Unlock Your Financial Freedom: Mastering Your Monthly Income Tax Calculation

Let's face it, navigating the world of taxes can feel about as fun as a flat tire on your bike. But what if I told you that mastering your monthly income tax calculation could be the secret sauce to unlocking financial freedom? It's true! By understanding how much you owe in taxes each month, you can budget effectively, avoid nasty surprises come tax season, and maybe even free up some cash for the fun stuff in life.

Think of it like this: every rupiah you pay in taxes is a rupiah that could be working harder for you – invested, saved, or even spent on a well-deserved vacation. By taking control of your monthly income tax calculations, you're taking charge of your financial destiny.

Now, "perhitungan pajak penghasilan bulanan," or monthly income tax calculation in English, might sound intimidating, but it doesn't have to be. It's like learning to ride a bike - with a little practice and the right guidance, you'll be a pro in no time.

In many countries, including Indonesia, your employer deducts income tax directly from your paycheck. This is called a Pay-As-You-Earn (PAYE) system. While this seems convenient, it's crucial to understand how this calculation works to ensure you're not overpaying or underpaying your taxes. And that's where we come in.

This guide is your roadmap to understanding, calculating, and optimizing your monthly income tax. We'll break down the complexities, demystify the jargon, and equip you with the knowledge to confidently navigate the world of taxes. Ready to ride that wave of financial freedom? Let's dive in!

Advantages and Disadvantages of Understanding Monthly Income Tax Calculation

To better illustrate the importance of understanding your monthly income tax calculation, let's delve into its pros and cons:

| Advantages | Disadvantages |

|---|---|

| Improved budgeting and financial planning | Requires time and effort to learn and calculate |

| Avoidance of underpayment penalties and interest | Tax laws and regulations can be complex and subject to change |

| Potential for tax savings through deductions and exemptions | Potential for errors in calculation if not performed accurately |

| Increased financial awareness and control |

5 Best Practices for Managing Your Monthly Income Tax

Let's explore some practical tips to help you stay on top of your monthly income tax obligations:

1. Track Your Income and Expenses Diligently: Maintaining detailed records of your income and eligible expenses is paramount. This will allow you to accurately calculate your taxable income and identify potential deductions.

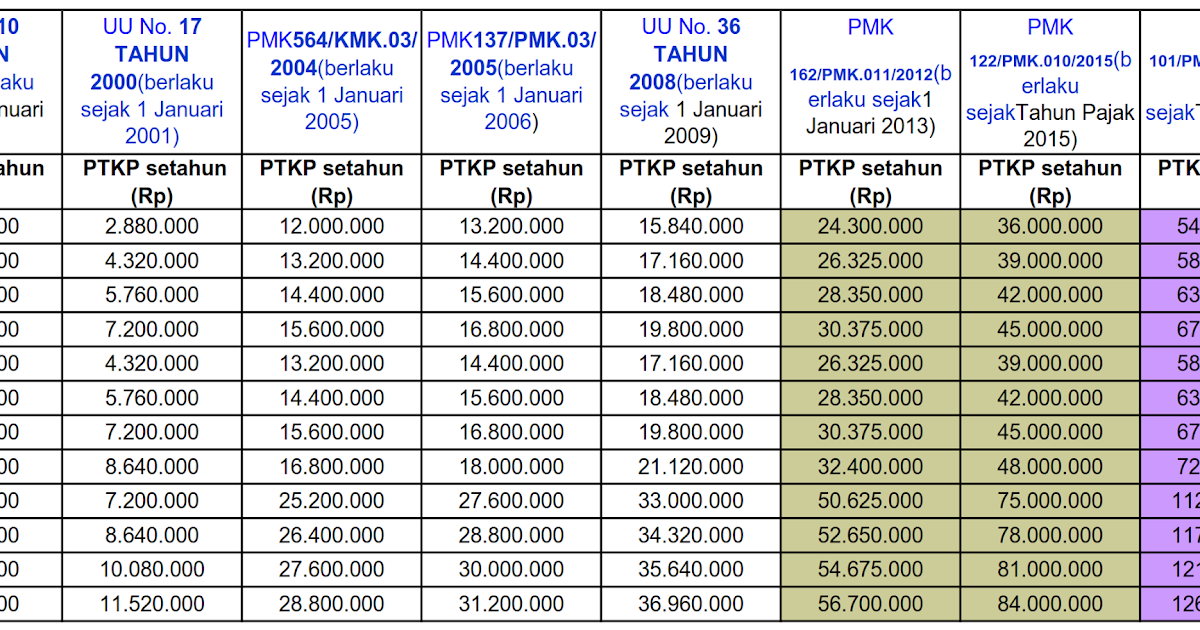

2. Familiarize Yourself with Tax Laws and Regulations: Tax codes can be intricate and subject to change. Make an effort to stay updated on the latest regulations, deductions, and exemptions relevant to your situation.

3. Leverage Technology to Your Advantage: Numerous online calculators and tax software programs are available to streamline the calculation process. These tools can simplify complex computations and minimize the risk of errors.

4. Seek Professional Guidance When Needed: If you find yourself grappling with complex tax scenarios or significant life changes, don't hesitate to consult with a qualified tax advisor. Their expertise can provide invaluable peace of mind.

5. Review and Adjust Regularly: Your financial circumstances and tax liabilities can evolve. It's wise to review your monthly income tax calculations periodically, particularly after major life events or changes in income.

By implementing these best practices, you can transform the seemingly daunting task of managing your monthly income tax into an empowering aspect of your financial journey.

In conclusion, understanding and mastering your "perhitungan pajak penghasilan bulanan" or monthly income tax calculations might seem like climbing a financial mountain, but the view from the top – financial clarity, control, and potentially more money in your pocket – is well worth the effort. Remember, knowledge is power, and by taking charge of your taxes, you're taking charge of your financial future. So, gear up, embrace the challenge, and enjoy the ride to financial freedom!

Unlocking worlds making reading comprehension fun for 3rd grade

Your healthcare needs walmart pharmacy on cordele road albany ga

Unlocking mathematical foundations exploring form 4 chapter 1 math questions

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon

perhitungan pajak penghasilan bulanan | Solidarios Con Garzon