Life Happens: What's a Qualifying Life Event for Insurance?

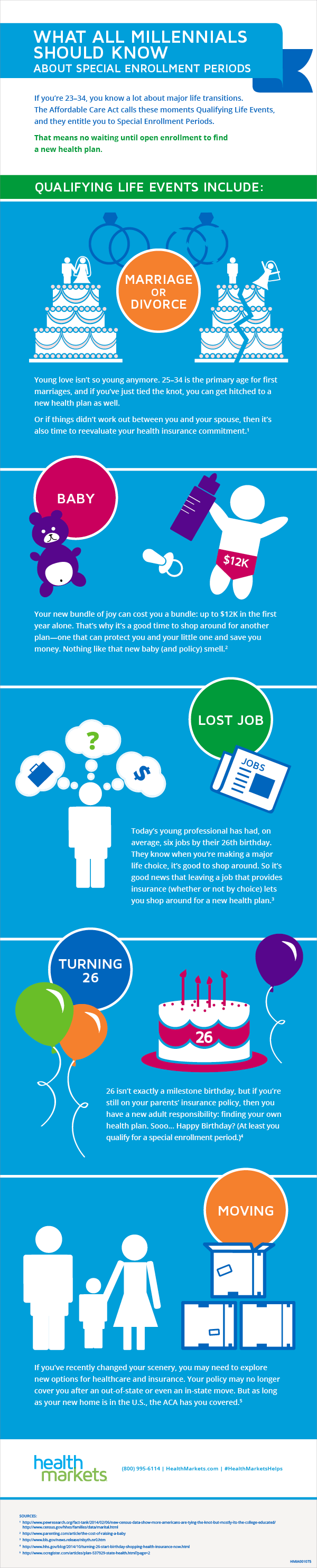

Life throws curveballs. A new job, a growing family, or even saying goodbye to a loved one - these major life changes often mean adjusting your safety net. That's where "qualifying life events" come in for your health, dental, and even car insurance.

Think of them like special enrollment periods. Usually, you can only change your insurance plan during a specific timeframe each year, But these events give you the flexibility to update your coverage to better suit your new normal, without waiting for open enrollment.

But what exactly qualifies? And how can you make sure you're taking advantage of these opportunities? Let's break it down.

Qualifying life events are specific situations recognized by insurance companies and government programs as significant enough to warrant changes to your existing insurance coverage. These events often come with shifts in your financial or health needs, making it essential to reassess your insurance policies.

The concept arose from the need for flexibility and fairness within the insurance system. Imagine losing your job-based health coverage and being unable to get new insurance until the next open enrollment! Qualifying life events address this by providing crucial coverage options during times of transition.

Advantages and Disadvantages of Qualifying Life Events for Insurance

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage when needed | Limited time frame to make changes after the event |

| Opportunity to enroll in a plan outside of open enrollment | May require providing documentation of the qualifying event |

| Ensures access to necessary healthcare and financial protection during significant life changes | Not all life events may qualify, potentially leaving individuals without coverage options in certain situations |

Best Practices for Navigating Qualifying Life Events and Insurance

1. Understand Your Options: Familiarize yourself with common qualifying life events and the types of insurance affected. This knowledge empowers you to anticipate when you might need to make changes.

2. Document Everything: When a qualifying event occurs, keep detailed records, including dates, relevant paperwork, and communication with your employer or insurance provider. This documentation will be crucial when enrolling in a new plan or making changes.

3. Act Quickly: Time is of the essence. Most insurance plans have a limited window (typically 30-60 days) to enroll or make changes after a qualifying life event. Don't delay; reach out to your insurance provider as soon as possible.

4. Compare Plans Carefully: Don't rush into a new insurance plan without careful consideration. Take the time to compare different options, considering factors like coverage, deductibles, premiums, and provider networks.

5. Seek Assistance If Needed: Navigating insurance options can be daunting, especially during stressful life transitions. Don't hesitate to seek help from your employer's HR department, insurance brokers, or government resources like Healthcare.gov (for health insurance).

Common Questions About Qualifying Life Events

1. What are some examples of qualifying life events? Common examples include:

- Loss of health coverage (job loss, divorce, aging off a parent's plan)

- Changes in household size (marriage, birth, adoption, death)

- Relocation to a new area

- Changes in income

2. How long do I have to change my insurance after a qualifying event? You typically have 60 days from the date of the event. However, it's essential to confirm the specific timeframe with your insurance provider.

3. What documents do I need to provide? The required documents vary depending on the event. For example, for marriage, you'll likely need a marriage certificate, while for a job loss, termination paperwork might be required.

4. Can I change any insurance plan during a qualifying life event? The available plan options might vary depending on the event and your insurance provider. For instance, you might have more choices if you're losing job-based coverage compared to simply adding a new dependent.

5. What if I miss the deadline to make changes? Missing the deadline could mean waiting until the next open enrollment period to adjust your coverage. Contact your insurance provider immediately to explore potential exceptions or options.

6. Can I use a qualifying life event to change insurance plans even if I'm happy with my current coverage? While possible, it's generally not recommended unless your needs have significantly changed. Carefully assess if the new plan aligns better with your situation before switching.

7. Do qualifying life events apply to all types of insurance? Qualifying life events primarily apply to health, dental, and sometimes vision insurance. Auto and home insurance usually don't have specific qualifying life event provisions, but significant life changes might warrant a review of your coverage.

8. Where can I find more information about qualifying life events specific to my state or situation? Contact your insurance provider, employer's HR department, or state insurance commissioner's office for personalized guidance.

Tips and Tricks for Navigating Qualifying Life Events and Insurance

- Set calendar reminders for deadlines to avoid missing the window for making changes.

- Keep digital copies of all documentation related to the qualifying event readily accessible.

- If denied coverage or facing issues, don't give up. Contact your state's insurance department for assistance and to understand your rights.

Life's big moments often come with adjustments to your insurance needs. By understanding what qualifies as a life event and acting promptly, you can ensure you're always covered, no matter what curveball comes your way. Remember, staying informed is key, and taking the time to review and adjust your insurance can provide invaluable peace of mind during times of transition.

Decoding chase cashiers check validity

Cracking the code california dmv test answers

Unlocking hardy county wv through gis mapping

What is a Qualifying Event and Why Does It Matter? | Solidarios Con Garzon

what is qualifying life event for insurance | Solidarios Con Garzon

What Are Qualifying Events For Health Insurance In California | Solidarios Con Garzon

The Amazing Truth About Qualifying Life Events for Millennials | Solidarios Con Garzon

Understanding Qualifying Life Events (QLEs) | Solidarios Con Garzon

What is a qualifying life event for health insurance? | Solidarios Con Garzon

Fillable Online Proof of qualifying life event form Fax Email Print | Solidarios Con Garzon

What is a qualifying life event? | Solidarios Con Garzon

What Employers Need to Know About a Qualifying Life Event | Solidarios Con Garzon

Health Insurance 101: What Is a Qualifying Life Event? | Solidarios Con Garzon

Qualifying Life Events for Insurance: 2024 Guide | Solidarios Con Garzon

Qualifying Life Events FAQs | Solidarios Con Garzon

what is qualifying life event for insurance | Solidarios Con Garzon

Hanford Mission Integration Solutions | Solidarios Con Garzon

New Special Enrollment Period Qualifying Life Events | Solidarios Con Garzon