Navigating Your Future: Understanding PTPTN Loan Amounts

Stepping into the world of higher education often comes hand-in-hand with financial considerations. For many Malaysian students, the National Higher Education Fund (PTPTN) provides a crucial lifeline, offering financial assistance to pursue their academic aspirations. However, navigating the intricacies of PTPTN loans, particularly understanding the loan amount one qualifies for, can seem like a daunting task.

This comprehensive guide aims to demystify the question that lingers on the minds of many aspiring students: "Berapa jumlah pinjaman PTPTN?" (How much PTPTN loan can I get?). We'll delve into the factors influencing your potential loan amount, the application process, and essential tips for managing your finances effectively as a student.

The prospect of higher education is undeniably exciting, but it also necessitates careful financial planning. Understanding how PTPTN loans work, the amount you're eligible for, and responsible financial management are crucial steps toward a successful and less stressful academic journey.

While the exact loan amount (berapa jumlah pinjaman PTPTN) varies from student to student, several factors come into play. Your chosen course and institution, family income, and academic performance are key determinants.

This guide will equip you with the knowledge to navigate the PTPTN system confidently. We'll explore practical strategies for loan repayment, ensuring a smooth transition from student life to your professional career. Let's delve into the details and empower you to make informed decisions regarding your education financing.

Advantages and Disadvantages of PTPTN Loans

| Advantages | Disadvantages |

|---|---|

| Provides access to higher education for students from diverse financial backgrounds | Graduating with debt can be a financial burden |

| Offers flexible repayment options, including income-contingent repayment schemes | Interest rates, although lower than commercial loans, can accumulate over time |

| Contributes to the development of a skilled workforce in Malaysia | Failure to repay can lead to legal consequences and affect future creditworthiness |

While PTPTN loans offer significant benefits, it's crucial to approach them with a clear understanding of both the advantages and potential drawbacks. This balanced perspective will empower you to make informed financial decisions throughout your academic journey.

Common Questions and Answers About PTPTN Loans (Berapa Jumlah Pinjaman PTPTN)

1. How do I know how much PTPTN loan (berapa jumlah pinjaman PTPTN) I am eligible for?

Your loan amount is determined by factors such as your chosen course and institution, family income, and academic performance. You can use the PTPTN loan calculator on their official website for an estimate.

2. What is the maximum PTPTN loan amount?

The maximum loan amount varies based on your chosen course and institution. It's best to check the latest guidelines on the PTPTN website.

3. What are the repayment options for PTPTN loans?

PTPTN offers various repayment plans, including income-contingent repayment, scheduled payments, and full settlement.

4. Can I get my PTPTN loan partially or fully waived?

Yes, PTPTN offers loan discounts and waivers for eligible students based on academic achievements or specific criteria.

5. What happens if I'm unable to repay my PTPTN loan on time?

It's crucial to contact PTPTN if you face difficulties with repayments. They offer restructuring options and support to prevent further complications.

6. What documents do I need for the PTPTN loan application?

Typically, you'll need your IC, offer letter, academic transcripts, and proof of income for your family. Check the PTPTN website for a complete list.

7. When can I apply for a PTPTN loan?

The application window is typically open after you receive your offer letter to a higher education institution. Stay updated on the PTPTN website for specific dates.

8. How do I contact PTPTN for inquiries or assistance?

You can reach PTPTN through their official website, customer service hotline, or visit one of their branches nationwide.

Conclusion

Embarking on your higher education journey is a significant step, and securing adequate financial support is crucial. Understanding the ins and outs of PTPTN loans, particularly the question of "berapa jumlah pinjaman PTPTN" (how much PTPTN loan you can get), is essential. Remember that the loan amount you qualify for depends on various factors, including your chosen course, family income, and academic performance. It's highly recommended to explore all available resources, including the PTPTN official website, loan calculators, and guidance from your institution's financial aid office. By arming yourself with knowledge and making informed decisions, you can navigate your PTPTN loan effectively, minimize potential debt, and focus on what truly matters – your education and future success.

Aluminum wheel torque your rides secret weapon

Ignite your spirit exploring the majestic phoenix tattoo sleeve

Nail the perfect fit your guide to kids snowboard size calculators

Jumlah Pinjaman PTPTN Yang Layak Diperoleh Perlu Pelajar Lepasan SPM | Solidarios Con Garzon

Jadual Bayaran Balik Pinjaman PTPTN 2024 Melalui Potongan Gaji | Solidarios Con Garzon

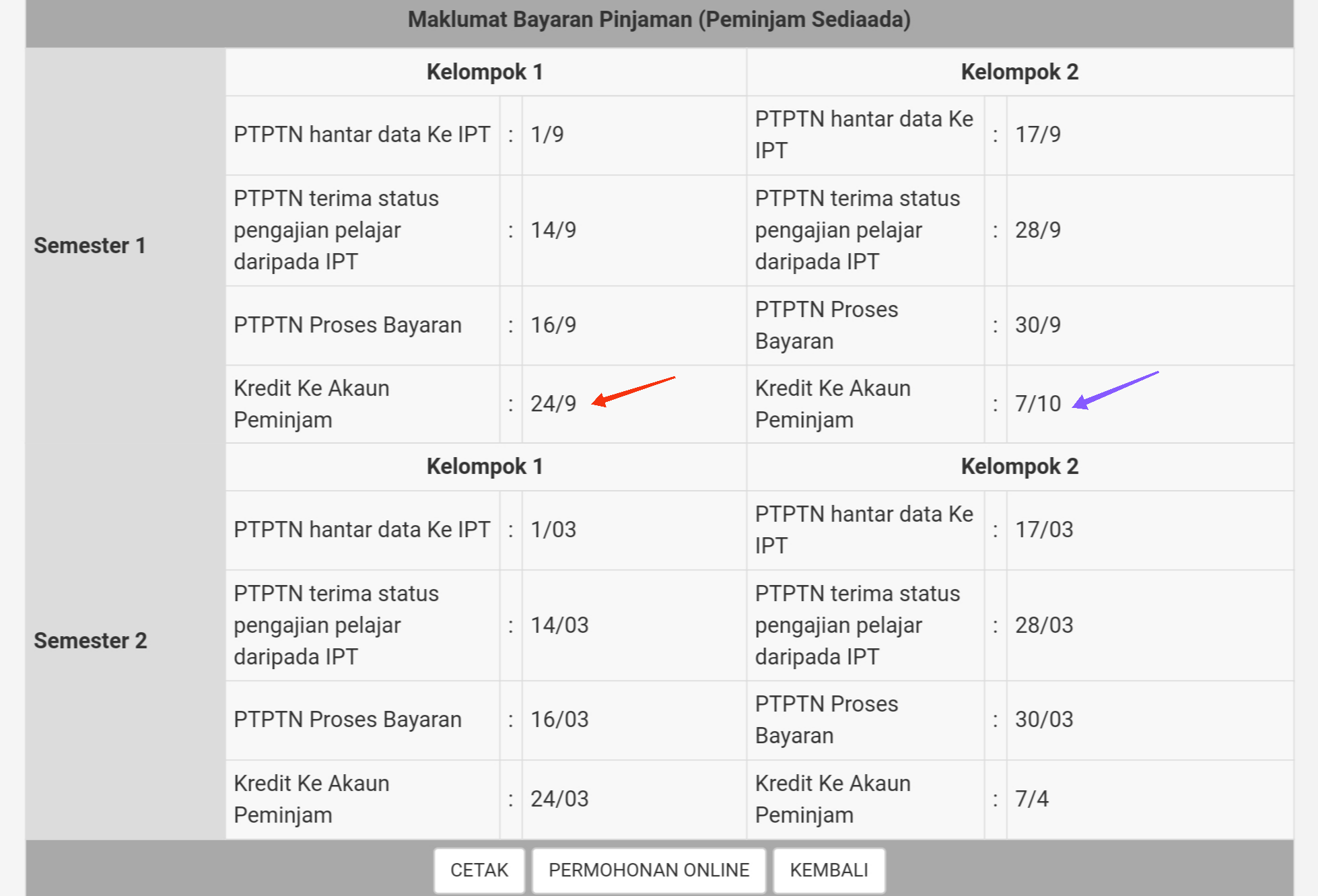

Cara semak tarikh pinjaman PTPTN masuk setiap semester. | Solidarios Con Garzon

Apa Itu Wang Pendahuluan Pinjaman (WPP) PTPTN? Berapa Jumlahnya? Semak | Solidarios Con Garzon

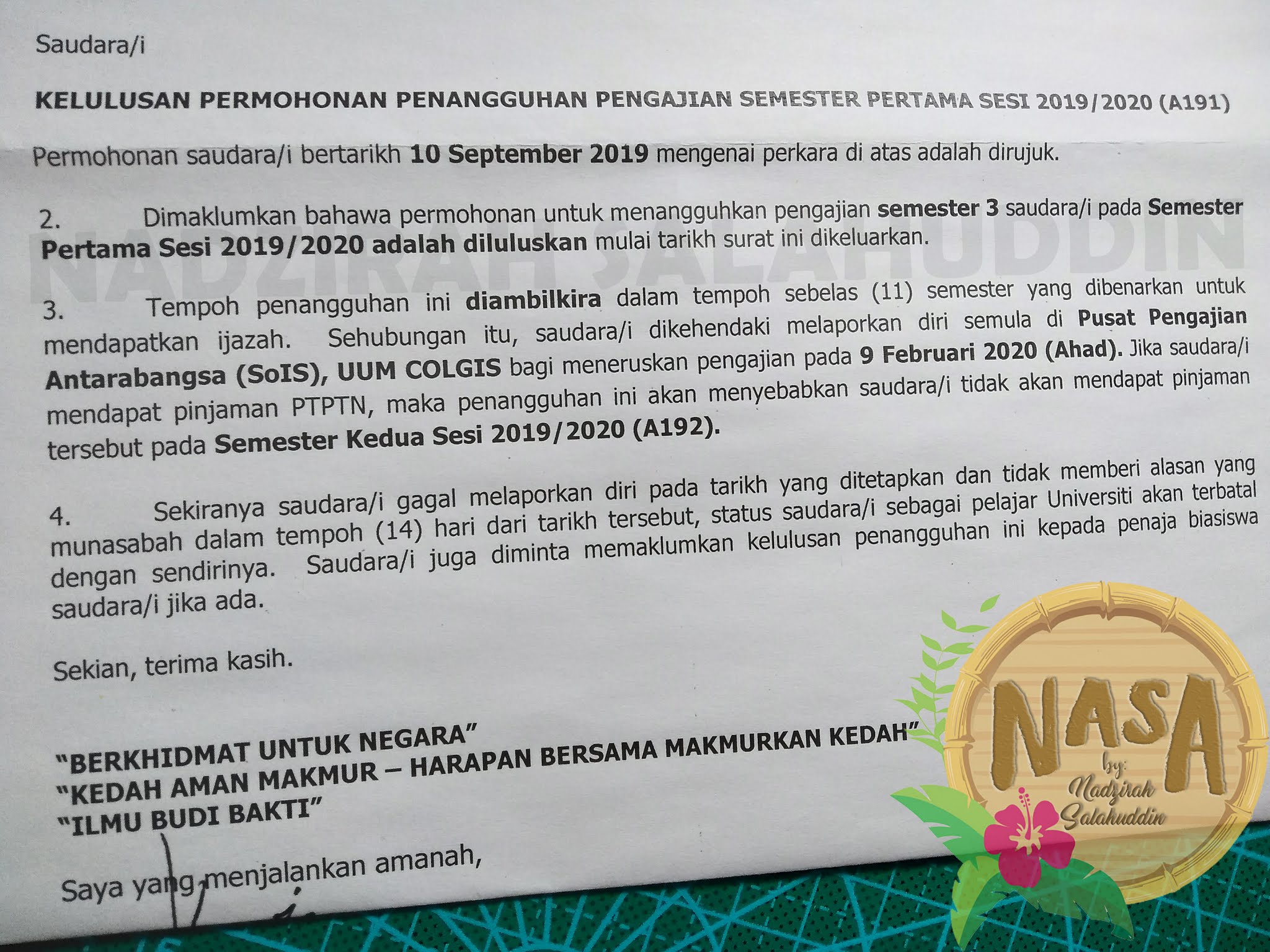

Pengalaman aku sebagai peminjam PTPTN. | Solidarios Con Garzon

Berapa Lama Proses Pengajuan KUR BRI 2023, Pinjaman Rp50 Juta, Cara | Solidarios Con Garzon

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Solidarios Con Garzon

PTPTN: Rezeki Tak Terduga :) | Solidarios Con Garzon

Semakan Pinjaman PTPTN & Tarikh Bayaran Online | Solidarios Con Garzon

Semakan Pinjaman PTPTN & Tarikh Bayaran Online | Solidarios Con Garzon