Decoding Your Bank of America Check: A Guide to Finding Your Account Number

In the labyrinth of modern finance, a small slip of paper holds the key to a vast network of transactions: the humble check. This seemingly simple document, a tangible representation of funds, carries within it a coded language of numbers, each with its own specific purpose. Among these, perhaps the most crucial is the bank account number, the very identifier of your financial identity within the institution.

For Bank of America customers, locating this vital sequence on a check can sometimes feel like deciphering a hidden message. Yet, understanding the structure and layout of a Bank of America check demystifies the process, transforming a potential puzzle into a simple act of observation. This exploration delves into the art of finding your Bank of America account number on a check, providing clarity and confidence in navigating this essential aspect of personal finance.

The evolution of the check itself is a testament to human ingenuity in facilitating commerce. From its ancient origins as clay tablets and medieval bills of exchange, the modern check emerged as a standardized instrument for transferring funds. Today, while electronic transactions gain prominence, the check remains a relevant tool, particularly for specific payments and situations. Understanding its components, especially the account number, remains essential for effective financial management.

The account number serves as the unique identifier for your individual account within the vast network of Bank of America's system. This numerical code allows for the accurate routing of funds, ensuring that deposits and withdrawals are processed correctly. Without this precise identifier, the seamless flow of financial transactions would grind to a halt, highlighting the importance of knowing where to find and how to interpret this critical piece of information.

Misinterpreting or misplacing your account number can lead to several issues, ranging from minor inconveniences to significant problems. Incorrectly entered numbers can delay payments or cause transactions to fail. Furthermore, sharing your account number with unauthorized individuals poses security risks, potentially leading to fraud or identity theft. Thus, accurately locating and safeguarding your account number is paramount for secure and efficient financial management.

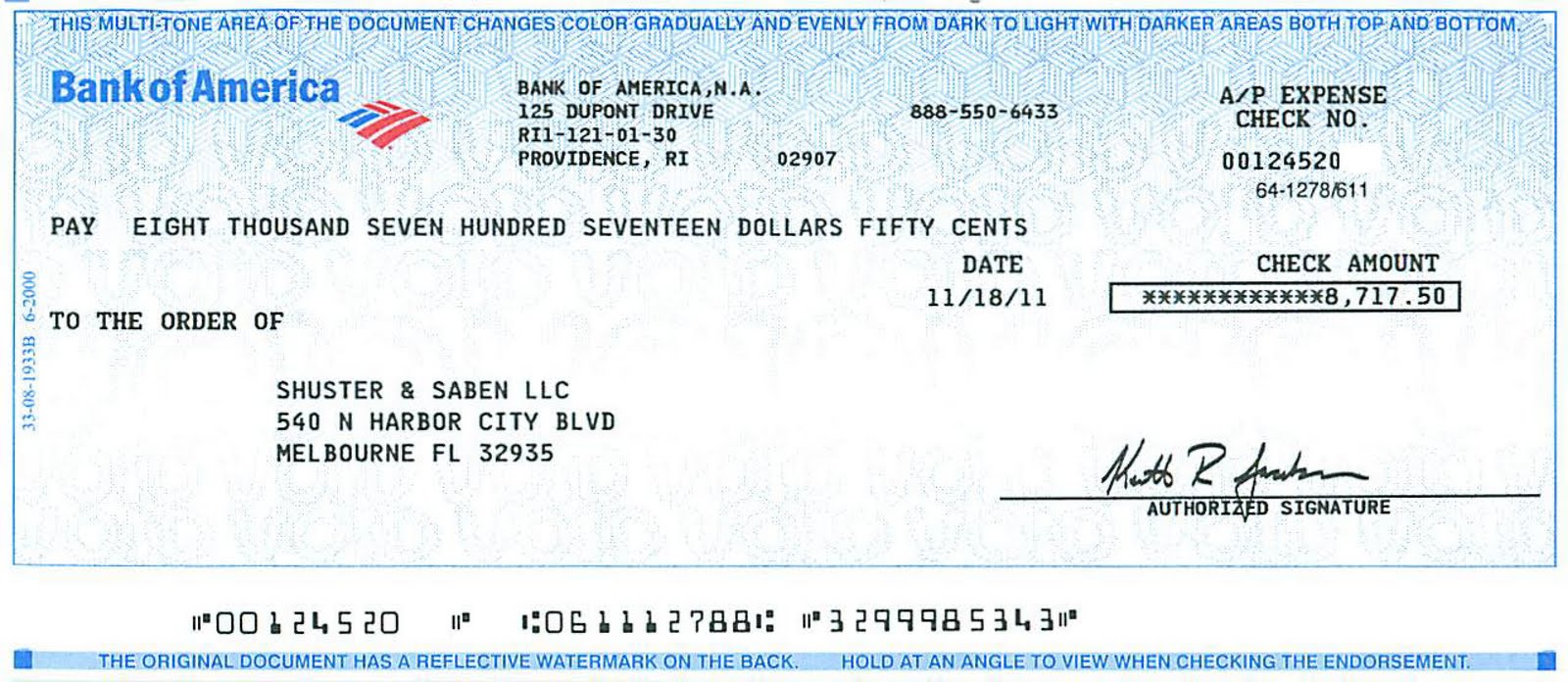

Your Bank of America account number is typically located at the bottom of your check. You'll see three sets of numbers printed in a special magnetic ink. The middle set of numbers is your account number. It's positioned between the routing number on the left and the check number on the right.

Benefits of knowing how to locate your account number include: efficient processing of transactions, ability to set up online banking and bill pay, and improved financial organization.

To locate your account number: examine the bottom of your check, identify the three sets of numbers, and locate the middle set – this is your account number.

Advantages and Disadvantages of Memorizing Your Account Number

| Advantages | Disadvantages |

|---|---|

| Quick access for transactions | Security risk if forgotten or shared inadvertently |

Best Practices: 1. Verify the account number with your bank statement. 2. Do not share your account number with untrusted sources. 3. Store your checks securely. 4. Shred discarded checks. 5. Regularly review your bank statements for discrepancies.

FAQs: 1. What if I can't find my checkbook? Check your online banking platform. 2. What if my check is damaged? Contact Bank of America for a replacement. 3. What do I do if I suspect fraud? Immediately report it to Bank of America. 4. Can I find my account number online? Yes, through online banking. 5. Is my account number the same as my debit card number? No, they are different. 6. How many digits is a Bank of America account number? It can vary. 7. What if I have multiple accounts? Each account has its own unique number. 8. Can I change my account number? Contact Bank of America for assistance.

Tips: Use online banking to quickly access your account information. Keep your checkbook in a secure location.

In conclusion, the seemingly mundane task of finding your Bank of America account number on a check is a crucial aspect of managing your finances. From the historical evolution of checks to the potential pitfalls of mismanaging this vital information, understanding its significance empowers you to navigate the complexities of modern banking with confidence. By mastering this simple skill, you gain control over your financial transactions, ensuring accuracy, efficiency, and security. Take the time to familiarize yourself with the layout of your check and safeguard your account number. This proactive approach will contribute to a smoother, more secure, and ultimately more empowering financial experience. Remember, knowledge is power, and in the world of finance, knowing where to find your account number is a fundamental step towards taking charge of your financial well-being.

The allure of chica de espaldas dibujo a glimpse into mystery and emotion

Forget pumpkin spice your fall garden is where its at

Snoopy and mortality exploring snoopy eines tages werden wir sterben

How To Find Account Routing Number Bank Of America | Solidarios Con Garzon

How to find routing account number on Bank of America app online and | Solidarios Con Garzon

Premier Bank Routing Number Michigan at George Askew blog | Solidarios Con Garzon

Image Bank Of America Cashier S Check Download | Solidarios Con Garzon

Top 10 east west bank ach routing number That Will Change Your Life | Solidarios Con Garzon

BANK OF EAST ASIA LIMITED | Solidarios Con Garzon

Bank Of America Wiring Number | Solidarios Con Garzon

Account Number On Bank Of America Business Check | Solidarios Con Garzon

Resultado de imagen para bank of america usa cashiers check samples | Solidarios Con Garzon

How to Find Account Number on Check | Solidarios Con Garzon

Western Positionieren Versammlung navy federal credit union bank | Solidarios Con Garzon