Decoding Your Paycheck: A Deep Dive into Salary Tax Deductions

Ever glanced at your paycheck and felt a twinge of confusion (or maybe a slight panic) when you saw the deductions? You're not alone. Understanding how your income tax is calculated can feel like navigating a labyrinth, but it's a journey worth taking for a healthier financial life. Let's demystify the process and empower you to decode those deductions.

At its core, calculating salary tax deductions is about determining the precise amount of income tax you owe based on your earnings. This isn't a one-size-fits-all equation; factors like your income bracket, filing status, eligible deductions, and regional tax laws all come into play. Think of it as a financial puzzle – each piece, from your gross income to applicable deductions, fits together to reveal the complete picture of your tax liability.

The history of income tax is a long and winding road, stretching back centuries. Early forms of taxation were often tied to specific events or wars. Fast forward to modern times, and income tax has become a cornerstone of most governments' revenue streams, funding public services, infrastructure, and social programs. The methods for calculating and collecting these taxes have evolved significantly, with technology playing an increasingly crucial role in streamlining the process.

However, this evolution hasn't come without its challenges. Navigating complex tax codes and staying updated on ever-changing regulations can feel daunting. That's where understanding your personal tax situation becomes paramount. By grasping the fundamentals of salary tax deductions, you're not just deciphering numbers on a page – you're taking control of your financial well-being.

Imagine this: you're planning a dream vacation, but those pesky tax deductions seem to be eating into your travel budget. This is where the true value of understanding your deductions shines. By maximizing eligible deductions and strategically planning your finances, you can potentially reduce your tax burden and free up more funds for the things you love. It's about working smarter, not harder, when it comes to your money.

Advantages and Disadvantages of Understanding Salary Tax Deductions

| Advantages | Disadvantages |

|---|---|

| Empowers informed financial decisions. | Can be time-consuming to stay updated on tax laws. |

| Helps identify potential tax savings and optimize deductions. | May require seeking professional advice for complex situations. |

| Provides peace of mind and reduces the risk of unexpected tax liabilities. |

While delving into the world of taxes may not be everyone's idea of a good time, the payoff is significant. By investing the effort to understand your salary tax deductions, you're not just crunching numbers – you're unlocking a world of financial knowledge that can empower you for years to come. So, embrace the challenge, seek guidance when needed, and embark on the journey to financial mastery.

Need medical imaging explore hillsborough nj imaging options

Cookie clicker ultra realistic

Unlock math success free grade 4 math sheets pdf download

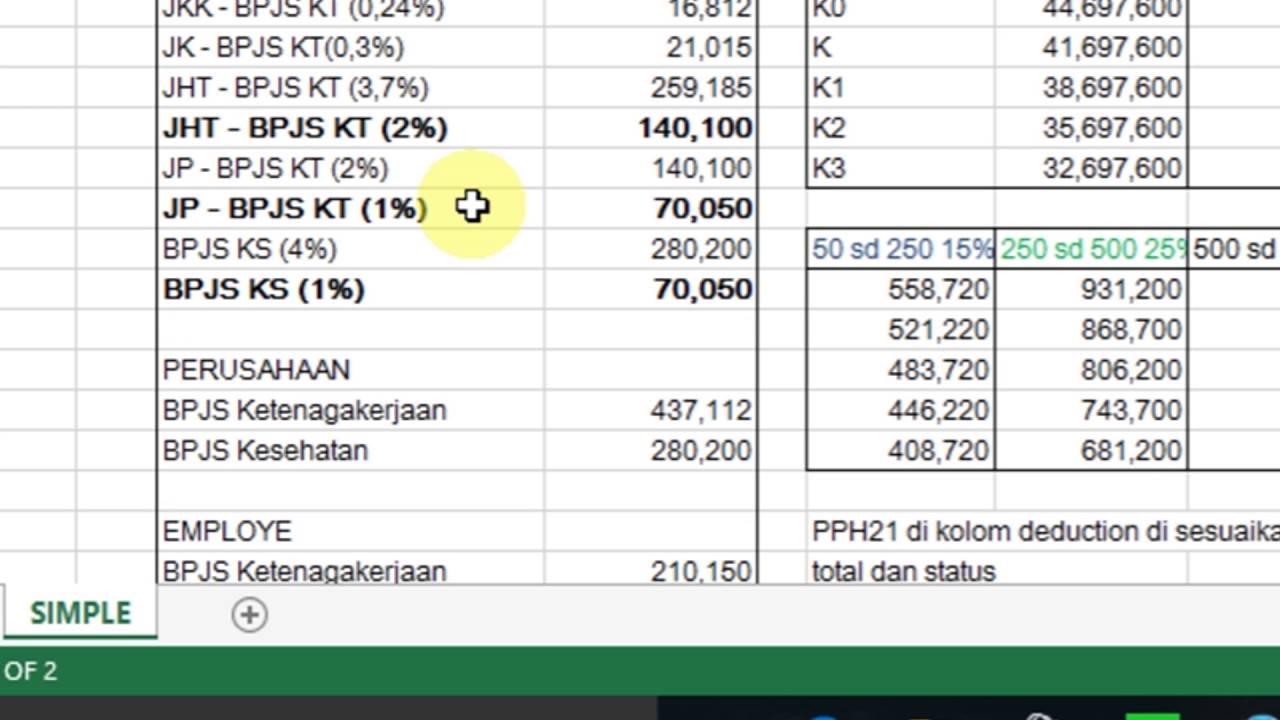

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

Cara Hitung Perhitungan PPh 21 Terbaru Excel 2023 + Download XLSX | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon

Cara Menggunakan Rumus Vlookup Dan Hlookup | Solidarios Con Garzon

menghitung potongan pajak gaji | Solidarios Con Garzon