Navigating Ohio Employee Compensation

Are you curious about how employee compensation works in Ohio? Whether you're an employer trying to build a competitive compensation package or an employee looking to understand your earnings, navigating the landscape of Ohio employee pay rates can seem complex. This guide aims to shed light on key factors influencing pay in the Buckeye State, offering valuable insights for both employers and employees.

Ohio's employee compensation structure is built upon a foundation of federal and state laws, market dynamics, and industry-specific standards. Understanding these elements is crucial for setting appropriate pay levels and ensuring fair compensation. From minimum wage regulations to prevailing wage requirements for public works projects, several factors contribute to the overall picture of Ohio employee earnings.

Historically, Ohio's pay rates have evolved alongside national trends, influenced by economic conditions, labor movements, and legislative changes. The state's minimum wage, for instance, has seen periodic adjustments to reflect changing cost-of-living realities. Understanding this historical context helps grasp the current state of employee compensation in Ohio.

The importance of fair and competitive Ohio employee pay rates cannot be overstated. For employers, offering attractive compensation is essential for attracting and retaining top talent. A well-compensated workforce is more likely to be productive, motivated, and committed to the organization's success. For employees, understanding pay rates allows them to assess their value in the job market and negotiate effectively for fair wages.

Several key issues currently impact Ohio employee pay rates. The rising cost of living, particularly in urban areas, is placing pressure on wages. Additionally, skill shortages in certain industries can drive up salaries for in-demand positions. Furthermore, the ongoing debate surrounding minimum wage increases continues to be a central issue in discussions about employee compensation in the state.

Ohio follows the federal minimum wage, which is currently $7.25 per hour. However, some cities and municipalities have adopted local ordinances setting higher minimum wages. For tipped employees, the minimum cash wage is lower, with employers required to make up the difference if tips do not bring the employee up to the standard minimum wage. This example illustrates the complexities that can arise within Ohio’s compensation landscape.

One of the benefits of understanding Ohio employee pay rates is the ability to negotiate effectively. Knowing the prevailing wage for your position and industry in Ohio empowers you to advocate for fair compensation. Additionally, understanding legal requirements surrounding overtime pay and other wage-related issues can protect you from potential exploitation.

If you're an employer, implementing a clear and transparent pay structure is crucial. Conduct regular market research to stay informed about prevailing wages for comparable positions in Ohio. Benchmarking your compensation against industry standards can help ensure you remain competitive in attracting and retaining employees.

Advantages and Disadvantages of Minimum Wage Increases in Ohio

| Advantages | Disadvantages |

|---|---|

| Increased consumer spending | Potential job losses |

| Reduced poverty | Increased prices for goods and services |

Frequently Asked Questions about Ohio Employee Pay Rates:

1. What is the minimum wage in Ohio? Answer: Ohio follows the federal minimum wage.

2. How do I find out the prevailing wage for my job? Answer: Resources like the Bureau of Labor Statistics offer wage data.

3. Are employers required to provide paid sick leave in Ohio? Answer: Not at the state level, but some cities may have local ordinances.

4. What should I do if I believe I am not being paid fairly? Answer: Contact the Ohio Department of Commerce.

5. How often do Ohio minimum wage laws change? Answer: Changes occur periodically, based on legislative action.

6. Where can I find information on Ohio's overtime pay laws? Answer: The Ohio Department of Commerce website offers resources.

7. Are there specific pay rate regulations for independent contractors in Ohio? Answer: Yes, independent contractors are subject to different rules than employees.

8. How does Ohio's minimum wage compare to neighboring states? Answer: Research neighboring states' labor laws for comparison.

In conclusion, navigating Ohio employee pay rates involves understanding a complex interplay of legal requirements, market forces, and industry-specific considerations. Staying informed about the factors influencing compensation is essential for both employers seeking to build competitive compensation packages and employees striving to understand their earnings potential. By utilizing available resources, engaging in ongoing learning, and advocating for fair practices, all parties can contribute to a more equitable and prosperous labor market in Ohio. This understanding is not just beneficial; it's crucial for fostering a healthy and productive work environment for everyone in the Buckeye State. Take the time to research, ask questions, and be proactive in understanding your rights and responsibilities. Your financial well-being depends on it.

Safely disconnecting your calor gas bottle a comprehensive guide

Beyond the tie fathers day gift baskets that truly connect

Protecting plainfield a look at the fire and police departments

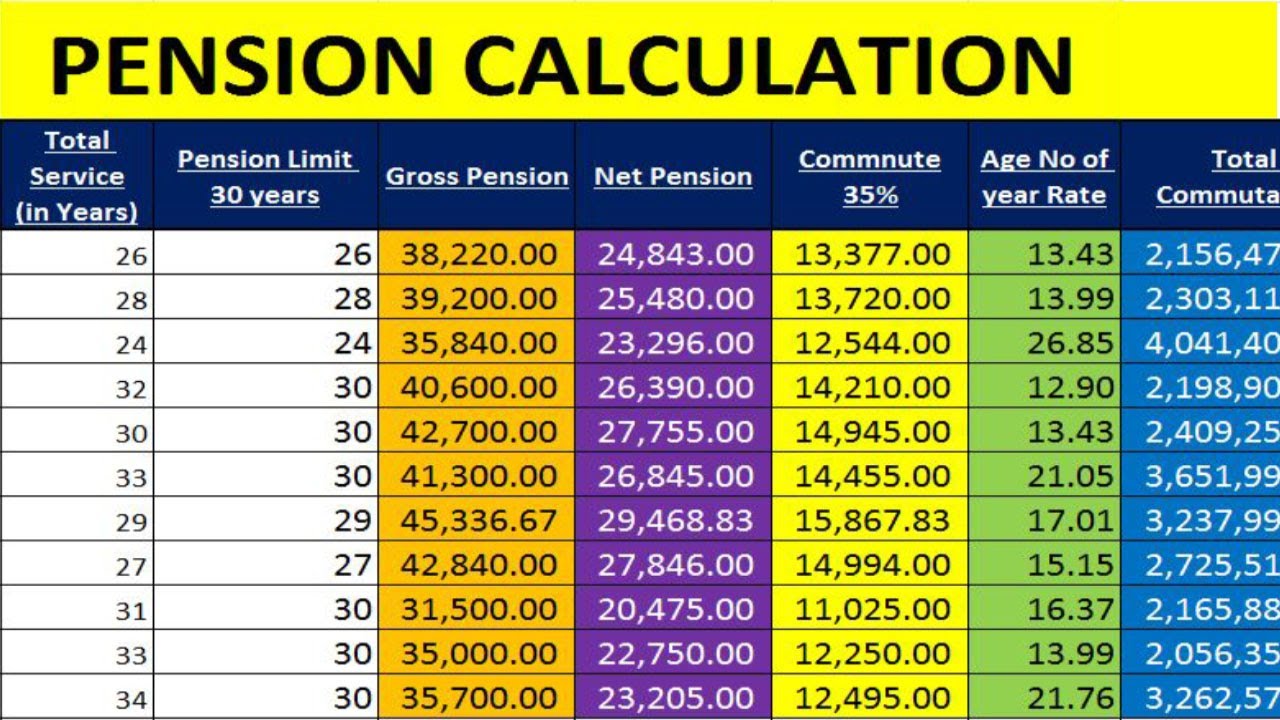

Proposed budget includes raises | Solidarios Con Garzon

Federal Government Releases New Salary Table | Solidarios Con Garzon

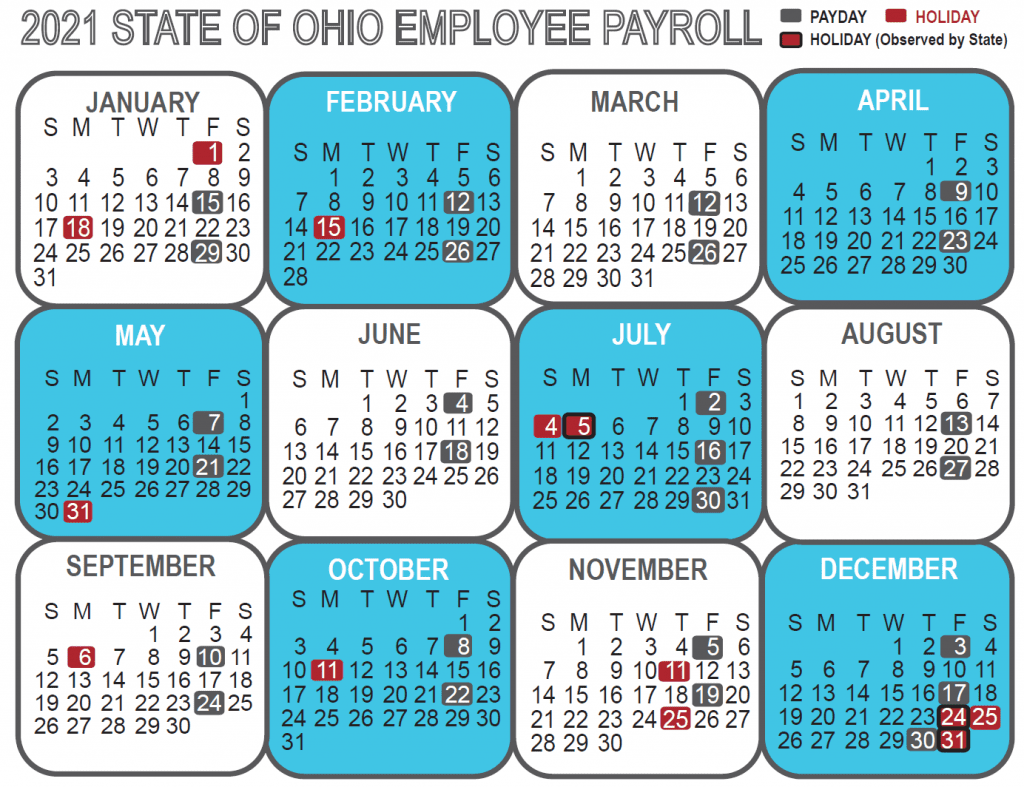

2024 State Of Ohio Employee Payroll Calendar | Solidarios Con Garzon

ohio employee pay rates | Solidarios Con Garzon

Ohio State Employee Holidays 2024 | Solidarios Con Garzon

State Of Ohio Employer Tax Tables | Solidarios Con Garzon

ohio employee pay rates | Solidarios Con Garzon

11 pay rate change form template | Solidarios Con Garzon