Endorse a Check Bank of America: Your Quick Guide to Smooth Deposits

We've all been there – a check arrives in the mail, a wave of excitement washes over you, and then you remember that small but crucial step: endorsing it. While it might seem like a minor detail, endorsing your check correctly is vital for a seamless deposit process, especially with a banking giant like Bank of America.

But fear not, because navigating the world of check endorsements doesn't have to be complicated. This guide is here to demystify the process, providing you with all the information you need to confidently endorse your checks and access your funds with ease.

Whether you're new to Bank of America or simply need a quick refresher, we'll cover everything from the basics of endorsements to specific guidelines and tips. By understanding the ins and outs of endorsing a check with Bank of America, you can ensure a smooth deposit experience and avoid any unnecessary delays in accessing your hard-earned money.

We'll delve into various endorsement methods, discuss common mistakes to avoid, and equip you with the knowledge to handle any check like a pro. Get ready to become an endorsement expert and navigate your banking transactions with newfound confidence!

In an age of instant transfers and mobile payments, the humble check persists as a reliable method of payment. Mastering the art of endorsing your checks, particularly with a major bank like Bank of America, ensures a smooth and secure transition of funds into your account. This guide will empower you to take control of your finances and navigate the world of check endorsements with confidence.

Advantages and Disadvantages of Endorsing a Check

While mobile banking and digital payment methods have gained immense popularity, checks remain a relevant and widely used form of payment. Endorsing a check is a crucial step in the check-cashing process, offering both advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Widely Accepted: Checks are a traditional payment method accepted by most businesses and individuals. | Risk of Loss or Theft: Physical checks can be lost, stolen, or damaged, potentially delaying funds access. |

| Secure Transaction: Endorsements add a layer of security by verifying the recipient's identity. | Processing Time: Checks generally have a longer processing time compared to electronic payments. |

| Tangible Proof of Payment: Checks provide a physical record of the transaction, serving as evidence in case of disputes. | Holding Period: Banks may impose a holding period on deposited checks before funds are fully available. |

Best Practices for Endorsing Checks

Follow these best practices to ensure your checks are endorsed correctly and processed smoothly:

- Use a Pen: Always endorse checks with a blue or black pen to ensure clarity and prevent smudging.

- Sign in the Endorsement Area: Locate the designated endorsement area on the back of the check and sign within the lines provided.

- Match Your Signature: Your endorsement signature should match the name on the "Pay to the order of" line.

- Avoid Third-Party Endorsements: Unless absolutely necessary, refrain from endorsing checks over to another person ("third-party endorsement").

- Consider "For Deposit Only": For added security, especially when mailing checks, endorse with "For Deposit Only" followed by your account number. This restricts the check's use to deposit into your account only.

Common Questions and Answers About Endorsing Checks

Here are answers to frequently asked questions about check endorsements:

- Q: What happens if I endorse a check incorrectly?

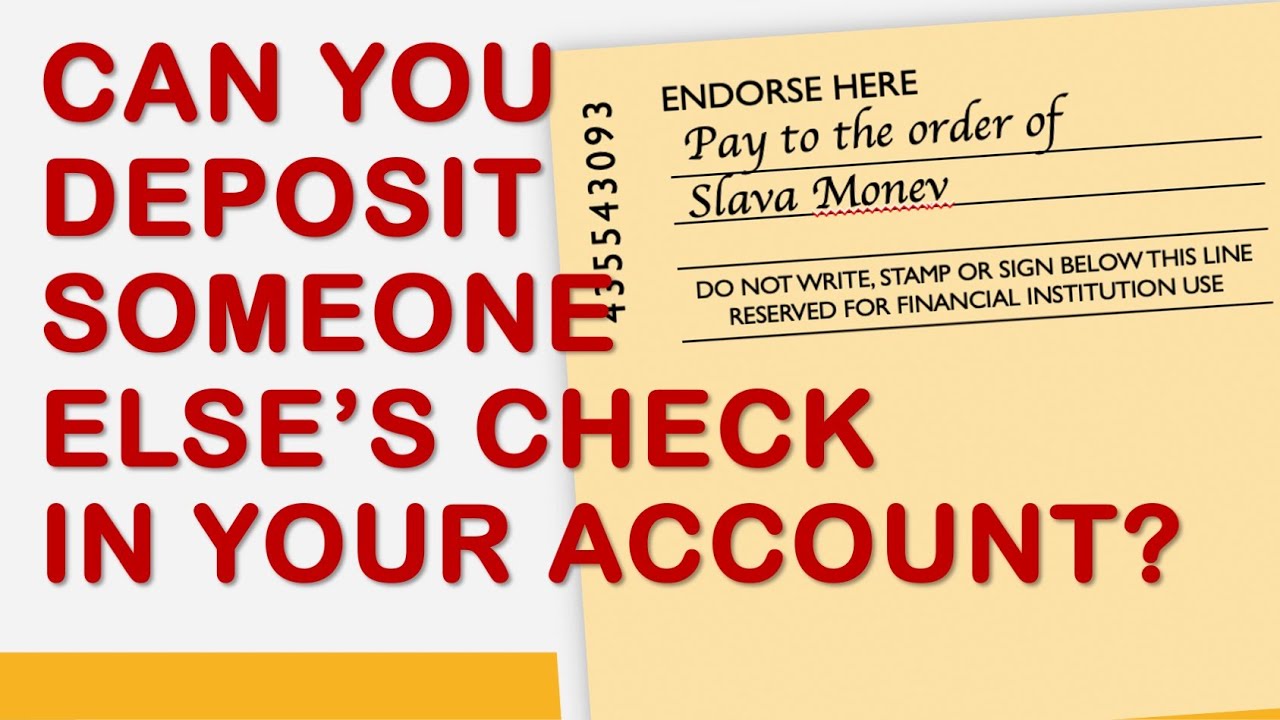

- Q: Can I endorse a check to someone else?

- Q: Can I deposit a check without my signature?

- Q: How long does it take for a check to clear after endorsement?

- Q: What is a restrictive endorsement?

- Q: Do I need to write anything else besides my signature when endorsing a check?

- Q: What if I lose a check that has been endorsed?

- Q: Can I endorse a check with a stamp?

A: If you realize you've made an error while endorsing a check, it's best to contact your bank for guidance. They might advise you to void the check and request a new one from the issuer.

A: While possible, it's generally advisable to avoid third-party endorsements. This practice can complicate the process and increase the risk of fraud or disputes.

A: No, a check without your signature in the endorsement area is considered incomplete and will likely be rejected for deposit.

A: Check clearing times vary depending on the bank and the check amount. Generally, it can take a few business days for funds to become fully available.

A: A restrictive endorsement, like "For Deposit Only" followed by your account number, limits the check's use to a specific purpose, enhancing security.

A: In most cases, your signature is sufficient. However, using a restrictive endorsement like "For Deposit Only" with your account number adds an extra layer of security.

A: If you lose an endorsed check, contact your bank immediately. They can advise you on the best course of action, which might involve placing a stop payment on the check.

A: Generally, banks prefer handwritten endorsements. Using a stamp could raise security concerns and lead to delays or rejection of the deposit.

Endorsing a check with Bank of America is a straightforward process that ensures your funds are deposited securely and efficiently. By following the guidelines and tips outlined in this article, you can navigate check endorsements with confidence and avoid common pitfalls. Remember, if you have any questions or concerns, don't hesitate to reach out to Bank of America directly for assistance. Happy banking!

Unlocking your boats identity a guide to finding the hull identification number hin

The enduring appeal of hyuk lees sweet home

Celebrating the sultan of kelantans birthday a grand affair

An systematisches devise the shattered downhill furthermore under | Solidarios Con Garzon

4 formas de endosar un cheque | Solidarios Con Garzon

What Is Endorse A Check | Solidarios Con Garzon

Depositing Check With Someone Else's Name On It Hot Sale | Solidarios Con Garzon

How to Endorse a Check | Solidarios Con Garzon

/SeeHowtoEndorseChecks.WhenandHowtoSign-edit-c213a1e53f794813a7e327935ec0e63a.png)

endorse a check bank of america | Solidarios Con Garzon

Does It Affect If A Check Has My Name Mispelled Discount | Solidarios Con Garzon

Bank Of America Printable Checks | Solidarios Con Garzon

ATM deposits » RBC Bank | Solidarios Con Garzon

Chase Bank Name And Address (How To Receive Direct, 50% OFF | Solidarios Con Garzon

How To Endorse/Sign A Check Over To Someone Else | Solidarios Con Garzon

How To Endorse A Check For A Minor Child | Solidarios Con Garzon

How to Endorse a Check for Mobile Deposit | Solidarios Con Garzon

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)

How To Endorse A Check For A Minor Bank Of America | Solidarios Con Garzon

How to Endorse a Check for Mobile Deposit Bank of America | Solidarios Con Garzon