Unlocking Financial Clarity: Mastering the Art of Accounting Worksheets

In the complex landscape of finance, accurate and organized data is paramount. But how do you wrangle all those numbers and transactions into something meaningful? Enter the accounting worksheet (often referred to as "hoja de trabajo contabilidad como se hace" in Spanish), a powerful tool that can transform your financial management. This isn't just about crunching numbers; it's about gaining a deeper understanding of your financial health.

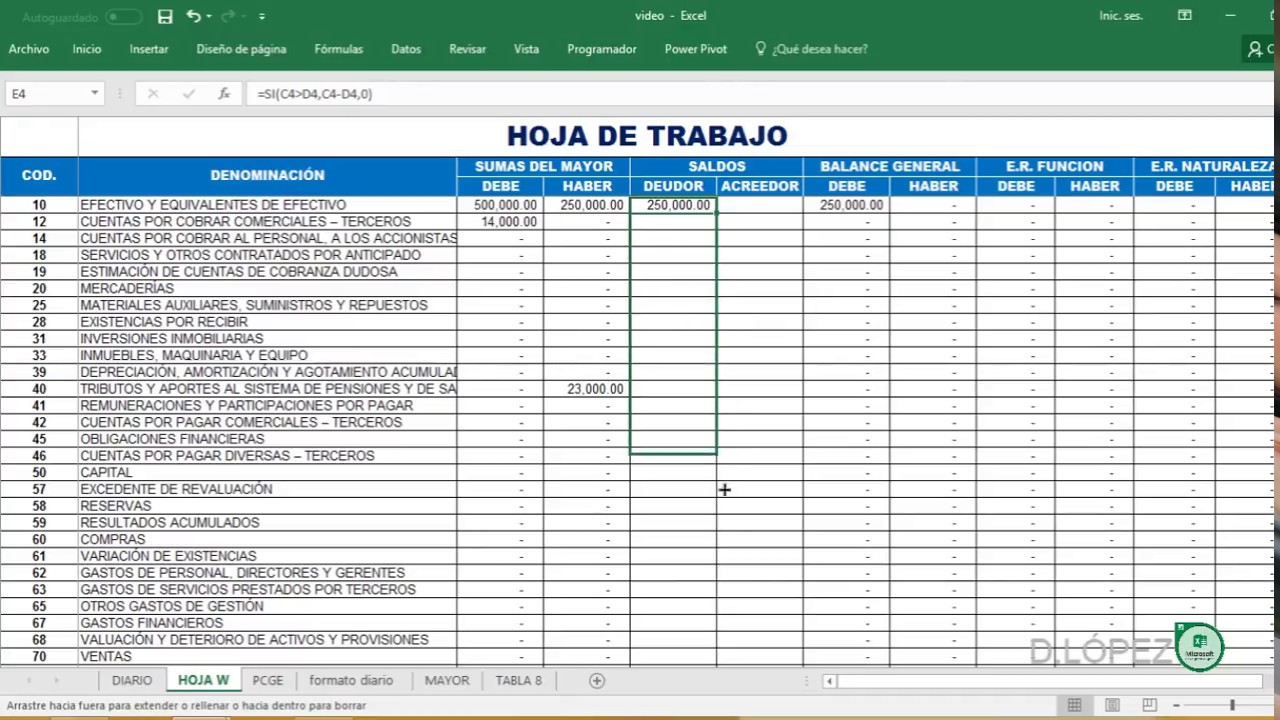

Think of an accounting worksheet as a behind-the-scenes blueprint for your financial statements. It's a structured document used to organize and analyze financial data before it's formally presented in financial reports. It's the bridge between raw transaction data and the polished insights you need to make informed decisions. Whether you're a small business owner, a freelancer, or managing your personal finances, understanding how to construct and utilize an accounting worksheet is essential.

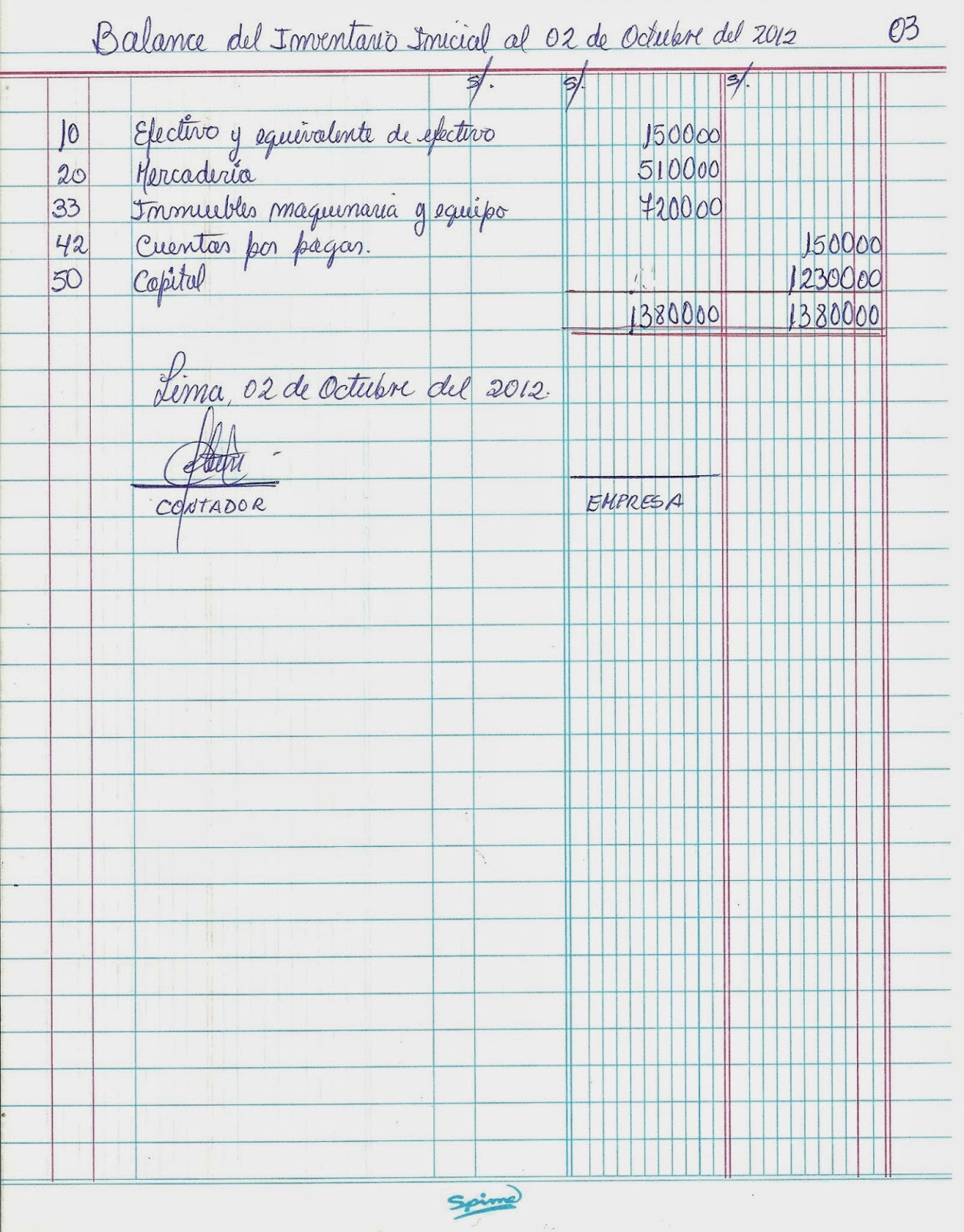

The history of accounting worksheets is intertwined with the development of double-entry bookkeeping. As businesses grew more complex, the need for a structured way to organize transactions and prepare financial statements became evident. While the exact origin is difficult to pinpoint, the fundamental principles of debit and credit, along with the need for trial balances, paved the way for the development of the modern accounting worksheet. This evolution reflects a continuous refinement in how financial information is processed and analyzed.

The core issue that accounting worksheets address is the complexity of financial data. Imagine trying to build a house without a blueprint. Similarly, trying to create accurate financial statements without first organizing and analyzing the underlying transactions is a recipe for disaster. The worksheet provides a structured framework for this process, ensuring that all transactions are accounted for and that the resulting financial statements are accurate and reliable.

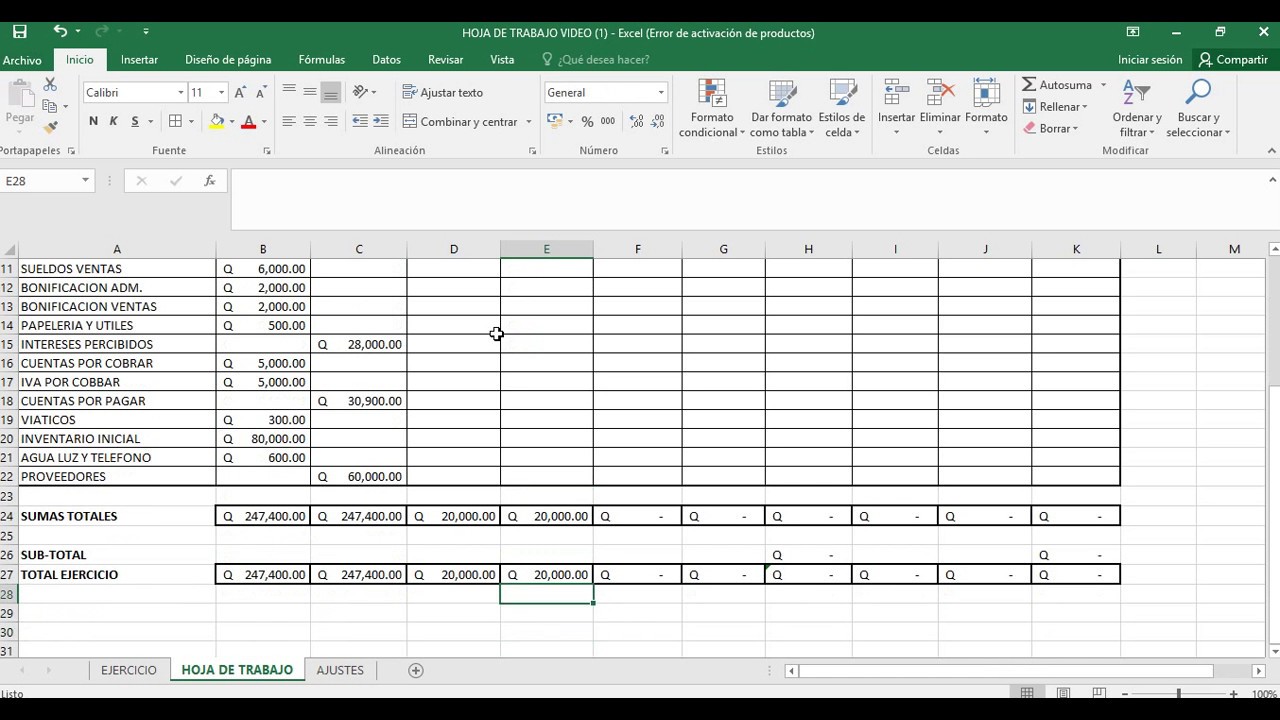

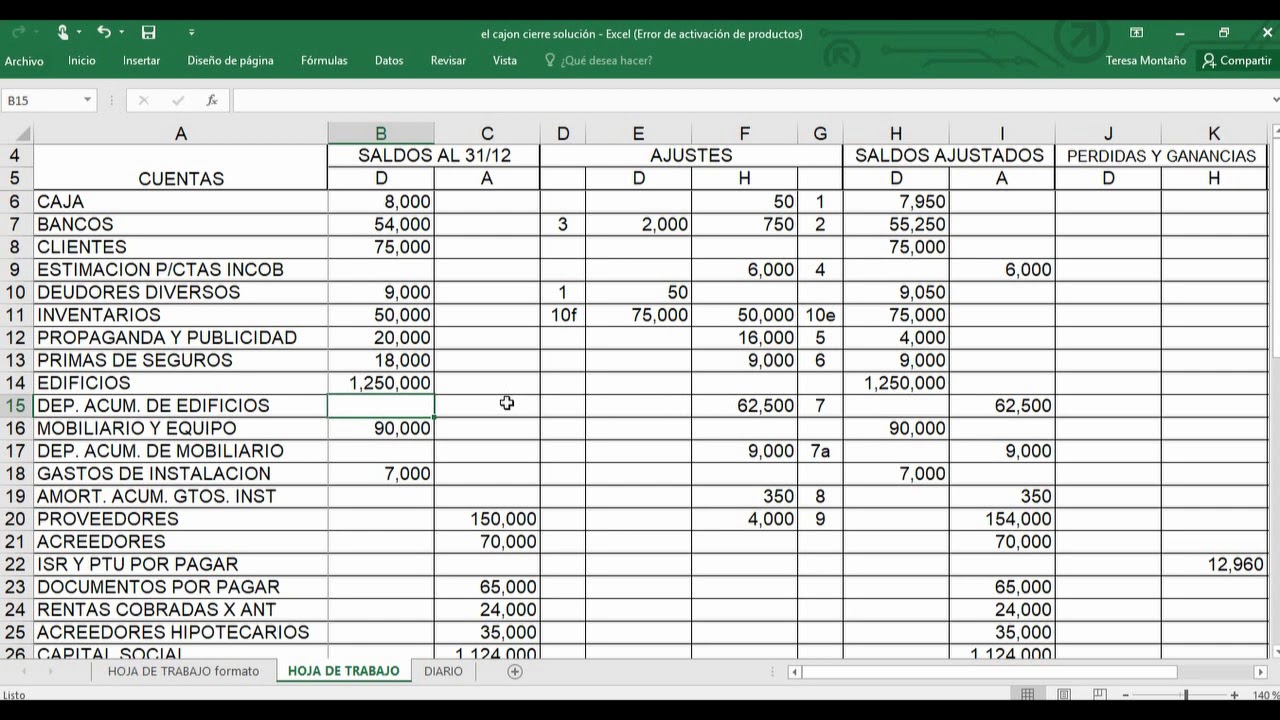

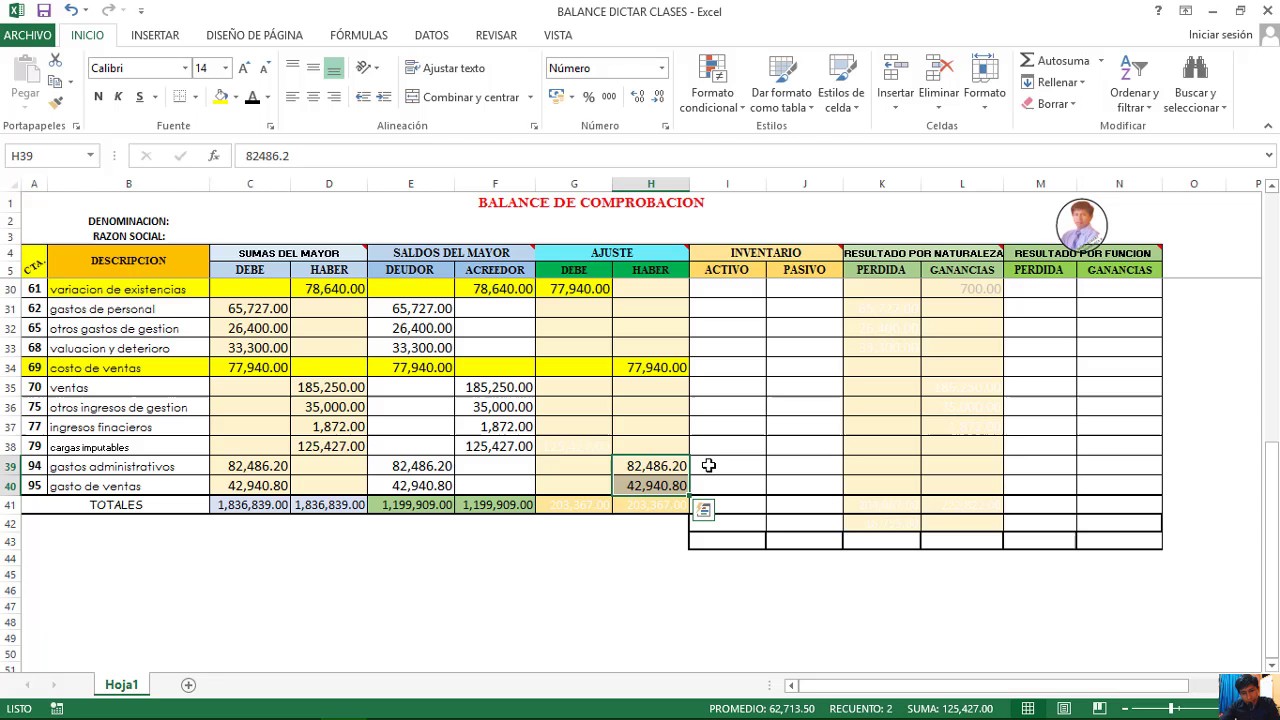

A basic accounting worksheet typically consists of columns for trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. The trial balance lists all account balances at a specific point in time. Adjustments are made to account for accruals, deferrals, and other necessary corrections. The adjusted trial balance reflects the updated balances after adjustments. Finally, the income statement and balance sheet columns are used to prepare the formal financial statements.

One of the primary benefits of using an accounting worksheet is improved accuracy. By providing a structured format for organizing and analyzing transactions, the worksheet helps minimize errors and ensures that all financial data is accounted for. For example, using a worksheet can help you identify and correct discrepancies between your bank statement and your internal records. This leads to more reliable financial statements and better decision-making.

Another advantage is enhanced efficiency. Instead of jumping directly into preparing financial statements, the worksheet allows you to work through the process step-by-step, making adjustments and corrections as needed. This streamlines the overall process and reduces the time required to generate accurate financial reports. For instance, using formulas within a spreadsheet-based worksheet can automate calculations, saving you valuable time and effort.

Furthermore, accounting worksheets facilitate better financial analysis. By organizing data into specific categories (assets, liabilities, equity, revenues, expenses), the worksheet provides a clear picture of your financial performance. This allows you to identify trends, analyze profitability, and make informed decisions about resource allocation. For example, a worksheet can help you track your expenses over time, identify areas where you can cut costs, and improve your overall financial health.

Advantages and Disadvantages of Using Accounting Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Can be time-consuming for complex transactions |

| Enhanced Efficiency | Requires a good understanding of accounting principles |

| Facilitates Better Financial Analysis | May not be suitable for all types of businesses |

Creating an accounting worksheet generally involves these steps: 1. Prepare a trial balance. 2. Make necessary adjustments. 3. Prepare an adjusted trial balance. 4. Extend balances to the income statement and balance sheet columns. 5. Prepare the formal financial statements.

Best Practices: 1. Use a consistent format. 2. Double-check your calculations. 3. Clearly document all adjustments. 4. Regularly reconcile your worksheet with your bank statements. 5. Seek professional advice if needed.

Frequently Asked Questions: 1. What is an accounting worksheet? 2. Why is it important? 3. How do I create one? 4. What are the different components? 5. What are some common mistakes to avoid? 6. Can I use software to create a worksheet? 7. What are some resources for learning more? 8. How often should I create a worksheet?

Tips and Tricks: Utilizing spreadsheet software can significantly simplify the creation and management of accounting worksheets. Leveraging formulas for automated calculations and built-in functions for data analysis can greatly enhance efficiency and accuracy.

In conclusion, the accounting worksheet, often referred to as "hoja de trabajo contabilidad como se hace," serves as a vital foundation for sound financial management. It empowers individuals and businesses alike to transform raw financial data into actionable insights. From improved accuracy and enhanced efficiency to facilitating in-depth analysis, mastering this tool unlocks a deeper understanding of your financial landscape. By embracing best practices and leveraging available resources, you can confidently navigate the complexities of finance and make informed decisions that drive success. Start using accounting worksheets today and experience the transformative power of organized financial data. Your future financial self will thank you.

Angel with ski mask tattoo meaning unmasking the symbolism

Skip the line renew lesen memandu online

The magnetism of cr7 cleats kids amazon a cultural phenomenon

Hojas De Contabilidad Para Imprimir | Solidarios Con Garzon

Como Se Hace Una Hoja De Trabajo En Contabilidad Ejemplos Para Images | Solidarios Con Garzon

Hoja De Trabajo Contable Ejemplos | Solidarios Con Garzon

Formato De Contabilidad En Excel Ejemplos | Solidarios Con Garzon

Como Llenar Un Libro Diario De Contabilidad | Solidarios Con Garzon

Modelo De Hoja De Trabajo | Solidarios Con Garzon

Ejemplo De Una Hoja De Trabajo En Contabilidad | Solidarios Con Garzon

Cómo crear modelos de balances contables en Excel Guía completa y paso | Solidarios Con Garzon

Hoja De Trabajo Contabilidad Ejemplo Images | Solidarios Con Garzon

Hoja De Trabajo Contabilidad | Solidarios Con Garzon

Para qué sirve la hoja de trabajo en contabilidad Una guía esencial | Solidarios Con Garzon

hoja de trabajo contabilidad como se hace | Solidarios Con Garzon

hoja de trabajo contabilidad como se hace | Solidarios Con Garzon

misil Melbourne Melbourne hoja de trabajo contabilidad en excel muy | Solidarios Con Garzon

hoja de trabajo contabilidad como se hace | Solidarios Con Garzon