Ocean County NJ Property Tax Information

Looking for property tax information in Ocean County, New Jersey? Understanding property taxes is a crucial part of homeownership or investing in real estate. This guide provides a comprehensive look at how to access Ocean County property tax records and what you can learn from them.

Navigating the complexities of property taxes can be daunting. Fortunately, Ocean County offers resources that simplify the process of finding property tax records. Whether you are a current homeowner, a prospective buyer, or simply conducting research, accessing these records can provide valuable insights.

Property tax records in Ocean County, NJ, contain a wealth of information about individual properties. These records typically include the assessed value of the property, the amount of tax due, and the property owner's information. They can also offer details about the property's history, such as previous sales prices and any outstanding liens.

Accessing these records is often a straightforward process, usually involving online databases or visits to the county tax assessor's office. The information gleaned from these records can be used for a variety of purposes, from understanding your own tax obligations to researching real estate market trends.

This guide aims to break down the essentials of Ocean County, New Jersey property tax record searches. We will explore the benefits of accessing these records, how to find them, and what to look for once you have them. We'll also address some frequently asked questions to ensure you're well-informed.

The history of property taxes in New Jersey dates back to colonial times. Originally, taxes were based on simple assessments of land and buildings. Over time, the system has evolved into the complex structure we see today, influenced by factors like population growth, economic changes, and legal reforms. The importance of these records lies in their ability to fund essential public services like schools, roads, and emergency services.

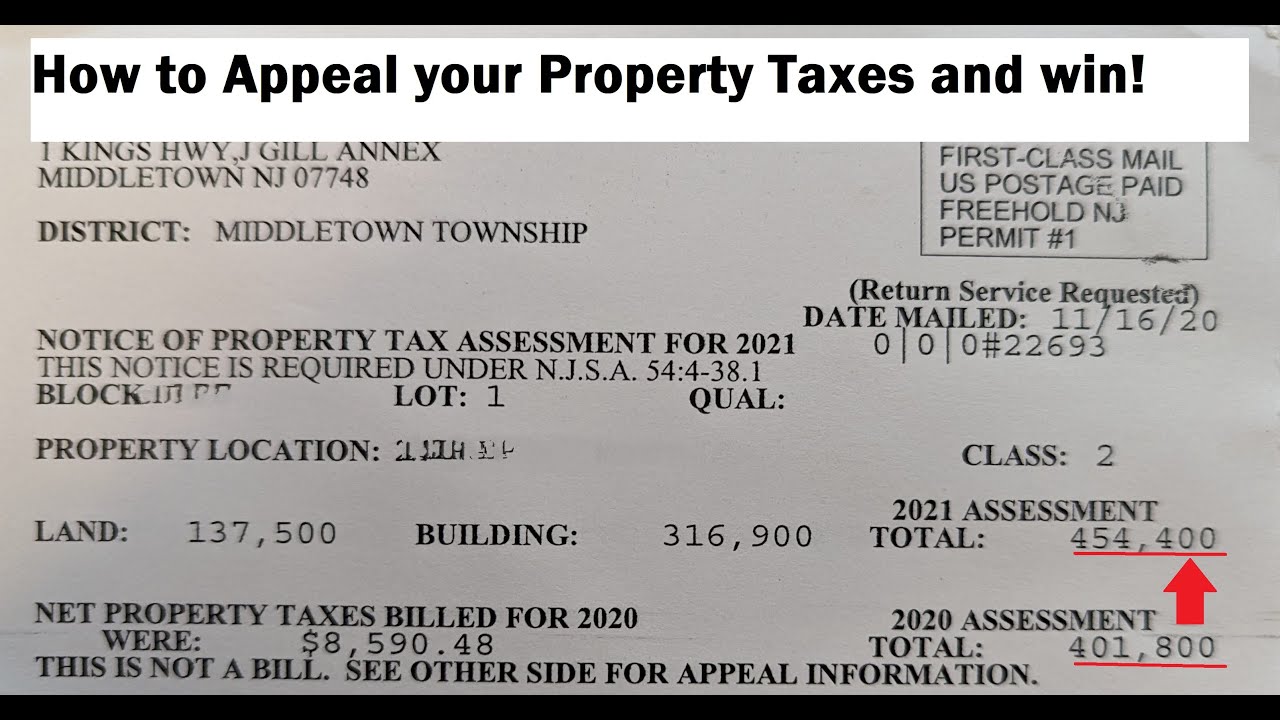

One of the main issues related to property taxes is their perceived fairness and accuracy. Ensuring assessments are accurate and equitable is a continuous challenge for tax authorities. Taxpayers have the right to appeal their assessments if they believe they are incorrect.

A property tax record search in Ocean County, NJ, allows you to find the assessed value, tax amount due, and ownership details for a specific property. For example, you could use the records to verify the tax information provided by a seller before purchasing a home.

One benefit of accessing these records is transparency. You gain a clear understanding of how your property taxes are calculated. Another benefit is that you can compare your property's assessment to similar properties, which can help determine if your assessment is fair. Finally, these records provide valuable historical data for real estate investment analysis.

To conduct a successful search, you can usually start with the Ocean County Tax Assessor's website. Many counties provide online databases for searching records. Alternatively, you can visit the assessor's office in person. Ensure you have the correct property address or block and lot number for accurate results.

Property Tax Search Checklist:

1. Property address

2. Block and lot number (if available)

3. Owner's name (if known)

Advantages and Disadvantages of Ocean County, NJ Property Tax Record Searches

| Advantages | Disadvantages |

|---|---|

| Transparency | Potential for data entry errors |

| Investment research tool | Time commitment for in-person searches |

| Fairness assessment | Can be overwhelming for first-time users |

Best Practices: 1. Verify information with official sources. 2. Understand assessment cycles. 3. Use accurate property identifiers. 4. Review appeal procedures. 5. Keep records of your searches.

Challenges and Solutions: 1. Website navigation issues - Contact the county for assistance. 2. Inaccurate data - Initiate an appeal process. 3. Limited historical data - Explore alternative sources. 4. Understanding legal jargon - Consult a real estate professional. 5. Difficulty locating specific information - Review online tutorials or guides.

FAQ: 1. How often are properties assessed? 2. How do I appeal my assessment? 3. What is a tax lien? 4. Where can I find the Ocean County Tax Assessor's office? 5. How are property taxes calculated? 6. What are property taxes used for? 7. What is the difference between assessed value and market value? 8. How can I pay my property taxes?

Tips and Tricks: Utilize online tutorials offered by the county. Familiarize yourself with key terms like "assessed value" and "tax rate." Keep records of all your property tax documents.

In conclusion, understanding Ocean County, NJ property tax records is essential for homeowners, prospective buyers, and anyone interested in real estate. Accessing these records provides valuable insights into property values, tax obligations, and market trends. By utilizing the available resources and following the tips outlined in this guide, you can confidently navigate the world of Ocean County property taxes. Take advantage of the online tools and contact the Ocean County Tax Assessor's office with any questions. Being informed about your property taxes can empower you to make sound financial decisions and ensure you are paying your fair share. Property taxes are a significant aspect of owning property in Ocean County, and understanding how they work is crucial for anyone invested in the local real estate market.

Unlocking the mystery what makes a dad joke good

Rav4 tire pressure woes conquer your tpms like a boss

Gmail account creation without a phone number is it possible

Ocean County Nj Property Tax Bill at Jo Barker blog | Solidarios Con Garzon

Jersey City Property Tax Payment at Wilmer Whitaker blog | Solidarios Con Garzon

ocean county nj property tax records search | Solidarios Con Garzon

New Jersey Property Records | Solidarios Con Garzon

Calumet County Property Tax Bills at Amber Roman blog | Solidarios Con Garzon

Ocean County Nj Property Tax Bill at Jo Barker blog | Solidarios Con Garzon

Vineland Nj Property Tax Bills at Sandy Kerns blog | Solidarios Con Garzon

Ocean County Nj Property Tax Payment at Alvin Morse blog | Solidarios Con Garzon

Ocean County Nj Property Tax Bill at Jo Barker blog | Solidarios Con Garzon

Bergen County NJ Property Tax Rates 2019 to 2020 201 455 | Solidarios Con Garzon

Ocean County Nj Property Tax Bill at Jo Barker blog | Solidarios Con Garzon

Edison Nj Property Tax Bill at Laurie Pritchard blog | Solidarios Con Garzon

beaver county property records search Recorder foodrecipestory | Solidarios Con Garzon

Block And Lot Map | Solidarios Con Garzon

Ocean County Nj Property Tax Bill at Jo Barker blog | Solidarios Con Garzon