CIMB Bank Account Statement: Your Financial Life, Laid Bare

We've all been there. That moment of dread mixed with morbid curiosity when you finally work up the nerve to peek at your bank account statement. Did that online shopping spree finally catch up with you? Is your balance as anemic as you fear? For CIMB Bank customers, this experience, while potentially anxiety-inducing, is also a gateway to understanding your financial health.

Let's be real, a CIMB bank account statement isn't exactly light reading. It's not the latest celebrity tell-all or a juicy thriller. But, much like that text from your crush, it holds a certain allure, a promise of revealing the intimate details of your financial life. And trust us, it's a story you need to be familiar with.

But deciphering your CIMB bank account statement doesn't have to be like cracking the Enigma code. Think of this as your crash course, your guide to navigating the ins and outs of these essential documents. We'll walk you through the jargon, the numbers, and the hidden clues that reveal the true state of your financial affairs.

First things first, why should you even care about your CIMB bank account statement beyond the obvious reason of knowing your balance? Well, consider it a financial report card, a detailed log of your income and expenses. It's the key to understanding your spending habits, spotting any irregularities, and ultimately, taking control of your money.

Ignoring your CIMB bank account statement is like driving with your eyes closed. Sure, you might be fine for a while, but eventually, you're going to hit something, and it won't be pretty. So buckle up, grab your metaphorical magnifying glass, and let's decode the mystery of your CIMB Bank account statement together.

Now, we know what you're thinking: "This all sounds very responsible and adult-like, but where's the fun in that?" Well, think of it this way: the better you understand your CIMB Bank account statement, the better equipped you are to make informed financial decisions. And informed financial decisions mean more freedom to do the things you love, whether it's traveling the world, indulging in your favorite hobbies, or simply enjoying a guilt-free online shopping spree (within reason, of course!).

Advantages and Disadvantages of CIMB Bank Account Statements

Let's face it, while we encourage you to befriend your CIMB bank account statement, it's not all sunshine and rainbows. Here's a balanced look at the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Provides a clear picture of your financial transactions. | Can be overwhelming to decipher, especially for those unfamiliar with financial jargon. |

| Helps you track your spending and saving habits. | May not always reflect real-time transactions, leading to potential discrepancies. |

| Essential for budgeting and financial planning. | Physical statements can be easily misplaced or lost. |

| Can be used as proof of income or address. | Risk of identity theft if statements fall into the wrong hands. |

| Helps detect fraudulent activities or errors. | Paper statements contribute to environmental waste. |

Now, let's dive into some of the best practices for handling your CIMB Bank account statement like a pro:

1. Review Regularly, Not Religiously: You don't need to perform a daily ritualistic reading of your statement (unless you find that soothing, in which case, you do you). Aim for a monthly review to stay on top of your finances.

2. Go Digital, Save a Tree: Opt for e-statements and reduce paper clutter. Plus, digital statements are easier to search and store.

3. Channel Your Inner Detective: Scrutinize your statement for any unfamiliar transactions. Report any discrepancies to CIMB immediately.

4. File and Forget (Safely): Keep your statements organized and stored securely, either digitally or in a locked file cabinet.

5. Shred It Like It's Hot: When disposing of old paper statements, shred them to prevent identity theft. Because, seriously, identity theft is not a joke, Jim!

Still have questions about your CIMB Bank account statement? We've got you covered:

Q: How often will I receive my CIMB Bank account statement?A: Typically, you'll receive your statement monthly. However, this can vary depending on your account type and preferences.

Q: What if I notice an error on my CIMB Bank account statement?A: Contact CIMB Bank immediately to report the discrepancy. They will investigate and rectify the error as soon as possible.

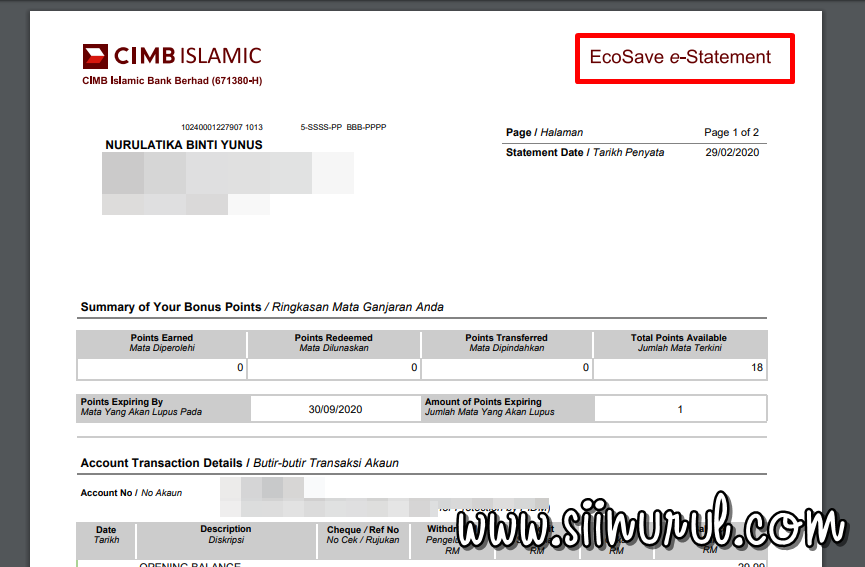

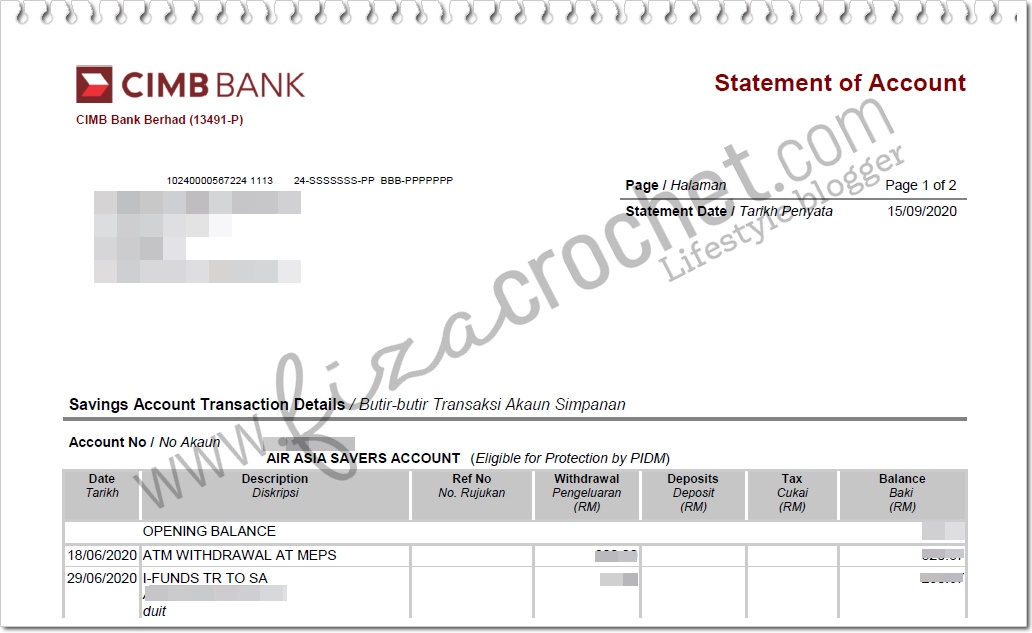

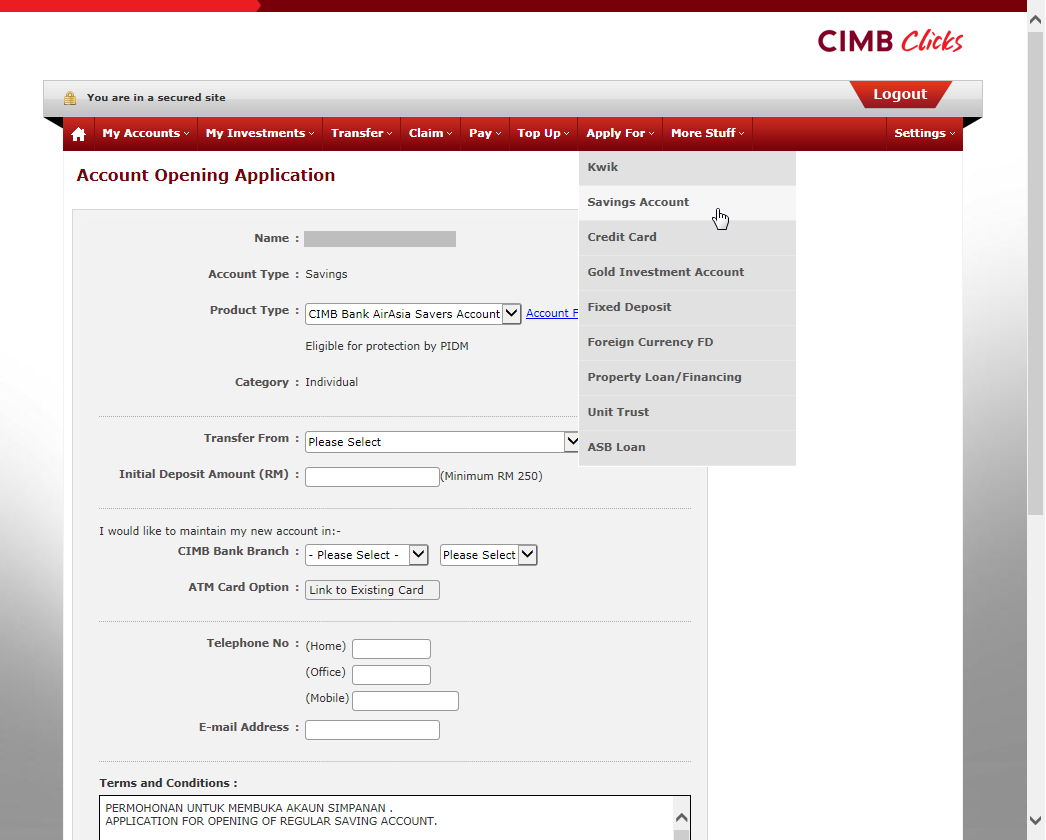

Q: Can I access my CIMB Bank account statement online?A: Yes, you can conveniently view and download your statements through CIMB Clicks internet banking or the CIMB Clicks mobile app.

Q: What information do I need to provide to access my CIMB Bank account statement online?A: You'll need your user ID and password to log in to CIMB Clicks. If you haven't already, you'll need to register for online banking.

Q: Can I request a copy of my CIMB Bank account statement from a previous year?A: Yes, you can request past statements, usually for a small fee. You can do this through CIMB Clicks, by visiting a branch, or by contacting customer service.

Q: Is there a charge for receiving paper statements from CIMB Bank? A: CIMB Bank may charge a fee for printed statements. Check their fee schedule or contact customer service for the most up-to-date information.

Q: What is the best way to store my CIMB Bank account statements securely?A: Digital storage in a password-protected folder is generally the most secure method. If keeping physical copies, store them in a locked file cabinet.

Q: Can I use my CIMB Bank account statement as proof of income? A: Yes, bank statements are widely accepted as proof of income for various purposes, such as loan applications or rental agreements.

There you have it - your crash course on navigating the world of CIMB Bank account statements. Remember, knowledge is power, especially when it comes to your finances. By understanding and utilizing your statement effectively, you're taking a proactive step toward financial well-being and peace of mind. So, go forth and conquer those statements, you savvy financial guru, you!

Exile exploring japans top music band on youtube

The lonely soul exploring the anima sola phenomenon

Ink masterpiece finding your perfect tattoo shop in evansville in

Cara Dapatkan Bank Statement CIMB Bank Melalui CIMBClicks | Solidarios Con Garzon

Cara Dapatkan Bank Statement CIMB Bank melalui CIMBClick | Solidarios Con Garzon

10 Cara Dapatkan Penyata Bank / Statement All Bank Malaysia | Solidarios Con Garzon

CIMB Business Current Account | Solidarios Con Garzon

Cimb Statement Of Account Philippines | Solidarios Con Garzon

Cara Dapatkan Bank Statement Cimb Bank Melalui CimbClicks | Solidarios Con Garzon

Download Cimb Bank Statement | Solidarios Con Garzon

BANK STATEMENT:CARA DAPATKAN/MUAT TURUN/PRINT(BANK CIMB/MAYBANK/RHB/BSN | Solidarios Con Garzon

Penyata Akaun Contoh Bank Statement Cimb Cara Mudah Dapatkan Penyata | Solidarios Con Garzon

![Cara Dapatkan Penyata Bank Statement CIMB Online [2023]](https://i2.wp.com/blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgjkO87eRnXgGAvYlOWyYFBghkBYliOQItVZ-SUBlit9uV6c8hLY2ef7UQFJole7rPPHptqBhSdHIrkeTmBQ-IsQXqD1g9sGN8FF2i4KLF3TN8xqpi5ariOlLK4QO0o3COGJfw8AZotWnJojoh6hmia3SFAvWZMJb7jmM5MMlzQmiwogHLjtYAyGHbe/s623/cara dapatkan statement cimb bank online.jpg)

Cara Dapatkan Penyata Bank Statement CIMB Online [2023] | Solidarios Con Garzon

Cimb Savings Account Interest | Solidarios Con Garzon

Create Cimb Bank Account | Solidarios Con Garzon

cimb bank account statement | Solidarios Con Garzon

Download Cimb Bank Statement | Solidarios Con Garzon

cimb bank account statement | Solidarios Con Garzon