Is Accrual Accounting Allowed Under GAAP? Unveiling the Mystery

Ever feel like you're lost in a maze of financial jargon? You're not alone. The world of accounting can be daunting, especially when terms like "accrual accounting" and "GAAP" get thrown around. You know these things are important for your business, but what do they actually *mean*? And more importantly, how do they work together? Buckle up, because we're about to demystify the connection between accrual accounting and GAAP, giving you the knowledge to navigate your financial landscape confidently.

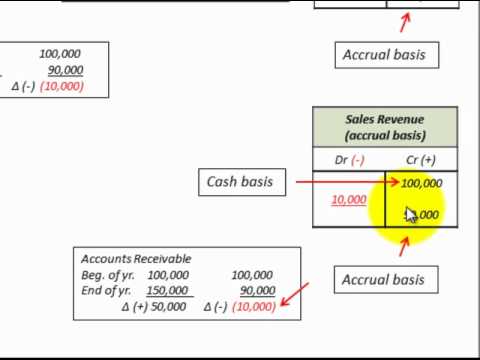

Let's start by tackling the elephant in the room: the often-confusing world of accounting methods. Essentially, there are two main ways businesses track their income and expenses: cash basis and accrual basis. Cash basis accounting is like keeping track of your spending on a weekend trip - straightforward and simple. You record money coming in when you receive it and money going out when you spend it. But here's where it gets interesting - accrual accounting paints a more complete picture of a business's financial health, which is super important, especially if you're aiming for long-term success.

Now, imagine you're running a bakery, the smell of fresh bread filling the air. You've just delivered a massive cake order for a wedding, but the payment won't arrive for another month. With cash basis accounting, you wouldn't recognize that income until the payment hits your account. But with accrual accounting, you acknowledge that income right away, even though the cash isn't in your hand yet. This is because you've already provided the service, and the payment is due, giving you a more realistic view of your current earnings.

So, where does GAAP fit into all of this? GAAP, or Generally Accepted Accounting Principles, are like the established rules of the accounting game in the United States. They provide a standardized framework for how businesses should record and report their financial transactions. And here's the kicker – GAAP generally requires accrual accounting for businesses that meet certain criteria, especially if they sell products on credit or maintain inventory. Think of it this way: GAAP sets the stage, and accrual accounting helps businesses play by the rules while gaining valuable insights into their financial performance.

But why is this important for you? Because understanding the relationship between accrual accounting and GAAP can empower you to make informed decisions about your business's finances. It allows you to track your true profitability, manage your cash flow effectively, and meet the reporting requirements of lenders, investors, and the ever-present tax authorities. So, the next time you encounter these terms, remember, they're not just accounting jargon; they're your keys to unlocking a deeper understanding of your business's financial well-being.

Advantages and Disadvantages of Accrual Accounting under GAAP

| Advantages | Disadvantages |

|---|---|

| Provides a more accurate picture of a company's financial health. | Can be more complex to implement than cash basis accounting. |

| Allows for better tracking of long-term trends. | May require specialized software or the expertise of a trained accountant. |

| Essential for businesses that sell products on credit or carry inventory. | May not be suitable for small businesses with very simple transactions. |

In the complex world of business finances, knowledge is power. By grasping the fundamentals of accrual accounting and its crucial link to GAAP, you equip yourself to make smarter decisions, enhance your financial reporting, and steer your business towards long-term success. So, take the time to understand these concepts - your business will thank you for it.

Unleash your inner meme lord too damn high meme maker guide

The intriguing dynamics of the wu lei and zhao lusi relationship

Upgrade your ride top car stereo systems under 200

Chapter 4 THE ADJUSTMENT PROCESSPrinciples of Accounting, Vo | Solidarios Con Garzon

Accrual Accounting Concepts and Examples for Business | Solidarios Con Garzon

Why Does GAAP Require Accrual Basis Accounting? | Solidarios Con Garzon

is accrual accounting allowed under gaap | Solidarios Con Garzon

is accrual accounting allowed under gaap | Solidarios Con Garzon

Smart Example Financial Statements 2019 Codys Statement Of Position Quizlet | Solidarios Con Garzon

is accrual accounting allowed under gaap | Solidarios Con Garzon

SOLVED: The direct write | Solidarios Con Garzon

.jpg)

is accrual accounting allowed under gaap | Solidarios Con Garzon

Answered: Amounts received in advance from | Solidarios Con Garzon

Accounting Principles Line Icons Collection. Double | Solidarios Con Garzon

Generally Accepted Accounting Principles (GAAP) Defined | Solidarios Con Garzon

is accrual accounting allowed under gaap | Solidarios Con Garzon

is accrual accounting allowed under gaap | Solidarios Con Garzon

What is GAAP in Accounting: Significance and Evolution of GAAP | Solidarios Con Garzon