Received Cashier's Check From Wells Fargo? What You Need to Know

In an era dominated by digital transactions, receiving a cashier's check might feel like stepping back in time. A paper document promising a specific amount of money, signed and stamped by a bank, holds a certain weight and air of security. But what happens when you receive a cashier's check from Wells Fargo, one of the biggest banking names in the US? Should you be excited? Wary? The answer, as with many financial matters, is nuanced.

Let's unpack the world of cashier's checks, focusing specifically on those issued by Wells Fargo. We'll delve into what they are, why they're used, and the steps you should take to ensure everything is above board. Because while cashier's checks are generally considered safer than personal checks, they are not immune to fraudulent use.

First things first, a cashier's check represents a payment guaranteed by the issuing bank, in this case, Wells Fargo. When you receive a cashier's check, Wells Fargo, not the individual or entity who provided it to you, guarantees the funds. This guarantee makes them a popular choice for large transactions where trust might be an issue, like buying a car or putting a down payment on a house.

The history of cashier's checks can be traced back to a time when carrying large amounts of cash was risky. They provided a safer alternative and helped facilitate major transactions. Today, their relevance remains, particularly in situations where a guaranteed form of payment is required.

Despite their perceived security, it's crucial to remember that cashier's checks, even those from reputable banks like Wells Fargo, can be counterfeited. Scammers have become increasingly sophisticated, and it's vital to be vigilant. Just because a check looks authentic doesn't mean it is.

Advantages and Disadvantages of Cashier's Checks from Wells Fargo

| Advantages | Disadvantages |

|---|---|

| Guaranteed by Wells Fargo | Potential for scams and counterfeit checks |

| Often required for large transactions | Can be inconvenient to obtain and deposit |

| Provide a sense of security for the recipient | Limited recourse if issues arise after deposit |

Best Practices When You Receive a Cashier's Check

Here are some essential tips to follow when you receive a cashier's check from Wells Fargo:

- Inspect the check: Look for any inconsistencies in printing, misspellings, or alterations. Pay close attention to the check number, amount, and Wells Fargo logo.

- Verify the check: Contact Wells Fargo directly using the number on their official website. Don't use contact information provided on the check itself. Verify the check number and amount.

- Be cautious of overpayment scams: If someone sends you a cashier's check for more than the agreed amount, it's a red flag. Do not send back the difference.

- Deposit it promptly: While cashier's checks are generally safe, it's best to deposit them quickly to minimize the risk of any issues arising.

- Keep records: Maintain copies of the check, communication with Wells Fargo, and any related transaction details for your records.

Common Questions About Cashier's Checks from Wells Fargo

Here are some frequently asked questions regarding Wells Fargo cashier's checks:

- How do I verify a cashier's check from Wells Fargo? Contact Wells Fargo directly using the phone number on their website or visit a branch. Provide the check number and amount for verification.

- What if the cashier's check is fake? Report it to Wells Fargo and local authorities immediately. Provide all relevant details and documentation.

- Can I track a cashier's check from Wells Fargo? Tracking is not typically available for cashier's checks.

- How long does it take for a Wells Fargo cashier's check to clear? While funds are generally available within one business day, it's best to allow for a longer hold period just in case.

- Can I get a refund on a cashier's check from Wells Fargo? Refunds are typically not issued for cashier's checks. If you need to return funds, you'll need to work with the original recipient.

- What if I lose a cashier's check from Wells Fargo? Contact Wells Fargo immediately to report the lost check. They will guide you through the process of getting a replacement.

- Can I deposit a Wells Fargo cashier's check at any bank? Yes, you can deposit it at most banks, though there might be fees associated.

- Is there a fee for getting a cashier's check from Wells Fargo? Yes, Wells Fargo typically charges a fee for issuing a cashier's check, which varies depending on your account type.

In conclusion, receiving a cashier's check from Wells Fargo can be a legitimate and secure way to receive payment, particularly for large transactions. However, it's crucial to remain cautious and take steps to verify the check's authenticity. Remember, if something feels off or too good to be true, it probably is. By following the tips outlined above and staying informed, you can confidently navigate the world of cashier's checks and protect yourself from potential fraud. When in doubt, always consult with a financial advisor or directly with Wells Fargo for guidance.

Michigans craft fair frenzy a guide to local treasures

Johnston and murphy banks

Streamlining your food delivery experience

Printable Blank Cashiers Check | Solidarios Con Garzon

Wells Fargo Blank Check Template | Solidarios Con Garzon

Pin by Kimberly Baum on Contract | Solidarios Con Garzon

Pensions get earn exist creditable up this retiree | Solidarios Con Garzon

How to Get a Cashier | Solidarios Con Garzon

chase bank irs refund 9 chase bank cashier s check resume pdf | Solidarios Con Garzon

received cashiers check from wells fargo | Solidarios Con Garzon

4 Easy Ways to Verify a Cashier's Check | Solidarios Con Garzon

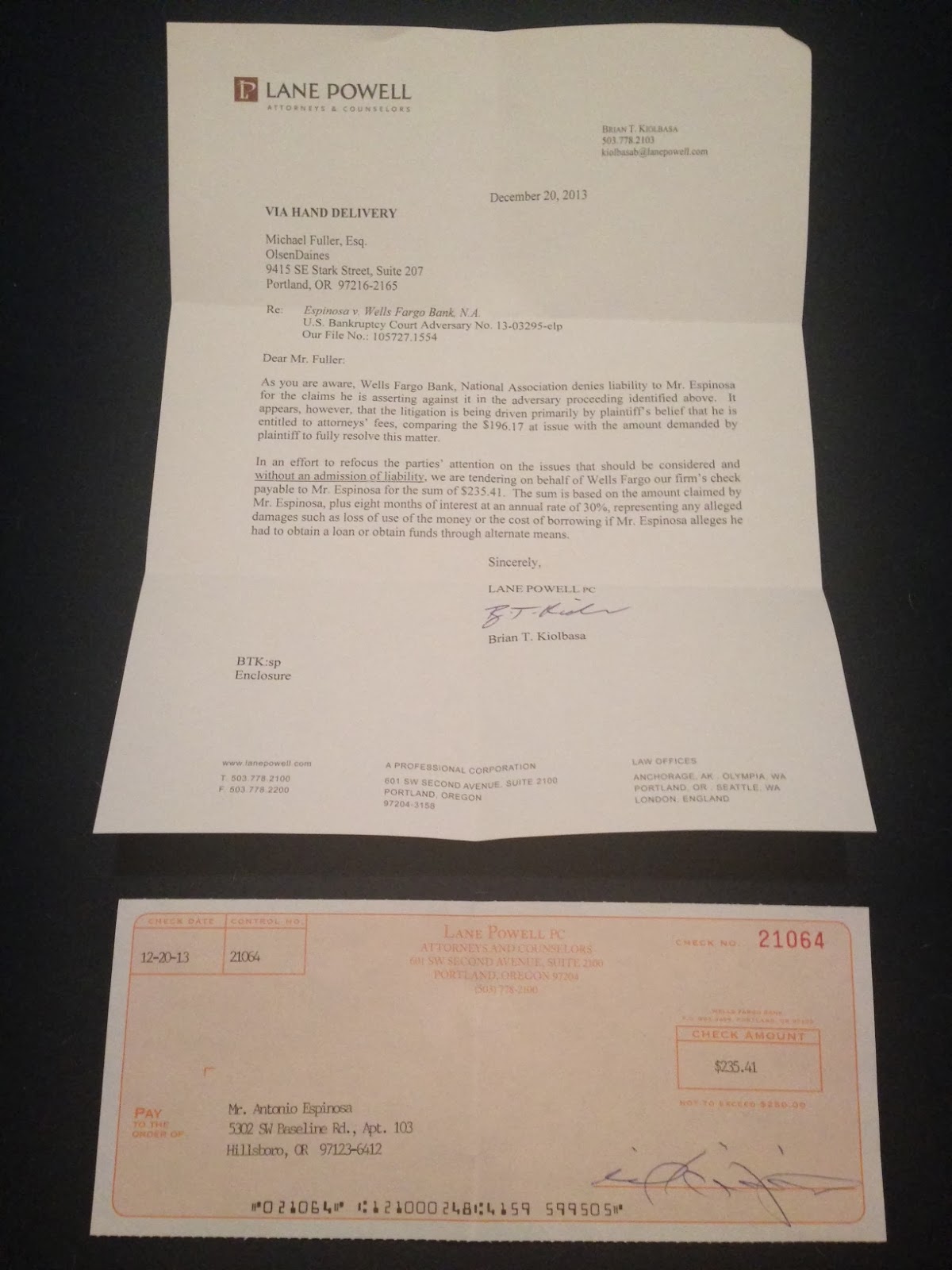

Underdog Law Blog: Wells Fargo 'Returns' Money It Disputes It Ever Took | Solidarios Con Garzon

Essential Guide to Wells Fargo Cashiers Check Verification | Solidarios Con Garzon

Wells Fargo Bank Cheque | Solidarios Con Garzon

How Much Is a Cashier | Solidarios Con Garzon

received cashiers check from wells fargo | Solidarios Con Garzon

Wells Fargo 6112 McCart Ave Ste 100, Fort Worth, TX Complaints and | Solidarios Con Garzon

how long cashiers check wells fargo | Solidarios Con Garzon