Streamlining Success: Your Guide to Wells Fargo Mobile Deposit for Business

In the whirlwind of today's fast-paced business landscape, every second counts. Juggling meetings, managing inventory, and nurturing client relationships leaves little room for time-consuming errands like bank visits. Thankfully, the digital age offers a saving grace: mobile banking. Imagine this – you're wrapping up a productive meeting, a new client hands you a check, and instead of making a detour to the bank, you simply pull out your phone. This, my friends, is the power of Wells Fargo Mobile Deposit for Business.

Gone are the days of rushing to the bank before closing time or waiting in line to deposit checks. With Wells Fargo Mobile Deposit for Business, you can deposit checks anytime, anywhere, directly from your smartphone or tablet. This convenient tool empowers you to stay on top of your finances while on the go, freeing up valuable time to focus on what truly matters – growing your business.

But how did we arrive at this point of banking nirvana? The evolution of mobile banking has been nothing short of remarkable. From the early days of online banking to the sophisticated mobile apps we have today, the financial industry has consistently pushed the boundaries of innovation to provide businesses with seamless and secure banking solutions. Wells Fargo, a long-standing leader in the banking industry, recognized the need for a mobile deposit solution tailored specifically for businesses, leading to the creation of this game-changing tool.

The importance of Wells Fargo Mobile Deposit for Business in today's business world cannot be overstated. In an era where efficiency reigns supreme, this innovative tool streamlines financial operations, giving businesses a competitive edge. But its significance goes beyond mere convenience. Mobile deposit for business enhances security by reducing the risk of check fraud and loss. It also promotes financial transparency by providing real-time transaction updates and account balances, allowing business owners to make informed decisions on the fly.

However, like any technological advancement, Wells Fargo Mobile Deposit for Business is not without its nuances. Understanding the eligibility requirements, deposit limits, and potential fees is crucial for a seamless experience. Additionally, familiarizing yourself with the app's features, security protocols, and best practices for mobile check deposit ensures secure and efficient transactions.

Advantages and Disadvantages of Wells Fargo Mobile Deposit for Business

| Advantages | Disadvantages |

|---|---|

| Convenience of depositing checks anytime, anywhere | Potential deposit limits and fees |

| Improved cash flow with faster check processing times | Requires a compatible smartphone or tablet and internet access |

| Enhanced security with reduced risk of check fraud and loss | Potential technical issues or app malfunctions |

To fully harness the power of Wells Fargo Mobile Deposit for Business, consider these best practices:

1. Ensure Secure Internet Connection: Always use a secure Wi-Fi network or your mobile data plan when making mobile deposits. Avoid using public Wi-Fi networks, as they may compromise your financial information.

2. Endorse Checks Properly: Endorse the back of each check with your signature and "For mobile deposit only at Wells Fargo." This helps prevent fraudulent use of your checks.

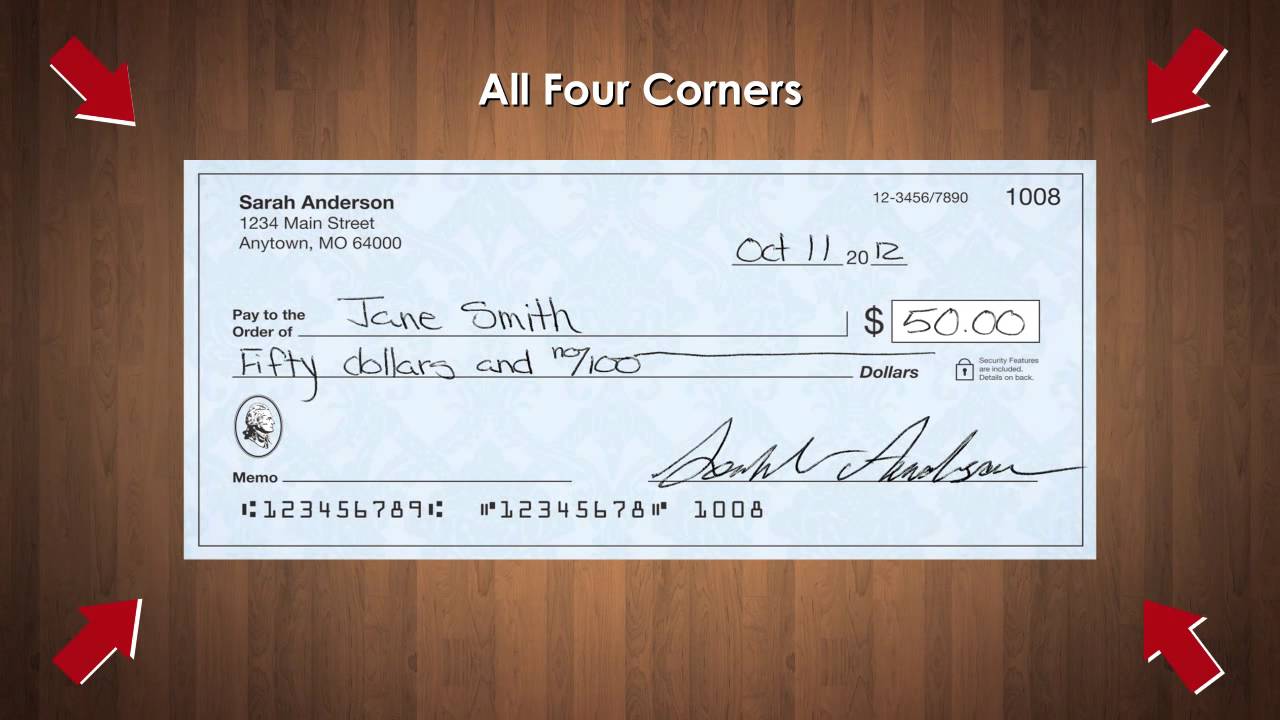

3. Capture Clear Check Images: Place your check on a flat, dark-colored surface and ensure adequate lighting. Take clear, well-lit photos of both the front and back of the check. This will ensure that your deposit is processed quickly and without any issues.

4. Verify Deposit Details: Before submitting your deposit, double-check the deposit amount, account number, and other relevant details. This will help prevent errors and delays in processing.

5. Keep Original Checks for a Short Period: After successfully depositing a check via mobile deposit, store the original check in a safe place for a short period, typically a few days, as advised by the bank. You can then shred the check for security purposes.

Wells Fargo Mobile Deposit for Business is more than just a convenient banking tool – it's a game-changer for businesses of all sizes. By embracing this technology, businesses can streamline their financial operations, enhance security, and gain a competitive advantage in today's fast-paced business world.

Unlocking your pnc account number a comprehensive guide

Unlocking global health como citar a la oms in your research

Unlocking fifa 23 career mode dominate with budget friendly left backs

wells fargo mobile deposit for business | Solidarios Con Garzon

wells fargo mobile deposit for business | Solidarios Con Garzon

Wells Fargo Mobile Deposit | Solidarios Con Garzon

wells fargo mobile deposit for business | Solidarios Con Garzon

How To Deposit A Check In A Wells Fargo ATM | Solidarios Con Garzon

Wells Fargo Printable Checks | Solidarios Con Garzon

Wells Fargo Bob's Discount Furniture Customer Service at Jeanette Young | Solidarios Con Garzon

Top 6 how to find account number on wells fargo app 2022 | Solidarios Con Garzon

Fix: Wells Fargo Mobile Deposit Not Working | Solidarios Con Garzon

wells fargo mobile deposit for business | Solidarios Con Garzon

Wells Fargo Printable Checks | Solidarios Con Garzon

USAA Asserts Mobile Check Deposit Patents Against Wells Fargo | Solidarios Con Garzon

How to deposit Wells Fargo mobile check and Limits | Solidarios Con Garzon

Wells Fargo Wall Calendar 2024 | Solidarios Con Garzon

Wells Fargo Mobile Deposit | Solidarios Con Garzon