Port St. Lucie Property Tax Exemptions: Your Guide to Sweet Tax Breaks

So, you're a property owner in Port St. Lucie, basking in the Florida sunshine, but maybe not so thrilled about those property tax bills? Let's talk about something that can put a little more sunshine in your wallet – property tax exemptions. They're like finding a twenty in your old jeans, except way more satisfying.

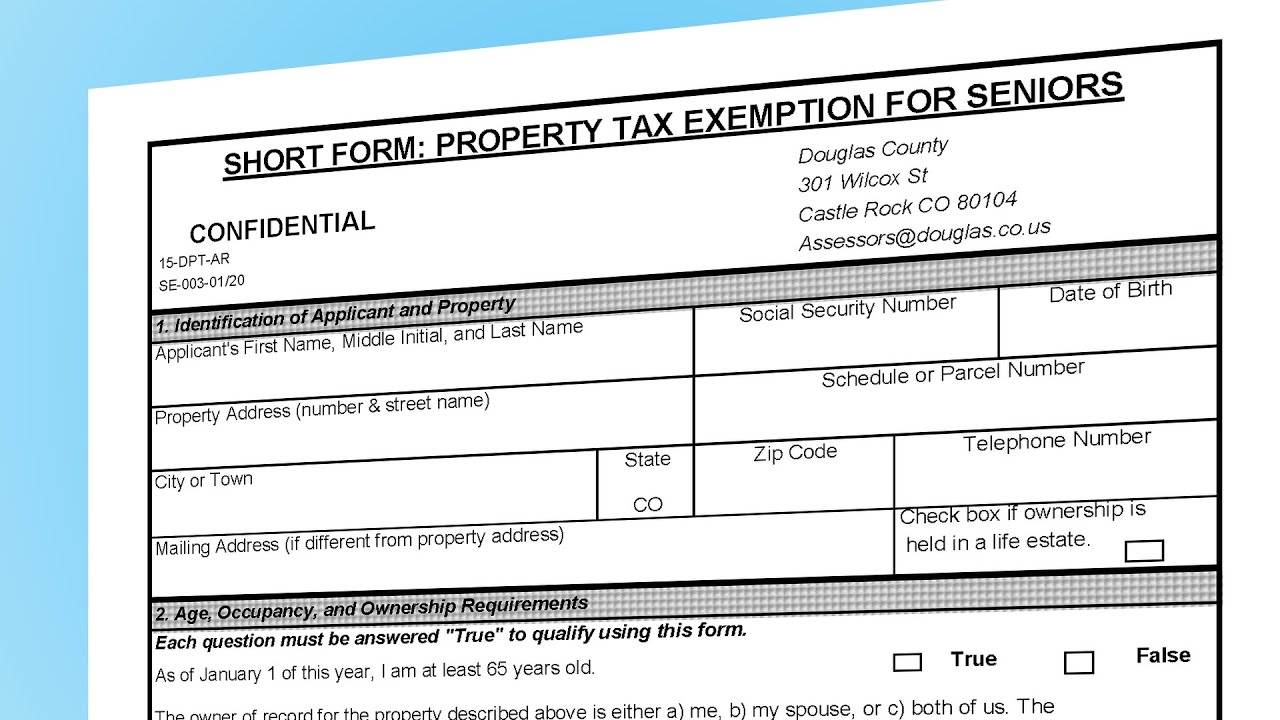

Navigating the world of property tax exemptions can feel like wandering through a bureaucratic maze. But fear not, intrepid homeowner! We're here to break down the complexities of Port St. Lucie property tax breaks and show you how to potentially shave some dollars off your annual bill. From homestead exemptions to exemptions for veterans and seniors, there's a whole world of potential savings waiting to be discovered.

These exemptions aren't just random acts of kindness from the government. They serve a purpose. Homestead exemptions, for instance, are designed to protect primary residences from escalating property values, ensuring that homeowners aren't priced out of their own homes. Other exemptions recognize the contributions of certain groups, like veterans and seniors, offering them some financial relief.

One of the key issues surrounding property tax exemptions is awareness. Many homeowners are simply unaware of the exemptions they qualify for, leaving money on the table year after year. Another challenge is the application process, which can sometimes feel daunting. But with the right information and a little persistence, you can successfully navigate the system and claim your rightful savings.

Let's talk specifics. The homestead exemption in Port St. Lucie can knock up to $50,000 off the assessed value of your home, resulting in significant tax savings. For veterans with disabilities, there are additional exemptions available, further reducing their tax burden. Seniors also have access to specific exemptions based on age and income.

Understanding the eligibility requirements for each exemption is crucial. For the homestead exemption, you must be a permanent Florida resident and own the property as of January 1st of the tax year. Different exemptions have different criteria, so it's important to do your homework.

Benefits of Port St. Lucie Property Tax Exemptions:

1. Reduced Property Taxes: The most obvious benefit is a lower tax bill. This frees up money for other expenses, investments, or simply enjoying the Florida lifestyle.

2. Protection from Rising Property Values: The homestead exemption shields your primary residence from drastic tax increases due to rising property values, providing a level of stability.

3. Support for Specific Groups: Exemptions for veterans, seniors, and individuals with disabilities provide targeted financial relief to those who have served our country or face unique challenges.

Action Plan:

1. Visit the St. Lucie County Property Appraiser's website.

2. Review the available exemptions and their eligibility requirements.

3. Gather the necessary documentation.

4. Submit your application before the deadline.

Advantages and Disadvantages of Port St. Lucie Property Tax Exemptions

| Advantages | Disadvantages |

|---|---|

| Lower property taxes | Application process can be complex |

| Financial stability for homeowners | Eligibility requirements can be stringent |

| Support for veterans and seniors | Potential for fraud |

Frequently Asked Questions:

1. What is a homestead exemption? (Answer: An exemption that reduces the assessed value of your primary residence.)

2. Who qualifies for a homestead exemption? (Answer: Permanent Florida residents who own and occupy their property as of January 1st.)

3. What are the deadlines for applying for exemptions? (Answer: Check the St. Lucie County Property Appraiser's website for specific deadlines.)

4. What documents do I need to apply? (Answer: This varies depending on the exemption, but typically includes proof of residency, ownership, and any other relevant documentation.)

5. How do I apply for an exemption? (Answer: Typically through the St. Lucie County Property Appraiser's website or office.)

6. What if my application is denied? (Answer: You can usually appeal the decision.)

7. Are there exemptions for widows/widowers? (Answer: Yes, there may be exemptions available.)

8. Are there exemptions for disabled individuals? (Answer: Yes, there are exemptions available for individuals with disabilities.)

Tips and Tricks:

Apply early to avoid missing deadlines. Keep copies of all documentation. Contact the St. Lucie County Property Appraiser's office with any questions.

In conclusion, Port St. Lucie property tax exemptions are a valuable tool for homeowners looking to reduce their tax burden. From the significant savings offered by the homestead exemption to the targeted relief provided for veterans and seniors, these exemptions can make a real difference in your finances. While navigating the system might seem challenging, the potential rewards are well worth the effort. Don't leave money on the table. Take the time to research the exemptions you qualify for, gather your documentation, and apply. By taking advantage of these programs, you can keep more of your hard-earned money in your pocket and enjoy the benefits of homeownership in Port St. Lucie. Empower yourself with knowledge and take control of your property taxes. It's your money, after all. So, go get it!

Iga and website and owensboro

21 shots for 21st birthday cake yay or nay

Caratulas de ciencias naturales para ninos

Mastering Tax Prep in Port St Lucie A Step | Solidarios Con Garzon

Property Tax Exemptions Fulton County Ga at David Cortez blog | Solidarios Con Garzon

port st lucie property tax exemptions | Solidarios Con Garzon

port st lucie property tax exemptions | Solidarios Con Garzon

Port Saint Lucie Appraiser | Solidarios Con Garzon

1371 Se Appamattox Terrace For Sale in Port St Lucie | Solidarios Con Garzon

Bold Real Esatate Group Port Saint Lucie property details Enjoy wide | Solidarios Con Garzon

port st lucie property tax exemptions | Solidarios Con Garzon

Single Family Detached Port Saint In Port St Lucie Florida United | Solidarios Con Garzon

St Lucie County Tax Collectors Office | Solidarios Con Garzon

Saint Lucie County Property Appraiser on LinkedIn You can now file for | Solidarios Con Garzon

8117 Alister Pl Port Saint Lucie FL 34986 | Solidarios Con Garzon

1327 NW Saint Lucie West Blvd Port St Lucie FL 34986 | Solidarios Con Garzon

Florida Map With Port St Lucie | Solidarios Con Garzon

St Lucie County Property Appraiser How to Check Your Property | Solidarios Con Garzon