Skip the Line: Your Guide to Wells Fargo Mobile Deposit Money Order

In today's fast-paced world, who has time for snail mail and bank lines? We want our transactions quick, easy, and preferably done from the comfort of our couch. This is where the convenience of mobile banking comes in, revolutionizing how we manage our finances. But what about those pesky money orders, often seen as relics of a bygone era? Can the future of banking handle these paper transactions?

The answer is a resounding yes! If you're a Wells Fargo customer, you can say goodbye to the inconvenience of depositing money orders in person. Wells Fargo's mobile deposit feature allows you to deposit money orders directly from your smartphone or tablet. This means you can skip the trip to the bank and deposit funds directly into your account with just a few taps.

But before you snap a photo and hit deposit, there are a few things you need to know about using Wells Fargo mobile deposit for money orders. From eligibility and limits to endorsements and potential hiccups, this guide will provide you with all the information you need to make your mobile deposit experience a breeze.

Mobile check deposit has been around for a while, but many people are surprised to learn they can use it for money orders too. This feature offers a new level of convenience for managing your finances, especially when dealing with these more traditional payment methods. No more rearranging your schedule for bank hours or waiting in line! With Wells Fargo mobile deposit, you have the power of banking right at your fingertips.

While mobile deposit for money orders offers a convenient alternative, it's essential to be aware of potential limitations and best practices. Understanding how to endorse your money order correctly, being mindful of deposit limits, and knowing how to troubleshoot potential issues will ensure a smooth and successful experience.

Advantages and Disadvantages of Wells Fargo Mobile Deposit for Money Orders

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Using Wells Fargo Mobile Deposit for Money Orders

To ensure a seamless and secure mobile deposit experience, here are some best practices to keep in mind:

- Endorse Your Money Order Correctly: Sign the back of the money order and write "For Mobile Deposit Only at Wells Fargo" above your signature. This helps prevent fraud and ensures your deposit is processed smoothly.

- Double-Check Your Information: Before submitting your deposit, carefully review the amount, account number, and any other entered information to avoid errors.

- Keep Your Money Order Until Funds Clear: While funds are typically available quickly, it's essential to hold onto your physical money order until the deposit has fully cleared and the funds are reflected in your account. This protects you in case of any discrepancies or issues.

- Be Aware of Deposit Limits: Familiarize yourself with Wells Fargo's mobile deposit limits for money orders. These limits may vary depending on your account type and history.

- Use a Secure Network: When making mobile deposits, always ensure you are connected to a secure and trusted Wi-Fi network to protect your financial information.

Common Questions and Answers About Wells Fargo Mobile Deposit Money Orders

Get answers to some frequently asked questions about using Wells Fargo mobile deposit for money orders:

- Q: What is the maximum amount I can deposit via mobile deposit for a money order?

A: Deposit limits for money orders may vary depending on your account type and history. It's always best to check with Wells Fargo for the most up-to-date information on deposit limits. - Q: How long does it take for a mobile deposit money order to clear?

A: Mobile deposits are typically processed quickly, and funds are often available within one to two business days. - Q: Can I deposit a money order made out to someone else using my Wells Fargo mobile app?

A: No, you can only deposit money orders that are made out to you. - Q: What if I made a mistake while depositing my money order?

A: Contact Wells Fargo customer service as soon as possible. They may be able to help correct the error or advise on the best course of action. - Q: Is it safe to deposit money orders through the Wells Fargo mobile app?

A: Wells Fargo uses advanced security measures to protect your transactions, making mobile deposits safe. However, always ensure you are using a secure network and follow best practices for mobile banking security.

Wells Fargo's mobile deposit feature offers an incredibly convenient and efficient way to deposit money orders, eliminating the need for in-person banking. By understanding the process, eligibility requirements, and best practices, you can leverage this technology to manage your finances with ease. While mobile deposit for money orders is generally safe and reliable, staying informed about potential issues and following security measures will ensure a positive experience. As banking technology continues to evolve, embracing tools like mobile deposit for money orders empowers you to manage your money efficiently and conveniently.

Unleash your inner artist exploring the world of escudo y bandera de colombia para colorear

Free printable borders transform your documents and crafts

Unleash your creativity building a pink house in minecraft

Blank Wells Fargo Deposit Slips Pdf | Solidarios Con Garzon

wells fargo mobile deposit money order | Solidarios Con Garzon

How to Deposit Check Online Wells Fargo | Solidarios Con Garzon

Wells Fargo Mobile Deposit at Carol Young blog | Solidarios Con Garzon

Wells Fargo Mobile Deposit Limits, Fees & Cut | Solidarios Con Garzon

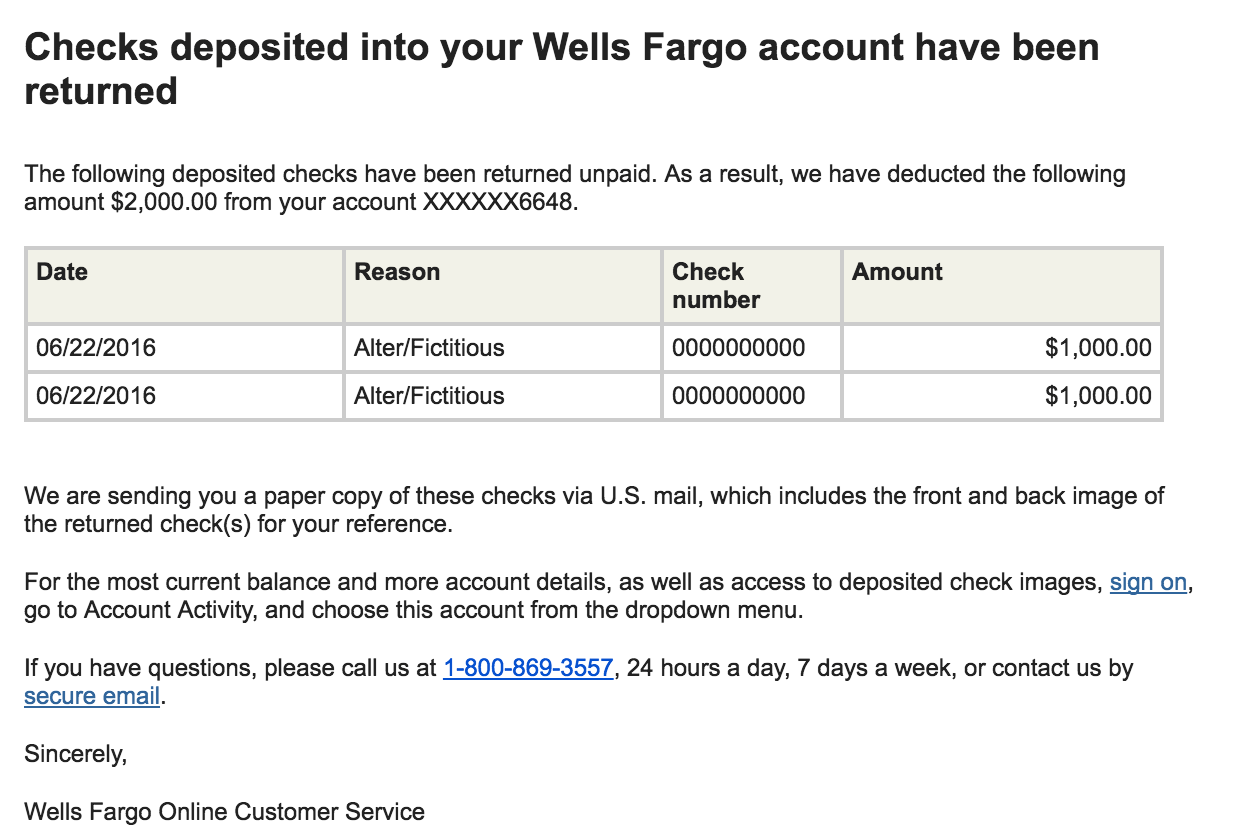

Wells Fargo shuts down reader for depositing bad money order | Solidarios Con Garzon

Wells Fargo Printable Checks | Solidarios Con Garzon

wells fargo mobile deposit money order | Solidarios Con Garzon

How To Deposit A Check In A Wells Fargo ATM | Solidarios Con Garzon

Wells Fargo Printable Checks | Solidarios Con Garzon

USAA Asserts Mobile Check Deposit Patents Against Wells Fargo | Solidarios Con Garzon

Wells Fargo ATM Withdrawal And Deposit Limits & How To Get More Cash | Solidarios Con Garzon

wells fargo mobile deposit money order | Solidarios Con Garzon

Wells Fargo Mobile Deposit | Solidarios Con Garzon

Wells Fargo ExpressSend: Review & Comprehensive Guide | Solidarios Con Garzon