PTPTN Loan Repayment Deferment: What You Need to Know

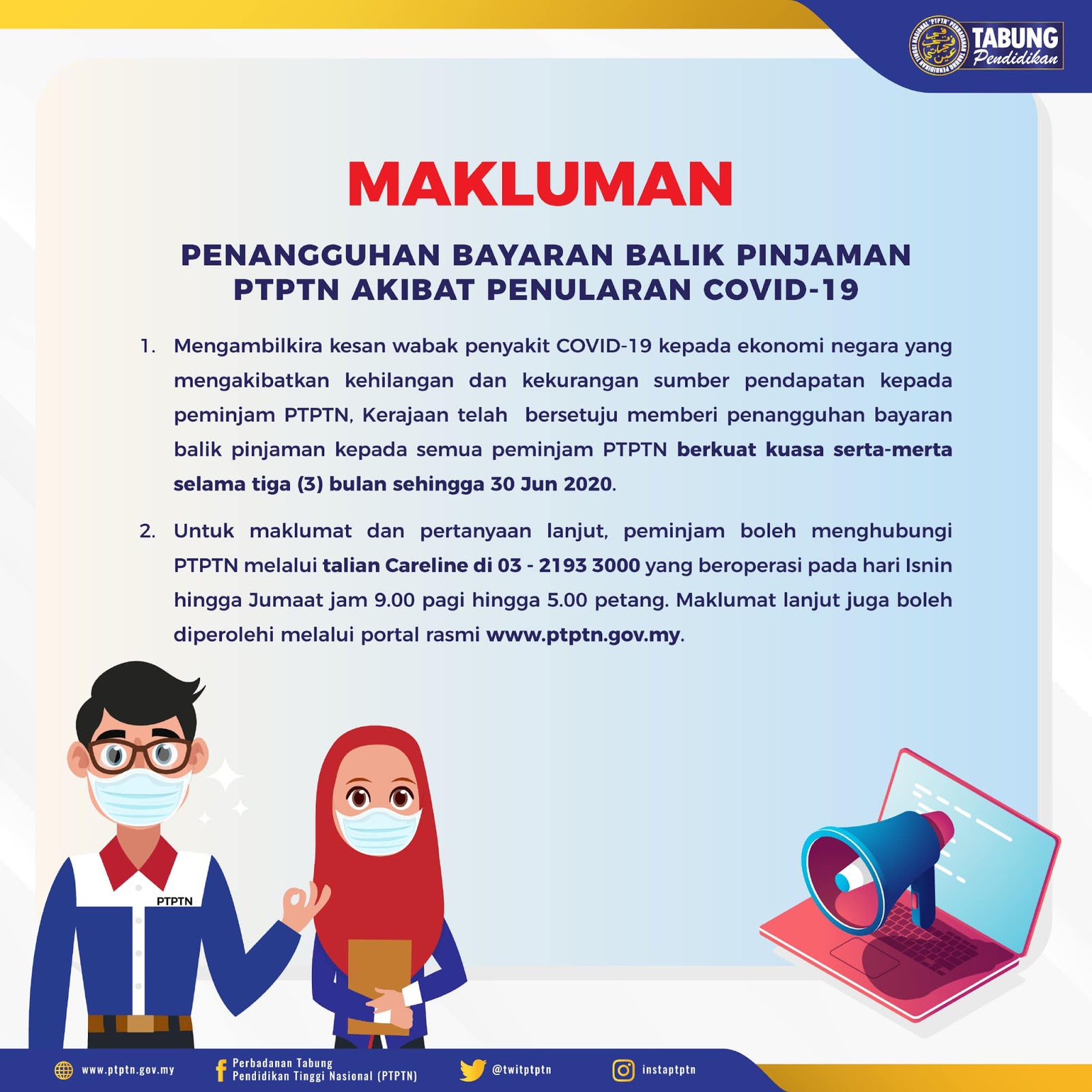

Graduating from university is a significant milestone, but it often comes with the weight of student loan repayments. For many Malaysian graduates, the National Higher Education Fund Corporation (PTPTN) loan has been instrumental in funding their tertiary education. However, life after graduation isn't always a smooth sail, and financial constraints can make it challenging to keep up with loan repayments. This is where the PTPTN loan repayment deferment option, known as "penangguhan bayaran balik PTPTN" in Malay, comes in.

The concept of a loan repayment deferment is not unique to PTPTN. Many financial institutions worldwide offer similar options to borrowers facing temporary financial hardships. It provides a safety net for borrowers, allowing them to temporarily pause their loan repayments and regain their financial footing.

In Malaysia, PTPTN loan repayment deferment has been a subject of much discussion and debate. On one hand, it provides much-needed relief to graduates struggling to make ends meet, allowing them to allocate their resources to essential needs. On the other hand, concerns have been raised about the potential long-term impact on the PTPTN fund's sustainability.

This article will delve deeper into the intricacies of PTPTN loan repayment deferment. We'll explore the eligibility criteria, application process, and the implications of opting for deferment. Whether you're a recent graduate facing financial difficulties or simply want to understand this option better, this comprehensive guide will provide valuable insights.

Navigating the world of student loan repayments can feel overwhelming. However, understanding the available options like PTPTN loan repayment deferment empowers borrowers to make informed decisions that align with their financial situation and long-term goals. Remember, seeking timely assistance and exploring available resources can make a significant difference in managing your student loan debt effectively.

Advantages and Disadvantages of PTPTN Loan Repayment Deferment

Like any financial decision, opting for PTPTN loan repayment deferment has its own set of advantages and disadvantages. It's crucial to weigh these carefully before making a decision.

| Advantages | Disadvantages |

|---|---|

| Provides temporary financial relief | Accrued interest increases the overall loan amount |

| Allows graduates to focus on other financial obligations | Extends the loan repayment period |

| May prevent defaulting on the loan | May affect credit score if not managed properly |

Common Questions and Answers about PTPTN Loan Repayment Deferment

Here are some frequently asked questions about penangguhan bayaran balik PTPTN:

1. Who is eligible for PTPTN loan repayment deferment?

Borrowers facing genuine financial hardship, such as unemployment, low income, or medical emergencies, may be eligible.

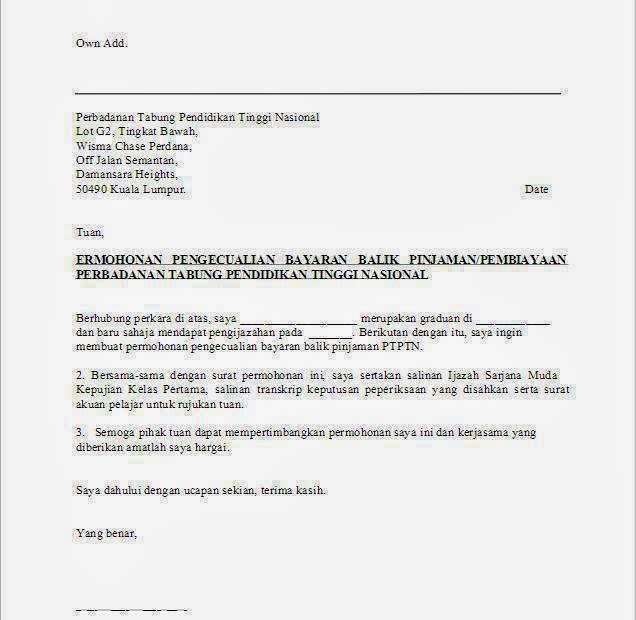

2. How do I apply for deferment?

Applications can be submitted online through the official PTPTN website or at any PTPTN branch.

3. What documents do I need to provide?

Supporting documents, such as proof of unemployment, salary slips, or medical bills, are usually required.

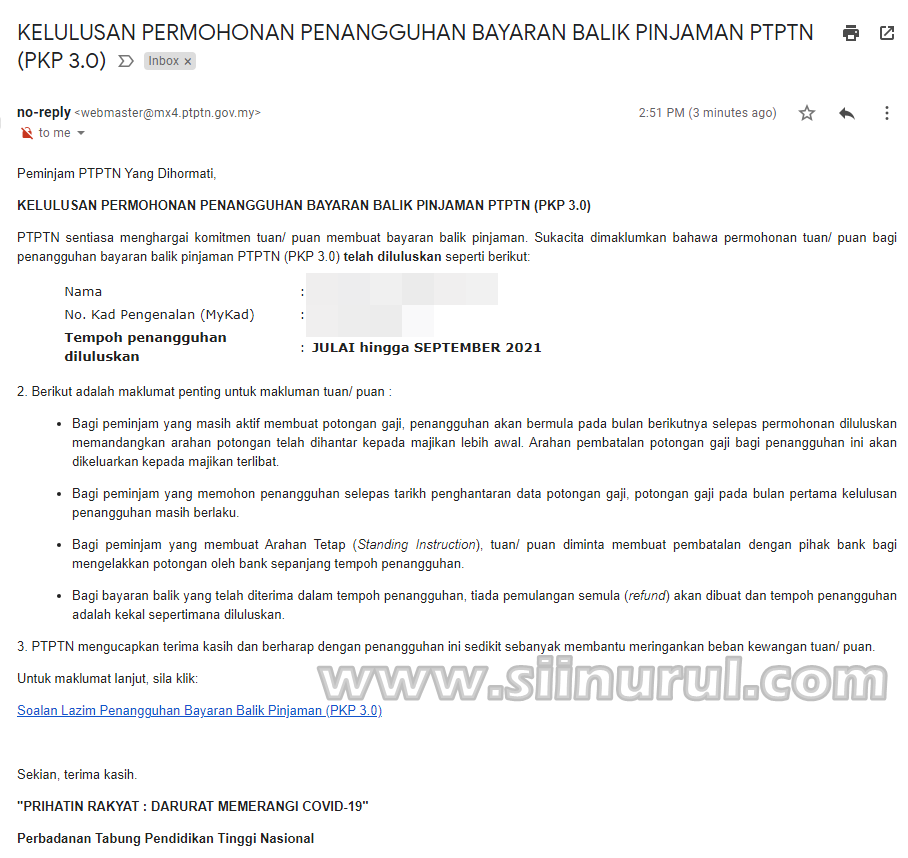

4. How long can I defer my loan repayment?

The deferment period varies depending on individual circumstances and the type of deferment approved.

5. Will I be charged interest during the deferment period?

Yes, interest will continue to accrue during the deferment period, increasing the total loan amount.

6. What happens after the deferment period ends?

Borrowers are required to resume their loan repayments based on a revised repayment schedule.

7. Can I make partial payments during the deferment period?

Yes, borrowers can make partial payments to reduce the overall interest accrued.

8. What are the consequences of not resuming repayment after the deferment period?

Failure to resume repayment can lead to late payment charges, legal action, and a negative impact on the borrower's credit score.

Tips and Tricks Related to PTPTN Loan Repayment Deferment

* Explore all available options before applying for deferment, such as restructuring your loan repayment schedule.

* Ensure you meet the eligibility criteria and submit all required documents accurately.

* Keep track of your deferment period and resume repayment promptly to avoid penalties.

* Communicate with PTPTN if you face any difficulties in resuming repayment after deferment.

Managing student loan debt requires careful planning and responsible financial behavior. While PTPTN loan repayment deferment can provide temporary relief, it should be considered as a short-term solution. By understanding the implications, eligibility criteria, and application process, borrowers can make informed decisions that align with their financial well-being. Remember, early planning, consistent communication with PTPTN, and exploring all available options are key to navigating student loan repayment successfully.

Turn your memories into masterpieces a simple guide to picture screensavers

Conquering the weekend how to make the most of your free time

Gm trouble code p0102 your cars cryptic whisperer

Contoh Surat Permohonan Pengecualian Bayaran Balik Ptptn | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

Contoh Surat Penangguhan Pembayaran Pinjaman Perumahan | Solidarios Con Garzon

3 Langkah Mudah Mohon Penangguhan Bayaran Balik PTPTN | Solidarios Con Garzon

Cara Mohon Diskaun & Penangguhan Bayaran Balik PTPTN | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

penangguhan bayaran balik ptptn | Solidarios Con Garzon

Permohonan Diskaun dan Penangguhan Bayaran Pinjaman PTPTN Tahun 2023 | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

Contoh Surat Rasmi Penangguhan Bayaran Kereta | Solidarios Con Garzon

Cara Membuat Penangguhan Bayaran Balik Pinjaman PTPTN (PKP 3.0) | Solidarios Con Garzon

PKP 3.0: Permohonan Penangguhan Bayaran Balik Pinjaman PTPTN Selama 3 | Solidarios Con Garzon