The Curious Saga of Chase Bank Check Endorsement (and Why It Matters More Than You Think)

We live in a world of Venmo, Apple Pay, and cryptocurrencies, where the tap of a screen can transfer thousands of dollars in an instant. So why are we still talking about this relic of the pre-digital age – the humble check? And why should you care about the seemingly arcane process of "Chase bank check endorsement?" Well, my friend, pull up a chair, because things are about to get interesting.

Let's face it, receiving a check in the mail isn't usually met with the same excitement as, say, winning the lottery. It's often accompanied by a sigh and a mental note to trudge to the bank. But here's the thing: that piece of paper represents actual money, and understanding how to handle it – specifically, how to endorse it for deposit at Chase – can mean the difference between a smooth transaction and a whole lot of unnecessary hassle.

Chase Bank, being one of the financial behemoths roaming the American landscape, has its own set of rules and regulations when it comes to check endorsements. Ignore them at your peril, because doing so could delay your funds, require multiple trips to the bank, or even result in your check being rejected altogether. Nobody wants that, especially when we're talking about your hard-earned cash.

Now, you might be thinking, "This all sounds terribly boring and complicated. Can't I just scribble my name on the back and call it a day?" Well, you could, but that's a risky move. The world of finance is a jungle, and a poorly endorsed check is like leaving a trail of breadcrumbs for fraudsters and scammers. They'd love nothing more than to snatch up your money, and a careless endorsement is like rolling out the red carpet for them.

So, consider this your crash course in Chase bank check endorsement, a survival guide to navigate the often-confusing world of banking. We'll delve into the nitty-gritty, exploring different types of endorsements, common pitfalls to avoid, and even some insider tips to make the process as painless as possible. By the end, you'll be a check-endorsing ninja, ready to face the financial wilderness with confidence.

Advantages and Disadvantages of Chase Bank Check Endorsement

While the digital age has brought about numerous payment options, check endorsements remain relevant. Let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Tangible Proof of Payment: A physical check provides concrete evidence of a transaction. | Security Risks: Lost or stolen endorsed checks can be easily cashed by unauthorized individuals. |

| Offline Accessibility: Checks can be used even without internet access, making them useful in certain situations. | Processing Time: Check deposits generally take longer to clear compared to electronic transfers. |

Best Practices for Chase Bank Check Endorsements

Mastering the art of the Chase bank check endorsement isn't rocket science, but a few savvy moves can save you time and headaches:

- Endorse at the Bank: Avoid endorsing checks until you're physically at the bank. This minimizes the risk of someone else cashing it if lost or stolen.

- Use Black or Blue Ink: Stick to these standard colors for clarity and to avoid any issues with check processing machines.

- Sign Consistently: Ensure your signature on the check matches the one Chase has on file. Discrepancies can raise red flags and delay your deposit.

- Verify Endorsement Line: The endorsement area on Chase checks is usually a designated box on the back. Double-check before signing to avoid errors.

- Consider "For Deposit Only": Adding this restriction above your signature limits the check's use to depositing into your account, enhancing security.

Common Questions (and Answers!) About Chase Bank Check Endorsements

Let's tackle some frequently asked questions about navigating the world of Chase bank check endorsements:

Q: Can I endorse a check over to someone else?

A: Absolutely! It's called a "third-party check" and requires adding "Pay to the order of [person's name]" above your signature.

Q: What if I make a mistake while endorsing my check?

A: Don't panic! It happens. Your best bet is to visit your local Chase branch and explain the situation. They can often provide guidance or a new check if necessary.

Q: How long does it take for a Chase check deposit to clear?

A: It varies, but typically allow 1-2 business days for funds to become available. Larger checks or those requiring special handling might take longer.

Q: Can I deposit a Chase check at a different bank?

A: Yes, but expect potential fees and a longer processing time. Depositing at a Chase branch or ATM is generally faster and more cost-effective.

Q: What if I lose a check that I've already endorsed?

A: Report it to Chase immediately! They can place a stop payment on the check to prevent fraudulent use.

Q: Is there a mobile app for Chase check endorsements?

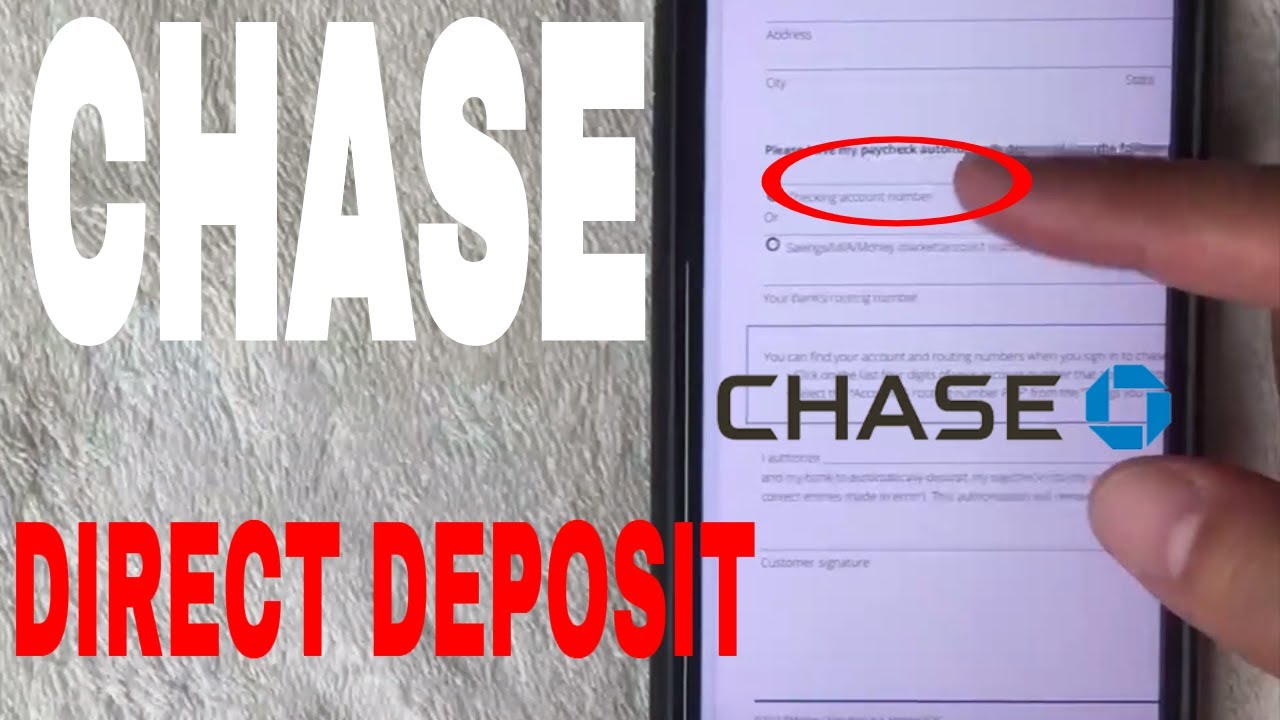

A: While there isn't a dedicated app solely for endorsements, Chase's mobile app allows you to deposit checks remotely using your phone's camera.

Q: What happens if I forget to sign the back of my check?

A: Your deposit might be delayed or rejected. Chase requires a valid signature for processing.

Q: Can I endorse a check that's made out to multiple people?

A: It depends! If it says "and" between the names, all parties need to endorse. If it's "or," usually one signature suffices. However, it's best to check with Chase directly to confirm.

Tips and Tricks for Chase Bank Check Endorsements

Want to become a check-endorsing pro? Here are some insider tips:

- Keep It Clean: Ensure the back of your check is free of stray marks, stains, or anything that could obscure your endorsement or confuse processing machines.

- Date It (Sometimes): While not always mandatory, adding the date next to your signature can be helpful for record-keeping and tracking purposes.

- Don't Fold on the Endorsement Line: Seems obvious, but creasing the endorsement area can make it difficult to read and potentially cause processing issues.

In the age of instant digital transactions, mastering the art of Chase bank check endorsement might seem like learning Latin – interesting but not particularly relevant. However, checks remain a common method of payment, and understanding the nuances of endorsing them properly can save you time, money, and unnecessary headaches.

Remember, that seemingly insignificant act of signing the back of a check is actually a critical step in the financial transaction process. By following the guidelines, understanding your options, and employing these tips and tricks, you can confidently navigate the world of Chase bank check endorsements and ensure your hard-earned money ends up exactly where it belongs – safely deposited into your account.

Unlocking potential a guide to contoh surat buka akaun bank untuk persatuan

Unlocking the power your guide to the ford mustang ecoboost fuel pressure regulator

Ditch the dinosaur bank of america checks online are here

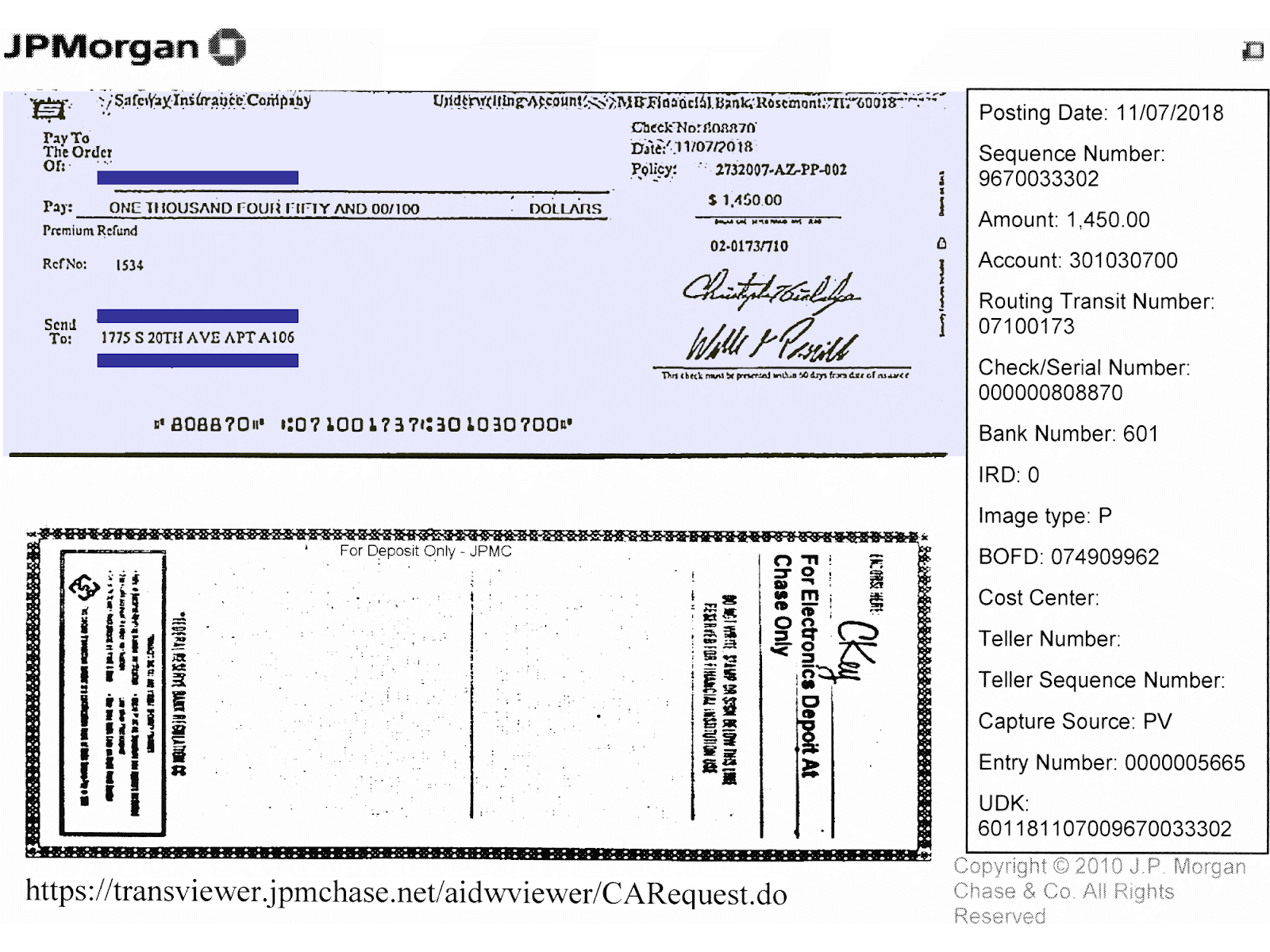

Chase Bank Deposit Slip | Solidarios Con Garzon

Chase Bank Endorsement Stamp Ten Mind Numbing Facts About Chase Bank | Solidarios Con Garzon

Printable Original Chase Bank Check | Solidarios Con Garzon

Chase Cashier Check Template | Solidarios Con Garzon

Chase Bank Name And Address (How To Receive Direct, 50% OFF | Solidarios Con Garzon

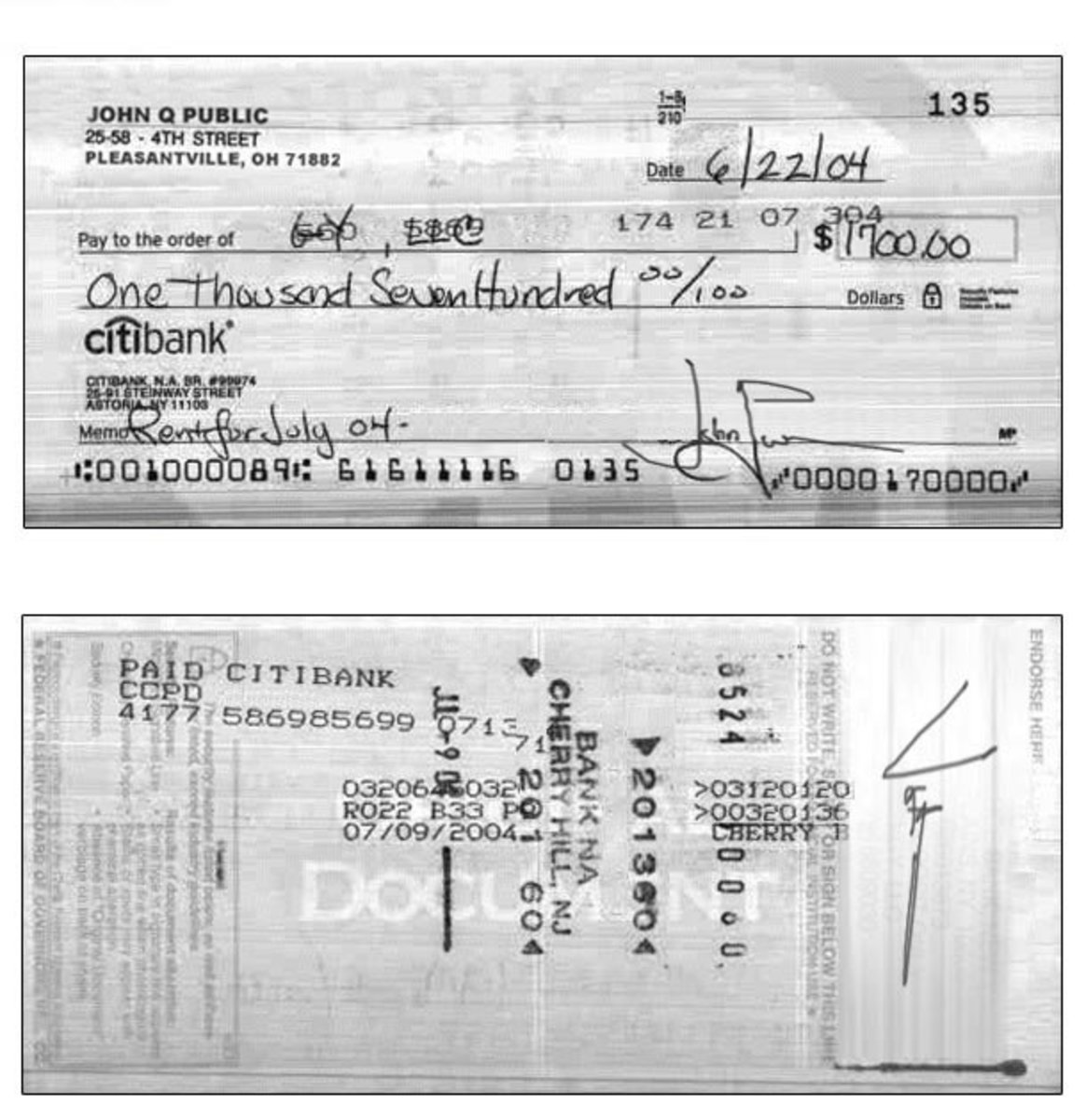

The Top 5 Most Common Check | Solidarios Con Garzon

How to Endorse a Check Correctly without any Mistake | Solidarios Con Garzon

Chase Bank Check Template Fresh 12 Cashier Check Template In 2020 | Solidarios Con Garzon

chase bank check endorsement | Solidarios Con Garzon

Bamboozled: 3 banks and a missing $500 check. Where did this customer's | Solidarios Con Garzon

chase bank check endorsement | Solidarios Con Garzon

How to Use Chase Quick Deposit Correctly | Solidarios Con Garzon

chase bank check endorsement | Solidarios Con Garzon

/Back-of-Check-Legend-56a0665a5f9b58eba4b043df.jpg)

Chase Bank Check Template | Solidarios Con Garzon

Bank Of America Printable Checks | Solidarios Con Garzon