Unlocking Financial Clarity: The Power of Monthly Financial Reporting

Imagine having a clear, concise snapshot of your finances every single month. You'd know exactly where your money is going, identify areas for improvement, and make informed decisions about your financial future. This is the power of monthly financial reporting, a practice that can transform your relationship with money.

Whether you're running a business or managing your personal finances, keeping track of your income and expenses is crucial. Monthly financial reports provide a structured framework to do just that, offering a comprehensive overview of your financial health.

The concept of tracking finances has been around for centuries, evolving alongside accounting practices. From handwritten ledgers to sophisticated software, the tools may have changed, but the fundamental importance remains the same. Today, with the increasing complexity of financial transactions, monthly reports are more vital than ever.

But why are these reports so important? Simply put, they provide the insights you need to make informed decisions. Without them, you're essentially navigating your finances in the dark, unaware of potential risks or opportunities.

One of the biggest challenges many face is a lack of consistency. Creating these reports sporadically won't yield the same benefits as a regular monthly practice. Additionally, inaccurate data entry or a lack of proper categorization can lead to misleading conclusions. This is why understanding the core principles and best practices is essential.

Advantages and Disadvantages of Monthly Financial Reporting

| Advantages | Disadvantages |

|---|---|

| Improved financial awareness | Time commitment for preparation |

| Better expense management | Potential for data entry errors |

| Informed financial decision-making | May not be suitable for all individuals/businesses |

While there are clear benefits, it's important to acknowledge potential drawbacks. Dedicating time each month for report preparation might seem daunting initially. However, the long-term advantages far outweigh this initial investment.

To truly harness the power of monthly financial reports, consider these best practices:

- Consistency is Key: Establish a regular schedule for preparing your reports, ideally at the end of each month.

- Utilize Technology: Leverage accounting software or spreadsheets to streamline the process and minimize errors.

- Categorize Meticulously: Create detailed categories for both income and expenses to gain granular insights.

- Analyze and Act: Don't just create reports; analyze the data, identify trends, and adjust your financial habits accordingly.

- Seek Professional Guidance: If you're unsure about certain aspects, consult with a financial advisor for personalized advice.

In conclusion, mastering monthly financial reporting is an investment in your financial well-being. While it requires effort and dedication, the rewards are substantial. By embracing these practices, you gain clarity, control, and the knowledge to make informed decisions that lead to a brighter financial future.

Hand tool safety mastering your inspection checklist

Behr weathered white paint reviews a comprehensive guide

Nuzul quran posters a modern take on a sacred celebration

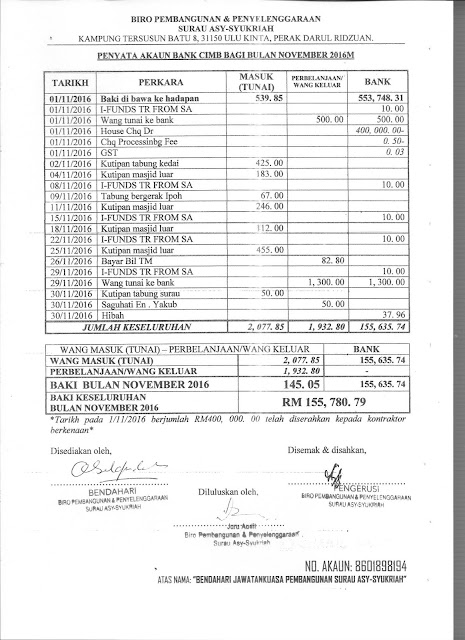

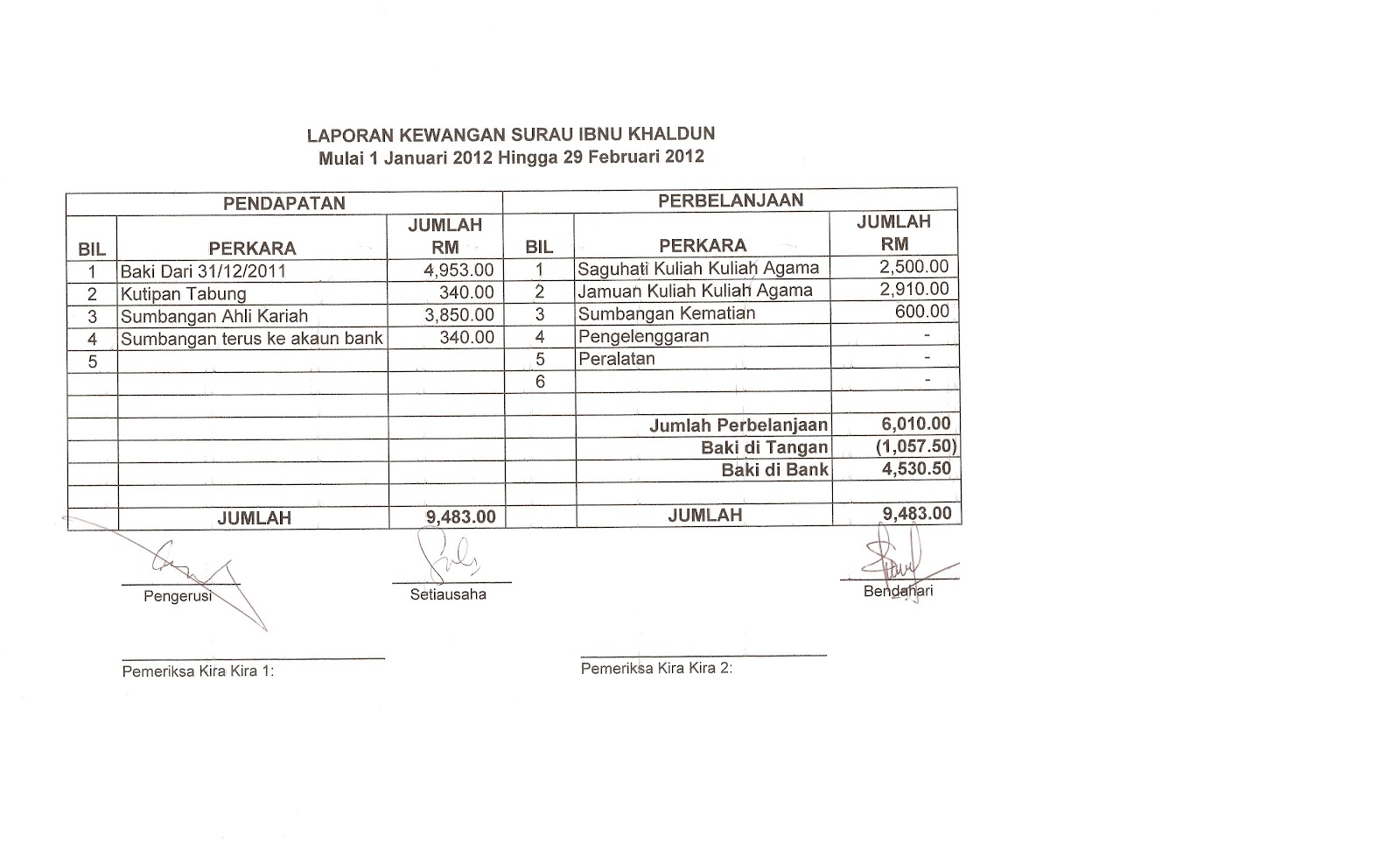

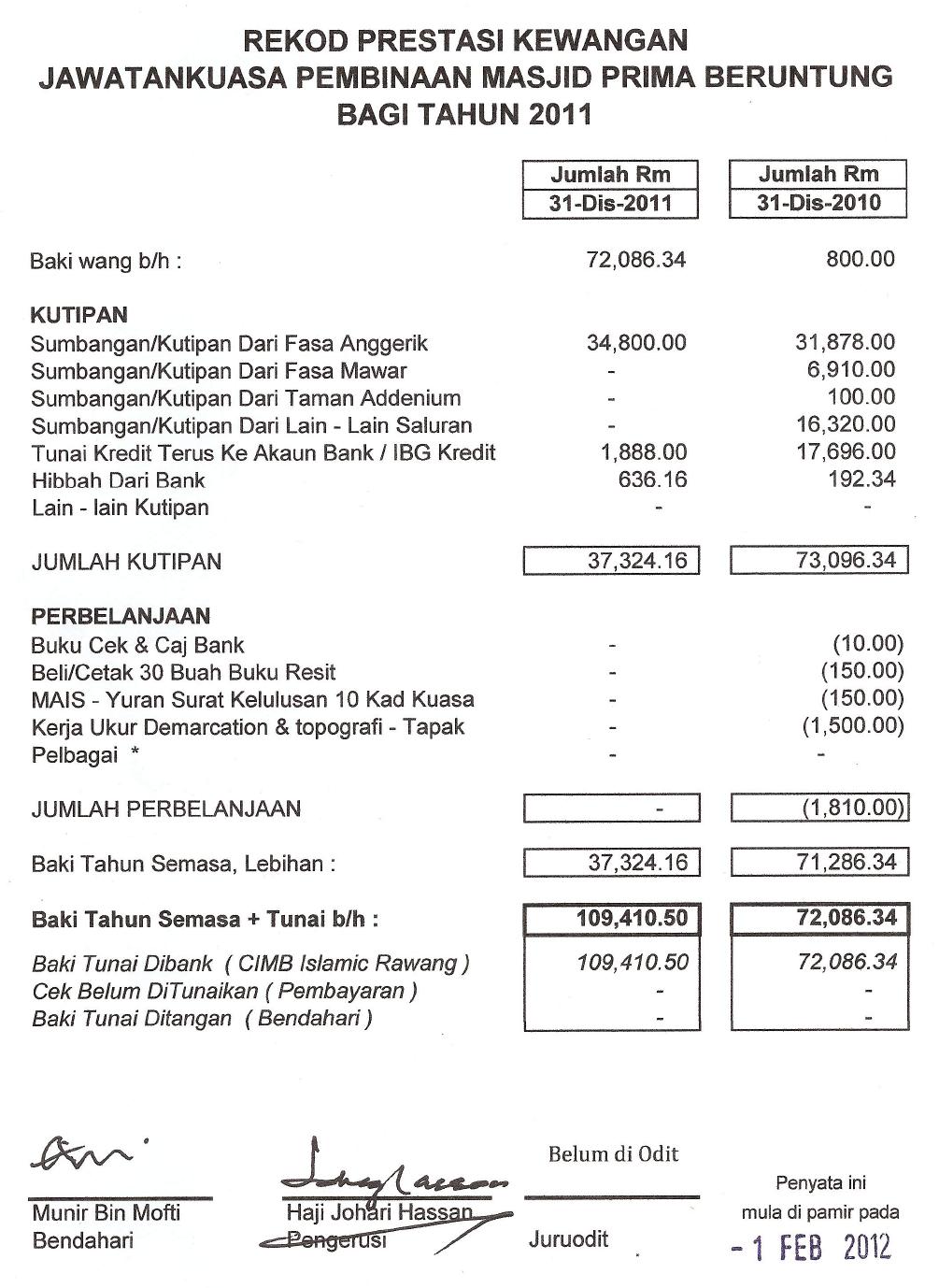

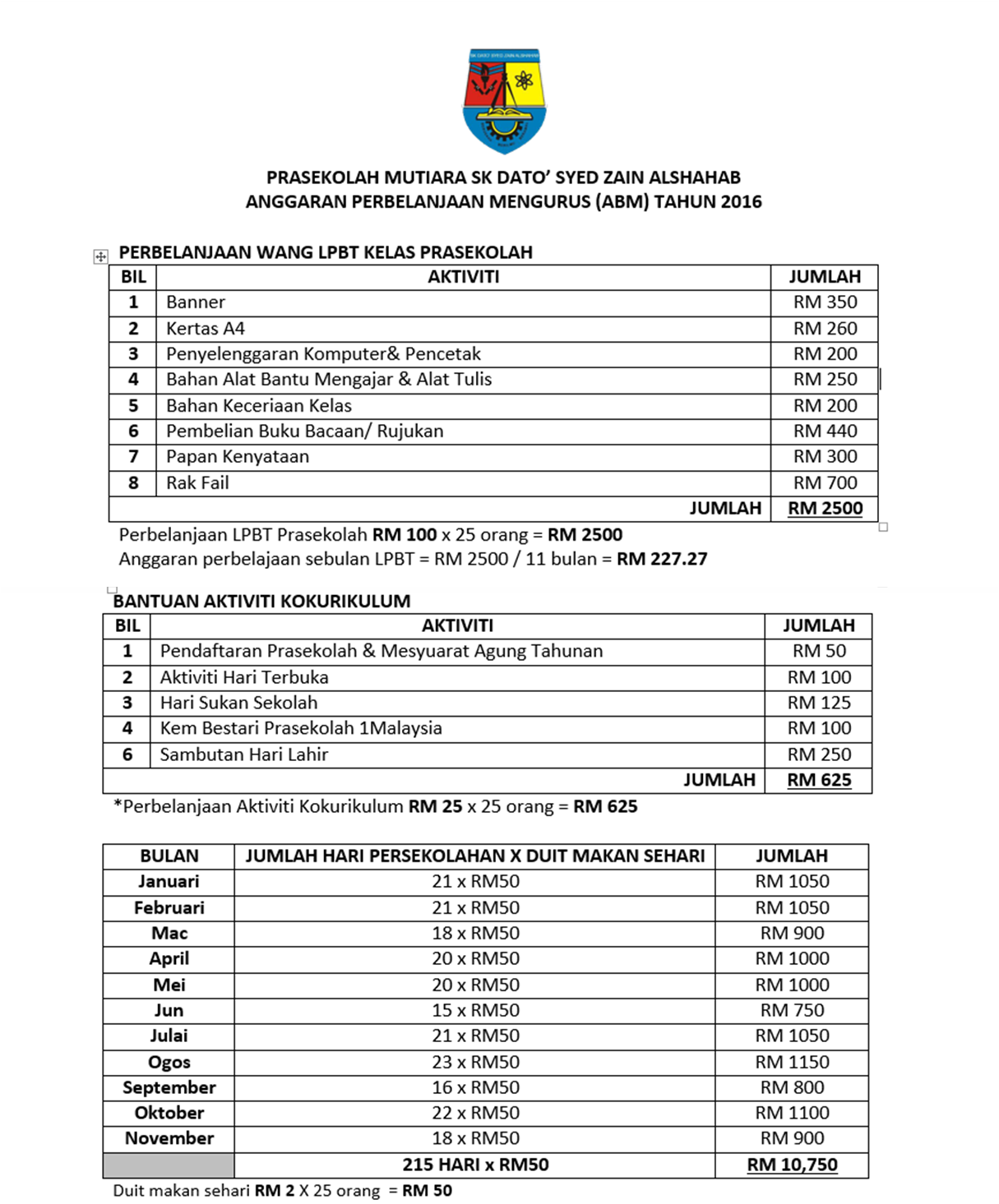

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon

contoh laporan kewangan bulanan | Solidarios Con Garzon