Unlocking Indonesian VAT Relief: The Power of the SKB PPN Application Letter

Imagine navigating the complex world of Indonesian taxes, only to discover a hidden portal to potential relief. That's the power of the Surat Keterangan Bebas Pajak Pertambahan Nilai, or VAT exemption certificate (SKB PPN), and its accompanying application letter – the contoh surat permohonan skb ppn. This document can be a game-changer for businesses, offering a pathway to significant cost savings.

But what exactly is this mystical document, and how can you harness its power? Simply put, the contoh surat permohonan skb ppn is a formal request submitted to the Indonesian tax authorities to obtain a VAT exemption. This exemption can apply to specific goods or services, offering a crucial advantage in a competitive market.

The contoh surat permohonan skb ppn plays a vital role in the Indonesian tax system, providing a mechanism for eligible businesses to avoid paying VAT on certain transactions. This system helps promote specific industries and activities deemed beneficial to the Indonesian economy. Understanding the nuances of this application is essential for any business operating within Indonesia.

Historically, the Indonesian government has used VAT exemptions as a tool to stimulate economic growth and support key sectors. The regulations surrounding these exemptions, including the requirements for the contoh surat permohonan skb ppn, have evolved over time to reflect changing economic priorities.

One of the main issues surrounding the contoh surat permohonan skb ppn is ensuring its accurate and complete submission. Errors or omissions in the application can lead to delays or even rejection, hindering a business's ability to benefit from the VAT exemption. Therefore, understanding the specific requirements and following a clear process is crucial.

A proper contoh surat permohonan skb ppn typically includes details such as the applicant's company information, the specific goods or services for which the exemption is sought, and supporting documentation justifying the request. A clear and concise explanation of how the exemption aligns with the eligible criteria is key to a successful application.

Benefits of a successfully obtained SKB PPN through a well-crafted contoh surat permohonan skb ppn include reduced input costs, increased competitiveness, and improved cash flow. For example, a company exporting goods might be eligible for a VAT exemption, allowing them to offer more competitive pricing in the international market.

To secure a VAT exemption, businesses should meticulously prepare their contoh surat permohonan skb ppn, ensuring all necessary information is included and accurately presented. Gathering supporting documents, such as business licenses and relevant financial records, is also critical.

While there isn't a standard checklist, ensure your contoh surat permohonan skb ppn includes company details, the specific VAT exemption requested, justification for the request, and all required supporting documents.

Advantages and Disadvantages of Utilizing contoh surat permohonan skb ppn

| Advantages | Disadvantages |

|---|---|

| Cost Savings | Complex Application Process |

| Increased Competitiveness | Potential for Delays |

| Improved Cash Flow | Risk of Rejection |

Best practices include consulting with a tax advisor, thoroughly reviewing the regulations, and submitting the application well in advance of the deadline. Keeping accurate records of the application process is also highly recommended.

FAQs include questions about eligibility criteria, required documentation, and the application process itself. Consulting with a tax professional can provide tailored answers based on specific business circumstances.

In conclusion, the contoh surat permohonan skb ppn is a powerful tool for businesses operating in Indonesia. While navigating the application process can be challenging, the potential benefits of a successfully obtained VAT exemption are significant. By understanding the requirements, following best practices, and seeking expert advice when needed, businesses can unlock the potential of the SKB PPN and gain a competitive edge in the Indonesian market. Don't let the complexities of the tax system intimidate you – embrace the power of the contoh surat permohonan skb ppn and discover the financial advantages it can offer your business. Take the time to research, prepare, and submit a compelling application. The potential rewards are well worth the effort.

Casas de renta en mexicali baja california your desert oasis awaits

Navigating the road the spanish language commercial drivers license manual

Exploring rolling stones greatest songs list a musical journey

Kementerian Komunikasi dan Informatika | Solidarios Con Garzon

Tata Cara Pengajuan SKB PPN Atas Import Mesin Dan Peralatan Pabrik | Solidarios Con Garzon

Contoh Surat Permohonan Skb Ppn | Solidarios Con Garzon

Contoh Surat Permohonan Cetak Ulang Spt Masa Ppn | Solidarios Con Garzon

SKB Hibah dan Waris | Solidarios Con Garzon

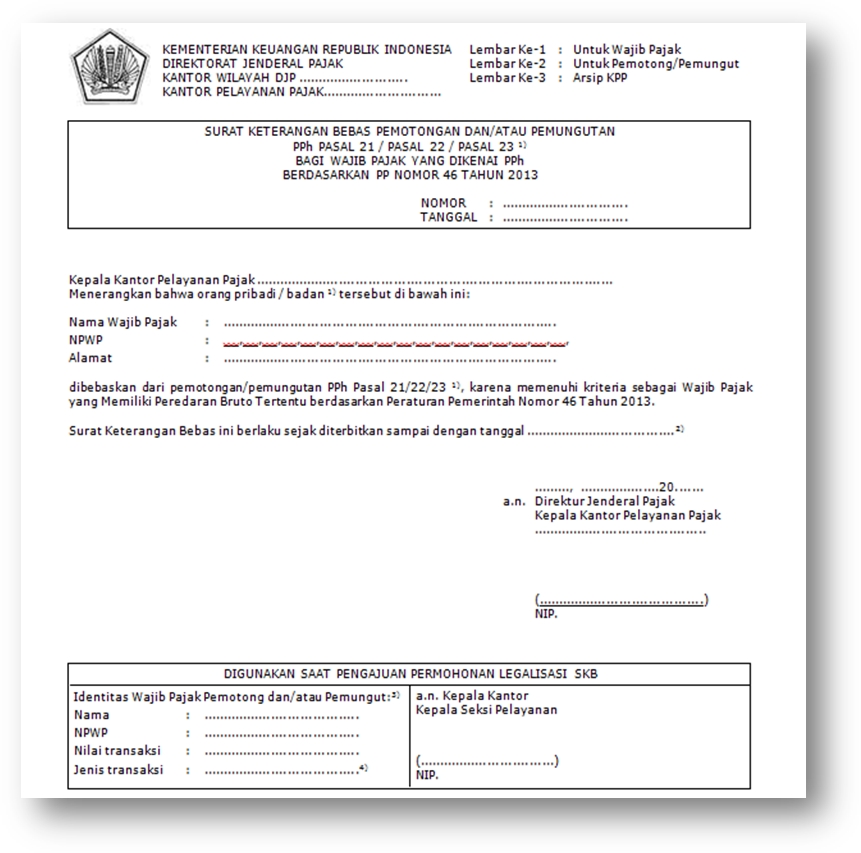

Download surat permohonan SKB surat keterangan bebas PP23 2018 2019 | Solidarios Con Garzon

Contoh Bukti Pembayaran Pajak Ppn | Solidarios Con Garzon

Insentif PPh 22 Impor Bidang Usaha Syarat dan Cara Mengajukan | Solidarios Con Garzon

Contoh Surat Pengajuan Skp Ppni Adalah | Solidarios Con Garzon

Contoh Surat Keterangan Bebas Pajak Permohonan SKB Pph 22 Impor | Solidarios Con Garzon

Pengajuan Skb Pph Pasal 23 | Solidarios Con Garzon

DOC Surat Permohonan Surat Keterangan Bebas SKB Pajakdocx | Solidarios Con Garzon

Permohonan Surat Keterangan Bebas Baru | Solidarios Con Garzon

Cara dan Syarat Permohonan Pembuatan SKB Surat Keterangan Bebas Pajak | Solidarios Con Garzon

Detail Contoh Surat Permohonan Skb Pph 22 Impor Koleksi Nomer 3 | Solidarios Con Garzon