Can You Deposit Third-Party Checks? A Comprehensive Guide

Navigating the world of personal finance can feel like deciphering a foreign language, especially when it comes to seemingly simple tasks like depositing a check. But what happens when the check wasn't made out to you directly? Can you deposit third-party checks? The answer, like many things in finance, is: it depends.

Third-party checks, or checks made payable to someone other than yourself, are common in various situations. Maybe you sold an item online and the buyer opted for a check, or perhaps a family member sent you a check intended for a shared expense. While the ability to deposit such checks can be incredibly convenient, it's crucial to understand the potential risks and how to navigate them responsibly.

Historically, banks were more lenient about third-party check deposits. However, as cases of check fraud and forgery increased, stricter regulations were put in place. This has led to a more cautious approach from financial institutions. Some banks outright prohibit third-party check deposits, while others have implemented stringent procedures to minimize risk.

The main concern with third-party checks lies in verifying the legitimacy of the transaction and the identity of all parties involved. Unlike a check made out to you, a third-party check introduces an additional layer of complexity. There's a chance the original payee didn't endorse the check properly, or worse, the check itself could be fraudulent.

Before you attempt to deposit a third-party check, it's crucial to contact your bank or financial institution to inquire about their specific policies. Some banks may allow it with restrictions, such as requiring the original payee to be present or having a signed endorsement with an added "Pay to the order of [your name]." Understanding your bank's stance is the first step in ensuring a smooth and secure transaction.

Advantages and Disadvantages of Depositing Third-Party Checks

To help illustrate the potential benefits and drawbacks, let's look at the advantages and disadvantages in more detail:

| Advantages | Disadvantages |

|---|---|

| Convenience: Offers a straightforward way to receive funds from another party. | Security Risks: Higher potential for fraud, forgery, or disputes. |

| Accessibility: Can be easier than other payment methods in certain situations. | Delays in Funds Availability: Banks may place holds on third-party checks, delaying access to funds. |

| Potential for Faster Payment: May be faster than waiting for a money order or other payment forms. | Limited Recourse: If issues arise with the check, it can be challenging to recover funds. |

Best Practices for Depositing Third-Party Checks

If your bank allows third-party check deposits, follow these best practices to mitigate risks:

- Verify the Check: Inspect the check for any signs of tampering, such as alterations to the payee, amount, or date.

- Confirm Endorsement: Ensure the original payee has endorsed (signed) the back of the check.

- Obtain Documentation: Request a signed and dated receipt from the original payee acknowledging the transfer of funds.

- Communicate with Your Bank: Inform your bank you're depositing a third-party check and inquire about any specific requirements or holds they may place on the funds.

- Maintain Records: Keep copies of the check, endorsement, and any communication with your bank for your records.

Common Questions About Depositing Third-Party Checks:

Here are some frequently asked questions to provide further clarity:

- Q: Is it legal to deposit a third-party check?

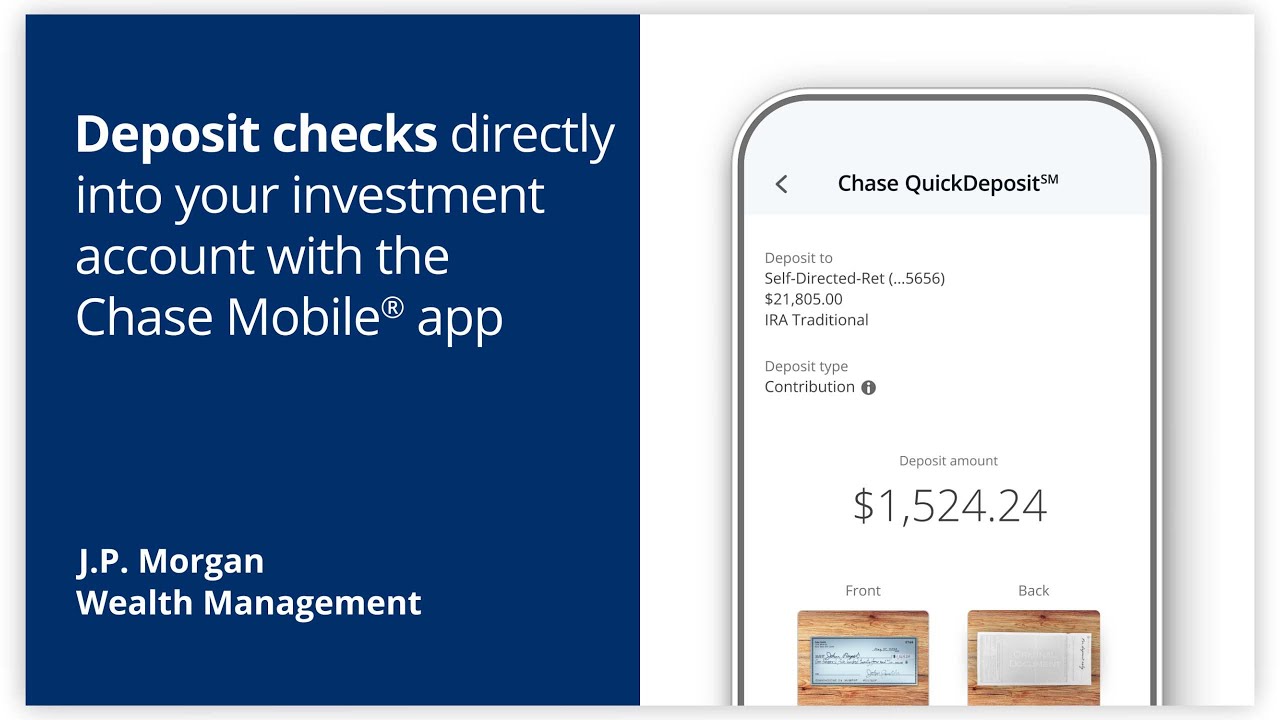

A: Yes, depositing a third-party check is legal in many jurisdictions, but banks are subject to regulations that may restrict or govern the process. - Q: Can I deposit a third-party check via mobile banking?

A: Some banks may allow this, but often have stricter limits on mobile deposits for third-party checks. - Q: What happens if the third-party check bounces?

A: You will likely be responsible for the amount of the check, potential fees, and any repercussions to your account.

Depositing third-party checks can be a convenient way to handle financial transactions, but it's not without its risks. By understanding your bank's policies, following best practices, and being aware of potential pitfalls, you can navigate this aspect of banking with greater confidence and minimize the likelihood of complications. Always prioritize secure banking practices to safeguard your finances.

Decoding the emoji verse facebook emojis on your iphone

Fresh popcorn behr paint color a warm welcoming hue for your home

Cramped quarters understanding the minimum area for bedroom philippines

Can You Deposit Someone Else's Check In Your Account? | Solidarios Con Garzon

/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)

How to Sign a Check Over to Somebody Else | Solidarios Con Garzon

How To Cash A Third Party Check | Solidarios Con Garzon

How can I sort my invoices by status? | Solidarios Con Garzon

Can you Deposit a Check for Someone Else? | Solidarios Con Garzon

Everything You Need to Know About Cashing a Third Party Check | Solidarios Con Garzon

Does Chime Accept Third | Solidarios Con Garzon

Can You Deposit Someone Else's Check? | Solidarios Con Garzon

Handling Cash, Checks, & Incoming EFT | Solidarios Con Garzon

Mobile Check Deposit Tips | Solidarios Con Garzon

How to Endorse Chase Bank Mobile Deposit? | Solidarios Con Garzon

Can U Deposit A Check Into Cash App | Solidarios Con Garzon

Where Can I Cash a Third Party Check? | Solidarios Con Garzon

Does Chime Accept Third Party Checks? An Authentic Guide | Solidarios Con Garzon

Where can I cash a third party check | Solidarios Con Garzon