Bank of America Cashier's Checks: A Deep Dive

In today's fast-paced financial landscape, secure and guaranteed payment methods are crucial. A cashier's check, particularly one from a reputable institution like Bank of America, offers a level of assurance that personal checks often can't match. But what exactly is a cashier's check from Bank of America, and how does it work?

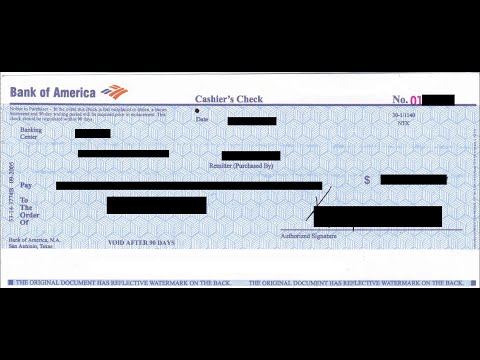

A cashier's check, also known as an official check, is a check guaranteed by the issuing bank. Unlike a personal check drawn against your account, a cashier's check is drawn against the bank's own funds. This makes it a more secure payment method, as the recipient has assurance that the funds are available. When you request a cashier's check at Bank of America, you provide them with the payment amount and payee information. The bank then deducts the funds from your account and issues a check bearing their official stamp and signature.

The origins of cashier's checks can be traced back to 18th-century Europe. These early forms of guaranteed payments evolved over time to become the cashier's checks we use today. The significance of these checks lies in their guaranteed nature, offering a greater level of security in transactions where trust might be a factor. This is particularly important in large purchases like real estate or vehicles, where personal checks may not be accepted.

One of the main issues surrounding cashier's checks, unfortunately, is the potential for fraud. Counterfeit cashier's checks are a persistent problem, highlighting the importance of verifying the check's authenticity. Bank of America offers several security features to protect against counterfeiting, and customers should be vigilant in examining checks for these features.

Obtaining a cashier's check at Bank of America is typically straightforward. You can visit a local branch, provide the necessary information and payment, and receive the check. Alternatively, some customers may be able to request a cashier's check through online banking, depending on their account type and relationship with the bank.

Now, let's delve into the benefits of using a Bank of America cashier's check. Firstly, guaranteed funds provide peace of mind to both the payer and the recipient. Secondly, they are widely accepted for large transactions, making them a practical choice for significant purchases. Thirdly, the formal nature of a cashier's check adds a layer of professionalism to the transaction.

To obtain a cashier's check at Bank of America, you'll need to visit a branch with valid identification and the necessary funds. You'll provide the payee's name and the amount, and the bank will issue the check.

One example: Imagine purchasing a used car from a private seller. A cashier's check provides the seller with guaranteed funds, while also protecting the buyer by ensuring a documented payment.

Advantages and Disadvantages of Cashier's Checks at Bank of America

| Advantages | Disadvantages |

|---|---|

| Guaranteed Funds | Potential for Fraud |

| Widely Accepted | Fees Involved |

| Professionalism | Less Convenient than other methods |

Best practices for using cashier's checks include verifying authenticity, storing them securely, and recording the check number for your records. Challenges may include lost or stolen checks, but Bank of America has procedures in place to address these issues.

Frequently Asked Questions: What is a cashier's check? How do I get one? How much does it cost? Can I stop payment on a cashier's check? Is it safe? What if it's lost? Where can I verify its authenticity? How long is it valid?

(Answers would follow each question, providing concise and helpful information.)

Tips and tricks: Keep a record of the check number. Verify the check with the bank if you have any doubts about its authenticity. Consider alternative payment methods if a cashier's check isn't practical.

In conclusion, a cashier's check from Bank of America offers a secure and reliable payment method for significant transactions. While there are potential drawbacks, such as fees and the risk of fraud, the benefits of guaranteed funds and wide acceptance often outweigh these concerns. Understanding the process of obtaining and using a cashier's check, along with being aware of best practices and potential challenges, empowers you to navigate financial transactions with confidence and security. For more information, consult Bank of America's website or visit your local branch. Taking advantage of this secure payment method can significantly enhance your financial peace of mind.

Oklahoma county jail inmate commissary

Experience vibrant spanish festivals near you this october

May the force be with you finding the best star wars happy birthday images

Bank Of America Cashier S Check Template | Solidarios Con Garzon

Fintech giant The Clearing House joins open | Solidarios Con Garzon

Chase Bank Check Template Fresh 12 Cashier Check Template In 2020 | Solidarios Con Garzon

Pin on A Los Angeles Padres diego san francisco diablo | Solidarios Con Garzon

Cashiers Check Examples Examples Of Cashiers Check 59 OFF | Solidarios Con Garzon

Bank Of America Cashier S Check Template | Solidarios Con Garzon

cashier's check at bank of america | Solidarios Con Garzon

Do Bank Checks Cost Money at Darcy Lopez blog | Solidarios Con Garzon

cashier's check at bank of america | Solidarios Con Garzon

Bank Of America Printable Checks | Solidarios Con Garzon

cashier's check at bank of america | Solidarios Con Garzon

Resultado de imagen para bank of america usa cashiers check samples | Solidarios Con Garzon

Bank of America Cashiers Check | Solidarios Con Garzon

Wells Fargo Blank Check Template | Solidarios Con Garzon

Bank Of America Cashiers Check Template | Solidarios Con Garzon