Decoding Your Bonus: A Guide to Employee Bonus Tax Calculations

Earning a bonus is a fantastic feeling, a tangible recognition of hard work and dedication. But before you start planning that dream vacation or splurging on a well-deserved treat, there's an important factor to consider: taxes. Yes, even bonuses are subject to taxes, and understanding how these taxes are calculated is crucial for both employees and employers.

While the thrill of receiving a bonus is universal, the way taxes are applied can vary significantly depending on your location and individual circumstances. This is why it's essential to understand the tax implications so you're not caught off guard when your actual take-home amount differs from your initial bonus excitement.

Let's delve into the world of bonus taxation, demystify the process, and equip you with the knowledge to navigate this financial landscape confidently. Whether you're a seasoned professional or new to the workforce, understanding how bonus taxes work is essential for effective financial planning and maximizing your earnings.

Calculating bonus taxes is not merely an administrative task—it directly impacts your income. Overpaying on taxes means having less money to invest, save, or spend on things you enjoy. Conversely, understanding how to optimize your tax situation could potentially lead to significant savings in the long run.

This comprehensive guide aims to shed light on the intricacies of bonus taxation. We'll explore various tax implications, provide practical tips for both employees and employers, and answer frequently asked questions to empower you to make informed financial decisions.

Advantages and Disadvantages of Understanding Bonus Tax Calculations

Understanding the intricacies of bonus tax calculations offers a range of benefits for both employees and employers. However, like any financial process, there can also be complexities. Here's a balanced look at the pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

Navigating the world of bonus taxation doesn't have to be daunting. By staying informed, seeking professional advice when needed, and embracing a proactive approach, you can ensure you're maximizing your earnings and making the most of your hard-earned rewards.

Unveiling the clarity a deep dive into wells fargo view your statements

Unlocking the secrets of payment authorization your ultimate guide

Sauk city wi pd ensuring community safety

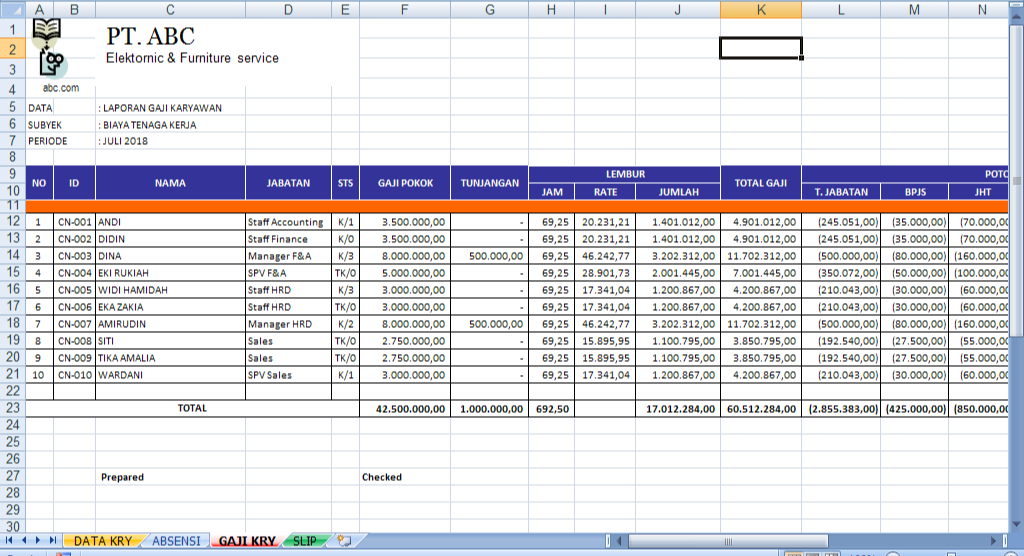

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon

cara menghitung pajak bonus karyawan | Solidarios Con Garzon