Decoding Wells Fargo Wire Transfers: Your Guide to Seamless Transactions

Imagine this: you're sitting at your computer, about to finalize a major purchase. You need to transfer a large sum of money quickly and securely. This is where understanding the ins and outs of wire transfers, particularly with a banking giant like Wells Fargo, becomes crucial.

In the world of finance, a wire transfer is like the express mail of money movement. It allows you to send or receive funds electronically, often across borders, with speed and reliability. But navigating the world of wire transfers can feel like stepping into a labyrinth, especially when terms like "SWIFT codes" and "intermediary banks" start getting thrown around.

Let's demystify the process, focusing specifically on Wells Fargo, one of the largest financial institutions in the United States. Whether you're a seasoned business owner or an individual sending money abroad, understanding the specifics of Wells Fargo wire transfers can save you time, money, and potential headaches.

At its core, a Wells Fargo wire transfer involves sending money electronically from your account to another account, either domestically or internationally. This differs from other transfer methods like ACH transfers, which are typically used for domestic transactions and can take longer to process. Wire transfers, on the other hand, offer a faster solution, especially for large sums or urgent payments.

However, before you initiate a Wells Fargo wire transfer, it's essential to gather the correct information, much like you would need the complete and accurate address when sending a physical letter. This is where the concept of a "Wells Fargo bank address for wire" comes into play. While it's not a physical address in the traditional sense, it encompasses a set of specific codes and details required to direct your transfer accurately.

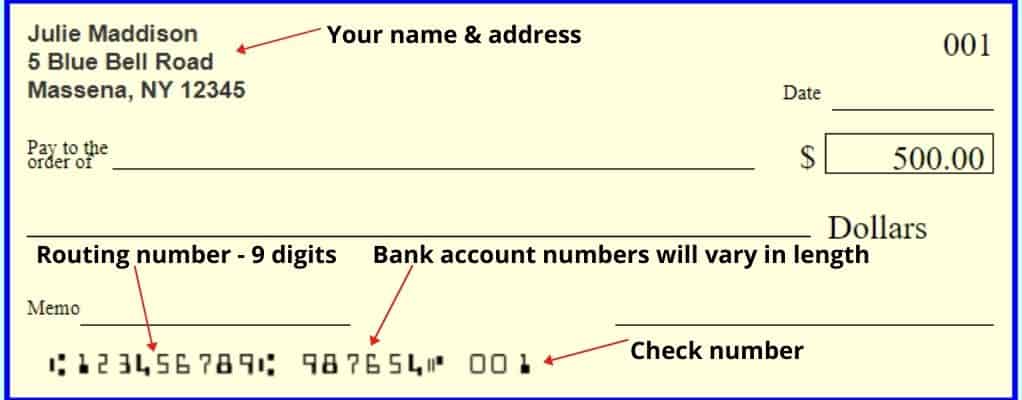

One key piece of information is the SWIFT code, also known as the BIC (Bank Identifier Code). Think of it as an international passport for banks, uniquely identifying Wells Fargo on the global financial network. For domestic wire transfers, you'll need the Wells Fargo routing number, a nine-digit code specific to your geographical location.

Beyond these identifiers, you'll also need the recipient's account number and their bank's name and address. Double-checking every detail is crucial to avoid delays or, worse, misdirected funds. While Wells Fargo strives to make wire transfers as smooth as possible, providing accurate information is paramount for a successful transfer.

Advantages and Disadvantages of Wells Fargo Bank Address for Wire

| Advantages | Disadvantages |

|---|---|

| Fast and Secure Transactions | Potential Fees |

| Global Reach | Requires Precise Information |

| High Transfer Limits | Irreversible Transactions |

To navigate the world of Wells Fargo wire transfers effectively, consider these best practices:

- Gather Accurate Information: Before initiating a wire transfer, double-check all recipient details, including their bank's SWIFT code (for international transfers) or routing number (for domestic transfers), account number, and complete bank address.

- Understand the Fees: Wells Fargo charges fees for both incoming and outgoing wire transfers, which can vary depending on the type of account you have and the destination of the transfer. Be sure to factor these fees into your budget.

- Verify Transfer Limits: Wells Fargo may have daily or transactional limits on wire transfers, especially for certain types of accounts. Check with your local branch or online banking platform to understand these limits.

- Confirm Processing Times: While wire transfers are generally faster than other methods, processing times can vary. International transfers might take longer due to time zone differences and additional bank processing.

- Keep Records Safe: Always retain confirmation receipts and transaction details for your records. This information can be crucial for tracking purposes or resolving any discrepancies that may arise.

While Wells Fargo wire transfers offer a reliable method for moving money, understanding the intricacies of the process, including the importance of accurate bank information and potential fees, is key to ensuring smooth and secure transactions.

Unleash your inner jester dazzling clown makeup ideas for women

Unlocking vehicle history your guide to free vin searches

Sunday school lessons printable and powerful for frugal faith formation

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon

wells fargo bank address for wire | Solidarios Con Garzon