Navigating the World of Different Checks in the Philippines

In today's increasingly digital world, it's easy to forget about the enduring relevance of traditional financial instruments. However, checks, despite their seemingly old-fashioned nature, remain a cornerstone of financial transactions in the Philippines. From paying bills to conducting business, different checks in the Philippines serve a variety of purposes, offering a level of security and convenience that continues to be valued by individuals and businesses alike.

This enduring relevance stems from the unique characteristics of the Philippine financial landscape. While digital transactions are steadily gaining traction, a significant portion of the population remains unbanked or underbanked. This means they may not have easy access to digital financial services, making checks a more accessible and trusted option for many.

Understanding the different types of checks available in the Philippines, their specific uses, and the regulations surrounding them is crucial for anyone seeking to navigate the country's financial system effectively. Whether you're a first-time check writer or a seasoned business owner, this comprehensive guide will equip you with the knowledge you need to utilize different checks confidently and securely.

We'll delve into the intricacies of various check types, explore their historical context, and highlight the benefits they offer in today's evolving financial landscape. Furthermore, we'll address common concerns and provide practical tips to ensure your check transactions are smooth and hassle-free.

So, whether you're looking to make a personal payment, settle a business deal, or simply expand your understanding of financial instruments in the Philippines, join us as we demystify the world of different checks and empower you with the knowledge to navigate it with confidence.

Advantages and Disadvantages of Different Checks in the Philippines

| Feature | Advantages | Disadvantages |

|---|---|---|

| Security |

|

|

| Convenience |

|

|

Best Practices for Using Checks in the Philippines

To ensure the safe and efficient use of checks, consider these best practices:

- Write clearly and legibly: Use a pen with permanent ink and ensure all details are legible to avoid processing delays or errors.

- Double-check all information: Verify the payee's name, amount, date, and signature before handing over the check.

- Keep records of all transactions: Maintain a check register to track issued checks, payee details, and payment amounts.

- Store unused checks securely: Protect your checkbook from loss or theft by storing it in a safe place.

- Report lost or stolen checks immediately: Contact your bank immediately if your checkbook is lost or stolen to prevent unauthorized use.

Common Questions and Answers About Checks in the Philippines

1. What are the different types of checks in the Philippines?

Common types include personal checks, business checks, cashier's checks, and manager's checks. Each type has specific uses and features.

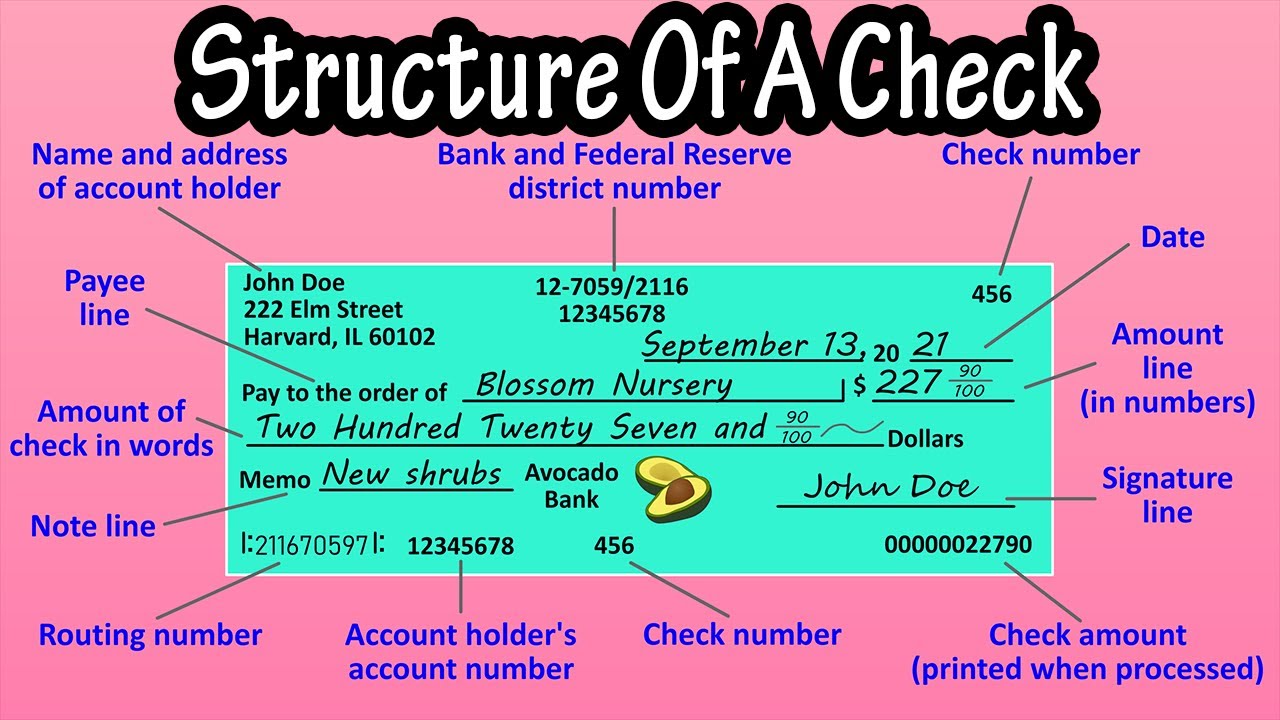

2. How do I write a check correctly?

Fill in the date, payee's name, amount in numbers and words, sign the check, and include a memo (optional) for payment details.

3. Can I deposit a check from a different bank?

Yes, you can deposit checks from other banks, but the clearing period might be longer than for checks from the same bank.

4. What should I do if I lose a check?

Report the lost check to your bank immediately to stop payment and prevent unauthorized use. You may need to complete an affidavit of loss.

5. How long does it take for a check to clear?

Clearing time varies depending on the type of check and banks involved. It can range from a few days to a couple of weeks.

6. Can I use a check to withdraw money?

Yes, you can write a check payable to "Cash" or yourself and cash it at your bank.

7. What are the fees associated with checks?

Banks may charge fees for checkbooks, stop payment requests, returned checks, and other related services. Inquire with your bank about their fee schedule.

8. Are checks still relevant in the digital age?

While digital transactions are on the rise, checks remain relevant, especially for large payments, business transactions, and individuals without convenient access to digital financial services.

Conclusion: Navigating the Financial Landscape with Checks

In conclusion, while the financial landscape continues to evolve with the rise of digital payment methods, different checks in the Philippines remain a relevant and valuable tool for individuals and businesses. They offer a unique blend of security, convenience, and accessibility that caters to a wide range of financial needs. Understanding the different types of checks, their uses, and best practices for using them empowers you to navigate financial transactions with confidence. By utilizing the information and insights shared in this guide, you can leverage the enduring relevance of checks to your advantage while navigating the dynamic world of finance in the Philippines.

Philippines Flag Vector, Philippines, Flag, Philippines Flag PNG and | Solidarios Con Garzon

Aviation authority vows tighter security checks | Solidarios Con Garzon

Understand The Diagram Of Checks And Balances | Solidarios Con Garzon

Philippines Flag With Metal Stand, Philippines Flag Post, Philippines | Solidarios Con Garzon

Philippines sets May 1 deadline for new bank checks | Solidarios Con Garzon

10 Checks and Balances Examples (2024) | Solidarios Con Garzon

Philippines Circle Flag Vector, Philippines Circle Flag, Circle Flag | Solidarios Con Garzon

Parts Of A Cheque | Solidarios Con Garzon

Parts of a Check Made Simple | Solidarios Con Garzon

Money in the Philippines: Everything You Need to Know | Solidarios Con Garzon

Philippines Flag Waving, Philippines Flag With Pole, Philippines Flag | Solidarios Con Garzon

Poly Viscose Check D137 | Solidarios Con Garzon

/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

How To Write a Check: A Step | Solidarios Con Garzon

Philippines Flag, Philippines, Flag, Philippines Flag Background PNG | Solidarios Con Garzon

VTA offers motorists free motor vehicle safety checks before Easter | Solidarios Con Garzon