshold is subject to change based on annual government regulations. Consulting official tax resources or seeking advice from tax professionals is recommended for the most up-to-date information.

2. How is "wajib pajak gaji berapa" calculated for foreigners working in Indonesia?

Foreign workers are generally subject to the same income tax regulations as Indonesian citizens. The "wajib pajak gaji berapa" threshold applies based on their earned income within Indonesia.

3. What are some common tax deductions available for individuals in Indonesia?

Common deductions may include expenses related to healthcare, education, dependents, and social security contributions. Understanding eligible deductions is crucial for potentially reducing your tax liability.

4. What happens if I don't pay taxes despite exceeding the "wajib pajak gaji berapa" threshold?

Failing to fulfill tax obligations can result in penalties, fines, or legal consequences. It's crucial to comply with Indonesian tax laws and seek assistance if needed.

5. Where can I find reliable information and resources regarding "wajib pajak gaji berapa"?

The official website of the Indonesian Directorate General of Taxes (Direktorat Jenderal Pajak/DJP) provides comprehensive information, forms, and regulations related to taxation in Indonesia.

6. Are there any specific tax exemptions or reliefs for certain professions or industries?

Yes, certain professions and industries might be eligible for specific tax exemptions or reliefs. Consulting official tax resources or seeking professional advice is recommended for exploring potential options.

7. How can I pay my income taxes in Indonesia?

Tax payments can typically be made through various channels, including online banking, ATM transfers, or designated tax offices. The DJP website provides comprehensive guidance on tax payment methods.

8. What are the consequences of late tax payments in Indonesia?

Late tax payments can incur penalties and interest charges. It's crucial to adhere to tax deadlines and seek assistance from tax authorities if facing difficulties in making timely payments.

Tips and Tricks for Managing Your "Wajib Pajak Gaji Berapa"

Here are some practical tips for managing your "wajib pajak gaji berapa":

- Maintain organized financial records throughout the year, including income statements, tax payment receipts, and documentation for potential deductions. This facilitates a smoother tax filing process.

- Consider utilizing tax software or seeking assistance from qualified tax professionals, especially if your financial situation is complex or you're unsure about specific regulations.

- Stay updated on any changes in Indonesian tax laws and regulations. The DJP website and reputable financial news sources can provide valuable information.

- Explore potential tax savings opportunities by researching eligible deductions, reliefs, and tax-advantaged investment options. Professional financial advisors can provide personalized guidance.

- Plan your finances proactively to accommodate your tax obligations. This includes setting aside funds regularly and anticipating potential tax liabilities.

Mastering "wajib pajak gaji berapa" is not merely about fulfilling legal obligations; it's about empowering yourself to thrive financially in Indonesia. By understanding your tax liabilities, exploring optimization strategies, and staying informed, you can navigate the Indonesian tax system with confidence. Remember, knowledge is power, and in the realm of personal finance, this knowledge translates into greater control over your financial well-being. Embrace the journey of understanding "wajib pajak gaji berapa" – it's an investment in your financial future.

Cara Hitung THR untuk Karyawan Outsourcing | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon

wajib pajak gaji berapa | Solidarios Con Garzon