Cara Semak No Cukai Pendapatan Syarikat: Your Guide to Verification

In today's intricate business landscape, due diligence is non-negotiable. Whether you're entering a new partnership, investing in a company, or simply ensuring the legitimacy of a vendor, verifying their tax information is crucial. This is where understanding "cara semak no cukai pendapatan syarikat" - the process of checking a company's income tax number in Malaysia - becomes essential.

Imagine this: you're about to close a lucrative deal with a promising company. Everything seems in order, but a nagging doubt lingers. How can you be absolutely certain you're dealing with a legitimate entity? This is not just about safeguarding your financial interests; it's about ensuring you're not inadvertently involved in any unethical or illegal activities.

Failing to verify a company's tax information can have serious consequences. You could fall victim to scams, face legal repercussions, or even jeopardize your own business reputation. Therefore, understanding and utilizing the "cara semak no cukai pendapatan syarikat" process is a vital step in conducting responsible business in Malaysia.

Fortunately, the process of checking a company's income tax number in Malaysia is generally straightforward. This guide aims to demystify "cara semak no cukai pendapatan syarikat," providing you with the knowledge and tools to navigate this process confidently.

From understanding the importance of tax identification numbers to exploring the various methods of verification, we'll equip you with the knowledge to make informed decisions and conduct business securely. This guide will also delve into the potential pitfalls and challenges you might encounter during the verification process and provide effective solutions to overcome them.

Advantages and Disadvantages of Verifying a Company's Tax Number

| Advantages | Disadvantages |

|---|---|

| Ensures the legitimacy of the business | Can be time-consuming |

| Helps avoid scams and fraudulent activities | May require navigating government websites or contacting specific agencies |

| Provides peace of mind and builds trust | Information may not always be readily available or up-to-date |

Best Practices for Verifying a Company's Tax Number

While the process of "cara semak no cukai pendapatan syarikat" is generally straightforward, following these best practices can streamline your verification efforts:

- Always verify: Make it a non-negotiable practice to verify the tax information of any business you're dealing with, regardless of the scale of the transaction.

- Utilize official sources: Rely on government websites or authorized platforms for verification to ensure the information's accuracy.

- Double-check the details: Pay close attention to the company name, registration number, and tax identification number, ensuring they match the provided documents.

- Stay informed: Keep abreast of any changes in regulations or verification processes by regularly checking official government websites.

- Seek professional help: If you encounter difficulties or have doubts, don't hesitate to consult a legal professional or tax advisor for guidance.

"Cara semak no cukai pendapatan syarikat" is more than just a bureaucratic procedure; it's a fundamental aspect of responsible business conduct in Malaysia. By understanding the importance of tax identification numbers and utilizing the available verification methods, you're not just protecting yourself from potential risks but also contributing to a more transparent and trustworthy business environment.

Remember, a few minutes spent verifying a company's tax information can save you from countless headaches and potential financial losses. Stay informed, stay vigilant, and conduct your business with confidence.

Sherwin williams green grey the undisputed king of colors

Unveiling the magic fun facts about mythical creatures

Unleash your inner canvas cute half sleeve tattoo ideas for women

Cukai Pintu, Cukai Tanah dan Cukai Petak? | Solidarios Con Garzon

Rahasia Cara Daftar E Filing Mahkamah Terbaik | Solidarios Con Garzon

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU | Solidarios Con Garzon

cara semak no cukai pendapatan syarikat | Solidarios Con Garzon

cara semak no cukai pendapatan syarikat | Solidarios Con Garzon

cara semak no cukai pendapatan syarikat | Solidarios Con Garzon

Cara Semak No Cukai Pendapatan LHDN Number | Solidarios Con Garzon

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | Solidarios Con Garzon

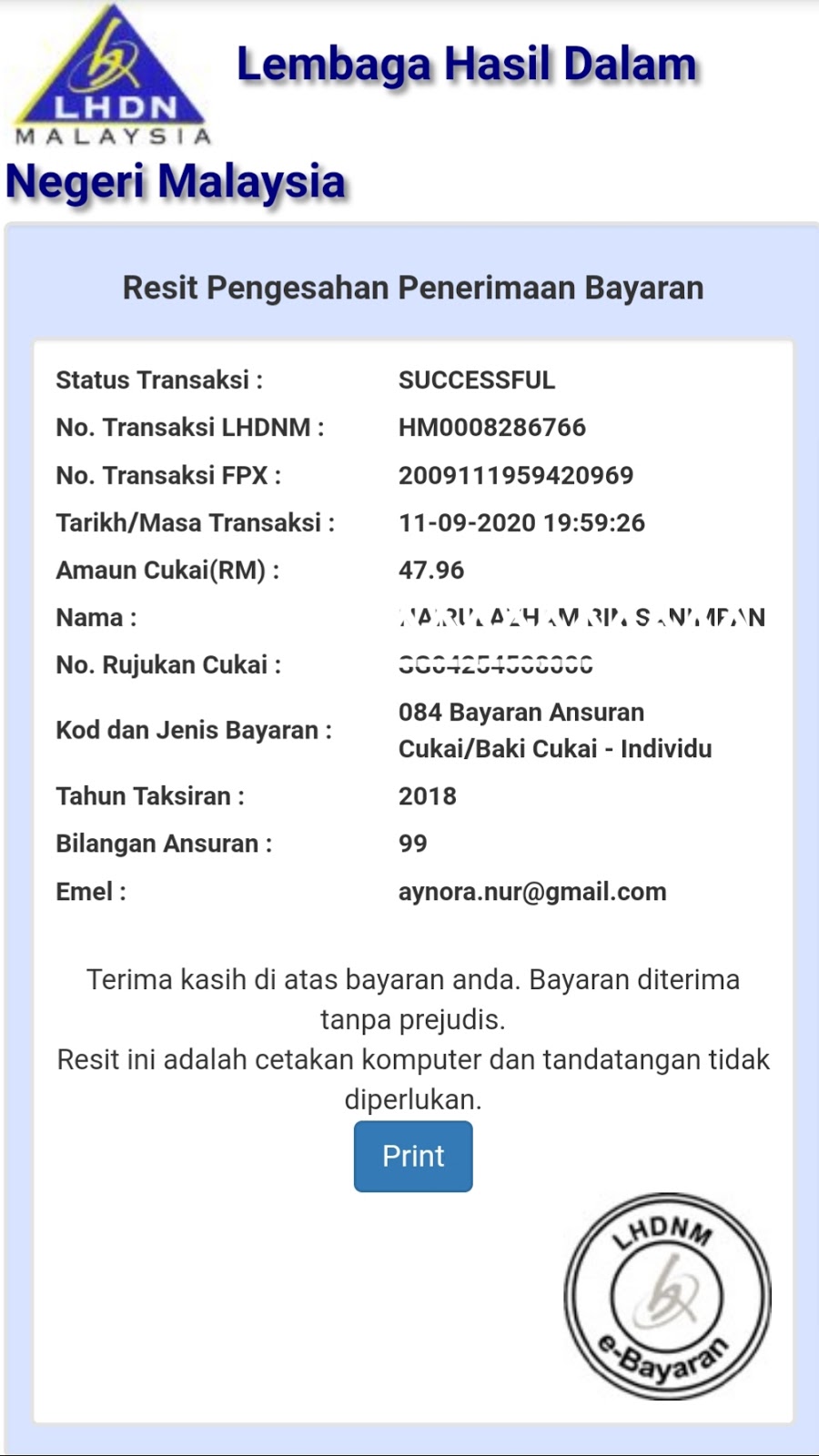

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah | Solidarios Con Garzon

Semak No Cukai Pendapatan Pekerja | Solidarios Con Garzon

Cara,Panduan Dan Langkah Isi Borang Cukai Pendapatan Online (E | Solidarios Con Garzon

CHECK NO CUKAI PENDAPATAN/SYARIKAT MALAYSIA | Solidarios Con Garzon

Cara Semak Cukai Tanah & Bayar Online Setiap Negeri, Tak Perlu Beratur | Solidarios Con Garzon

SEMAKAN NO CUKAI PENDAPATAN SYARIKAT MALAYSIA | Solidarios Con Garzon

Semak No Cukai Pendapatan, Contoh Nombor LHDN Number | Solidarios Con Garzon